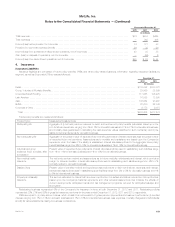

MetLife 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

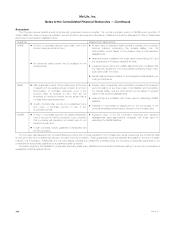

Notes to the Consolidated Financial Statements — (Continued)

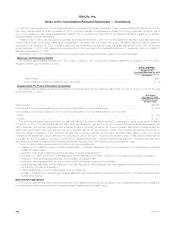

‰Amortization of DAC and VOBA excludes amounts related to: (i) net investment gains (losses) and net derivative gains (losses), (ii) GMIB Fees and

GMIB Costs, and (iii) Market Value Adjustments;

‰Amortization of negative VOBA excludes amounts related to Market Value Adjustments;

‰Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and

‰Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements, and

(iii) acquisition and integration costs.

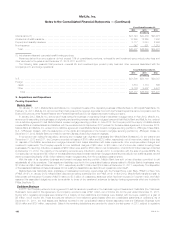

Set forth in the tables below is certain financial information with respect to the Company’s segments, as well as Corporate & Other, for the years

ended December 31, 2012, 2011 and 2010 and at December 31, 2012 and 2011. The segment accounting policies are the same as those used to

prepare the Company’s consolidated financial statements, except for operating earnings adjustments as defined above. In addition, segment

accounting policies include the method of capital allocation described below.

Economic capital is an internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide a basis

upon which capital is deployed. The economic capital model accounts for the unique and specific nature of the risks inherent in the Company’s

business.

The Company’s economic capital model aligns segment allocated equity with emerging standards and consistent risk principles. Segment net

investment income is credited or charged based on the level of allocated equity; however, changes in allocated equity do not impact the Company’s

consolidated net investment income, operating earnings or income (loss) from continuing operations, net of income tax.

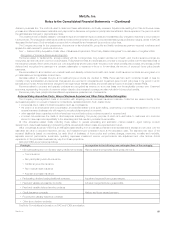

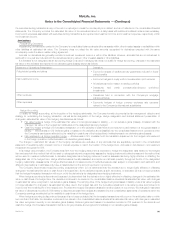

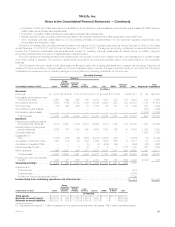

Operating Earnings

Americas

Year Ended December 31, 2012 Retail

Group,

Voluntary

& Worksite

Benefits

Corporate

Benefit

Funding Latin

America Total Asia EMEA Corporate

& Other Total Adjustments Total

Consolidated

(In millions)

Revenues

Premiums ................... $ 6,532 $14,794 $ 3,237 $ 2,578 $ 27,141 $ 8,344 $ 2,370 $ 56 $37,911 $ 64 $37,975

Universal life and investment-type

product policy fees .......... 4,561 662 225 785 6,233 1,491 333 155 8,212 344 8,556

Net investment income ......... 7,670 1,768 5,703 1,198 16,339 2,895 535 703 20,472 1,512 21,984

Other revenues ............... 879 422 259 16 1,576 26 121 33 1,756 150 1,906

Net investment gains (losses) .... — — — — — — — — — (352) (352)

Net derivative gains (losses) ..... — — — — — — — — — (1,919) (1,919)

Total revenues .............. 19,642 17,646 9,424 4,577 51,289 12,756 3,359 947 68,351 (201) 68,150

Expenses

Policyholder benefits and claims

and policyholder dividends .... 9,010 13,691 5,704 2,231 30,636 5,819 1,196 119 37,770 1,586 39,356

Interest credited to policyholder

account balances ........... 2,375 167 1,358 393 4,293 1,784 126 39 6,242 1,487 7,729

Goodwill impairment ........... — — — — — — — — — 1,868 1,868

Capitalization of

DAC...................... (1,753) (138) (29) (353) (2,273) (2,288) (723) — (5,284) (5) (5,289)

Amortization of DAC and VOBA . . . 1,607 133 22 224 1,986 1,563 626 2 4,177 22 4,199

Amortization of negative VOBA . . . — — — (5) (5) (456) (94) — (555) (67) (622)

Interest expense on debt ........ — 1 8 (1) 8 5 1 1,176 1,190 166 1,356

Other expenses ............... 5,369 2,351 478 1,375 9,573 4,738 1,810 559 16,680 1,431 18,111

Total expenses ............. 16,608 16,205 7,541 3,864 44,218 11,165 2,942 1,895 60,220 6,488 66,708

