MetLife 2012 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

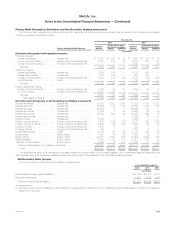

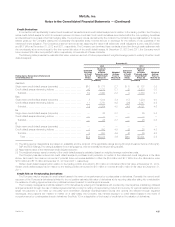

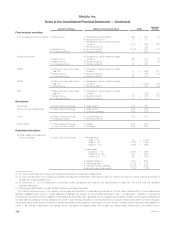

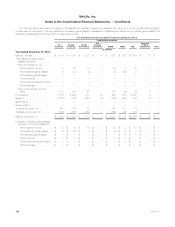

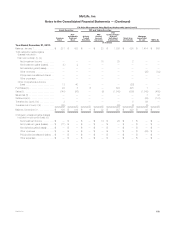

December 31, 2011

Fair Value Hierarchy Total

Estimated

Fair ValueLevel 1 Level 2 Level 3

(In millions)

Assets:

Fixed maturity securities:

U.S. corporate .................................................................... $ — $ 99,001 $ 6,784 $105,785

Foreign corporate ................................................................. — 59,648 4,370 64,018

Foreign government ............................................................... 76 50,138 2,322 52,536

U.S. Treasury and agency ........................................................... 19,911 20,070 31 40,012

RMBS .......................................................................... — 41,035 1,602 42,637

CMBS .......................................................................... — 18,316 753 19,069

ABS............................................................................ — 11,129 1,850 12,979

State and political subdivision ........................................................ — 13,182 53 13,235

Total fixed maturity securities ....................................................... 19,987 312,519 17,765 350,271

Equity securities:

Common stock ................................................................... 819 1,105 281 2,205

Non-redeemable preferred stock ..................................................... — 380 438 818

Total equity securities ............................................................. 819 1,485 719 3,023

FVO and trading securities:

Actively Traded Securities ........................................................... — 473 — 473

FVO general account securities ...................................................... — 244 23 267

FVO contractholder-directed unit-linked investments ...................................... 7,572 8,453 1,386 17,411

FVO securities held by CSEs ........................................................ — 117 — 117

Total FVO and trading securities ..................................................... 7,572 9,287 1,409 18,268

Short-term investments (1) ........................................................... 8,150 8,120 590 16,860

Mortgage loans:

Commercial mortgage loans held by CSEs .............................................. — 3,138 — 3,138

Mortgage loans held-for-sale (2) ...................................................... — 9,302 1,414 10,716

Total mortgage loans .......................................................... — 12,440 1,414 13,854

Other invested assets:

MSRs .......................................................................... — — 666 666

Other investments ................................................................. 312 124 — 436

Derivative assets: (4)

Interest rate ..................................................................... 32 10,426 338 10,796

Foreign currency exchange rate ..................................................... 1 1,316 61 1,378

Credit ......................................................................... — 301 29 330

Equity market ................................................................... 29 2,703 964 3,696

Total derivative assets ........................................................... 62 14,746 1,392 16,200

Total other invested assets ..................................................... 374 14,870 2,058 17,302

Net embedded derivatives within asset host contracts (5) ................................... — 1 362 363

Separate account assets (6) .......................................................... 28,191 173,507 1,325 203,023

Total assets ...................................................................... $65,093 $532,229 $25,642 $622,964

Liabilities:

Derivative liabilities: (4)

Interest rate ...................................................................... $ 91 $ 2,351 $ 38 $ 2,480

Foreign currency exchange rate ...................................................... — 1,103 17 1,120

Credit .......................................................................... — 85 28 113

Equity market ..................................................................... 12 211 75 298

Total derivative liabilities ........................................................... 103 3,750 158 4,011

Net embedded derivatives within liability host contracts (5) ................................... — 19 4,565 4,584

Long-term debt of CSEs ............................................................. — 2,952 116 3,068

Liability related to securitized reverse residential mortgage loans (7) ............................ — 6,451 1,175 7,626

Trading liabilities (7) ................................................................. 124 3 — 127

Total liabilities ..................................................................... $ 227 $ 13,175 $ 6,014 $ 19,416

(1) Short-term investments as presented in the tables above differ from the amounts presented in the consolidated balance sheets because certain

short-term investments are not measured at estimated fair value on a recurring basis.

MetLife, Inc. 141