MetLife 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

approval and other customary closing conditions in each of the jurisdictions. The results of the Caribbean Business are included in continuing

operations.

2012 Disposition

American Life U.K. Assumption Reinsurance

During July 2012, the Company completed the disposal, through a ceded assumption reinsurance agreement, of certain closed blocks of business

in the United Kingdom (“U.K.”), to a third party. Simultaneously, the Company recaptured from the third party the indemnity reinsurance agreement

related to this business, previously reinsured as of July 1, 2011. These transactions resulted in a decrease in both insurance and reinsurance assets

and liabilities of $4.1 billion. The Company recognized a gain of $25 million, net of income tax, on the transactions for the year ended

December 31, 2012, which was recorded in net investment gains (losses) in the consolidated statement of operations.

2011 Dispositions

MSI MetLife

On April 1, 2011, the Company sold its 50% interest in Mitsui Sumitomo MetLife Insurance Co., Ltd. (“MSI MetLife”), a Japan domiciled life insurance

company, to its joint venture partner, MS&AD Insurance Group Holdings, Inc. (“MS&AD”), for $269 million (¥22.5 billion) in cash consideration, less

$4 million (¥310 million) to reimburse MS&AD for specific expenses incurred related to the transaction. The accumulated other comprehensive losses in

the foreign currency translation adjustment component of equity resulting from the hedges of the Company’s investment in the joint venture of

$46 million, net of income tax, were released upon sale but did not impact net income for the year ended December 31, 2011 as such losses were

considered in the overall impairment evaluation of the investment prior to the sale. During the years ended December 31, 2011 and 2010, the Company

recorded losses of $57 million and $136 million, net of income tax, respectively, in net investment gains (losses) within the consolidated statementsof

operations related to the sale. The Company’s operating earnings relating to its investment in MSI MetLife were included in the Asia segment.

MetLife Taiwan

On November 1, 2011, the Company sold its wholly-owned subsidiary, MetLife Taiwan Insurance Company Limited (“MetLife Taiwan”) for

$180 million in cash consideration. The net assets sold were $282 million, resulting in a loss on disposal of $64 million, net of income tax, recorded in

discontinued operations, for the year ended December 31, 2011. Income (loss) from the operations of MetLife Taiwan of $20 million and $22 million,

net of income tax, for the years ended December 31, 2011 and 2010, respectively, was also recorded in discontinued operations. See “—Discontinued

Operations” below.

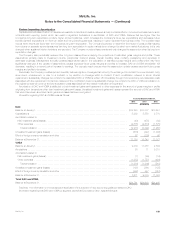

2010 Acquisition of ALICO

Description of Transaction

On November 1, 2010 (the “ALICO Acquisition Date”), MetLife, Inc. acquired all of the issued and outstanding capital stock of American Life

Insurance Company (“American Life”) from AM Holdings LLC (formerly known as ALICO Holdings LLC) (“AM Holdings”), a subsidiary of American

International Group, Inc. (“AIG”), and Delaware American Life Insurance Company (“DelAm”) from AIG (American Life, together with DelAm, collectively,

“ALICO”) (the “ALICO Acquisition”) for a total purchase price of $16.4 billion. The ALICO Acquisition significantly broadened the Company’s

diversification by product, distribution and geography, meaningfully accelerated MetLife’s global growth strategy, and provides the opportunity to build

an international franchise leveraging the key strengths of ALICO.

The $7.2 billion cash portion of the purchase price was funded through the issuance of common stock as described in Note 16, fixed and floating

rate senior debt as described in Note 12 as well as cash on hand. The securities issued to AM Holdings included (a) 78,239,712 shares of MetLife,

Inc.’s common stock; (b) 6,857,000 shares of Series B Contingent Convertible Junior Participating Non-Cumulative Perpetual Preferred Stock (the

“convertible preferred stock”) of MetLife, Inc.; and (c) 40 million common equity units of MetLife, Inc. with an aggregate stated amount at issuance of

$3.0 billion, initially consisting of (i) three purchase contracts (the “Series C Purchase Contracts,” the “Series D Purchase Contracts” and the “Series E

Purchase Contracts” and, together, the “Purchase Contracts”), obligating the holder to purchase, on specified future settlement dates, a variable

number of shares of MetLife, Inc.’s common stock for a fixed price; and (ii) an interest in each of three series of debt securities (the “Series C Debt

Securities,” the “Series D Debt Securities” and the “Series E Debt Securities,” and, together, the “Debt Securities”) issued by MetLife, Inc. Distributions

on the common equity units will be made quarterly, through contract payments on the Purchase Contracts and interest payments on the Debt

Securities, initially at an aggregate annual rate of 5.00% (an average annual rate of 3.02% on the Purchase Contracts and an average annual rate of

1.98% on the Debt Securities) as described in Note 15.

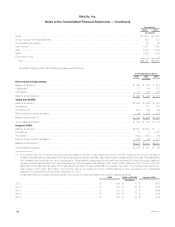

Contingent Consideration

The Company guaranteed that the fair value of a fund of assets backing certain U.K. unit-linked contracts would have a value of at least £1 per unit

on July 1, 2012. If the shortfall between the aggregate guaranteed amount and the fair value of the fund exceeded £106 million (as adjusted for

withdrawals), AIG would pay the difference to the Company and, conversely, if the shortfall at July 1, 2012 was less than £106 million, the Company

would pay the difference to AIG. At July 1, 2012, the shortfall between the aggregate guaranteed amount and the fair value of the fund was less than

£106 million, resulting in a payment of $108 million by the Company to AIG during the third quarter of 2012. The contingent consideration liability was

$109 million at December 31, 2011. The decrease in the contingent consideration liability amount from December 31, 2011 to the date of settlement

was recorded in net derivative gains (losses) in the consolidated statement of operations.

Branch Restructuring

On March 4, 2010, American Life entered into a closing agreement (the “Closing Agreement”) with the Commissioner of the Internal Revenue

Service (“IRS”) with respect to a U.S. withholding tax issue arising as a result of payments made by its foreign branches. The Closing Agreement

provides that American Life’s foreign branches will not be required to withhold U.S. income tax on the income portion of payments made pursuant to

American Life’s life insurance and annuity contracts (“Covered Payments”) for any tax periods beginning on January 1, 2005 and ending on

December 31, 2013 (the “Deferral Period”). The Closing Agreement required that American Life submit a plan to the IRS within 90 days after the close of

the ALICO Acquisition, indicating the steps American Life would take (on a country by country basis) to ensure that no substantial amount of

MetLife, Inc. 101