Provision for income tax expense

(benefit) ................... 1,032 481 659 130 2,302 554 146 (679) 2,323 (2,195) 128

Operating earnings .......... $ 2,002 $ 960 $ 1,224 $ 583 $ 4,769 $ 1,037 $ 271 $ (269) 5,808

Adjustments to:

Total revenues ............................................................................... (201)

Total expenses ............................................................................... (6,488)

Provision for income tax (expense) benefit .......................................................... 2,195

Income (loss) from continuing operations, net of income tax ....................................... $ 1,314 $ 1,314

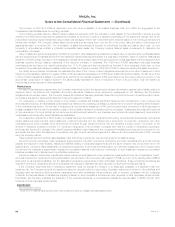

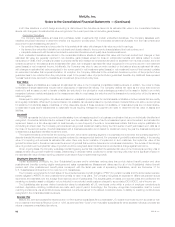

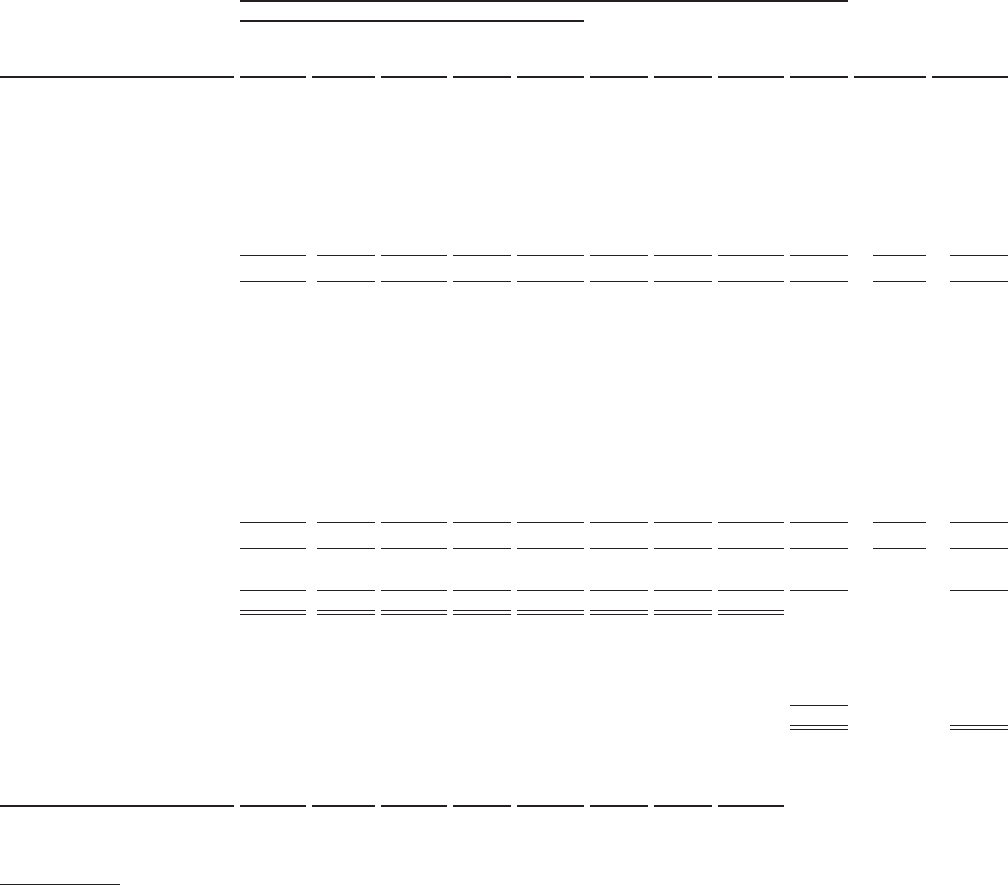

At December 31, 2012 Retail

Group,

Voluntary

& Worksite

Benefits

Corporate

Benefit

Funding Latin

America Asia (1) EMEA Corporate

& Other Total

(In millions)

Total assets ................ $332,387 $44,138 $217,352 $23,272 $131,138 $23,474 $65,020 $836,781

Separate account assets ..... $150,513 $ 532 $ 71,875 $ 4,200 $ 8,273 $ — $ — $235,393

Separate account liabilities ... $150,513 $ 532 $ 71,875 $ 4,200 $ 8,273 $ — $ — $235,393

(1) Total assets includes $111.0 billion of assets from the Japan operations which represents 13% of total consolidated assets.

MetLife, Inc. 97