MetLife 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

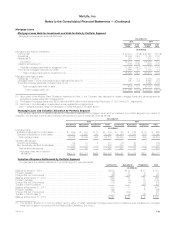

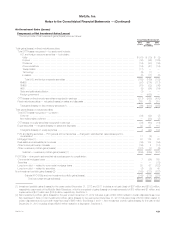

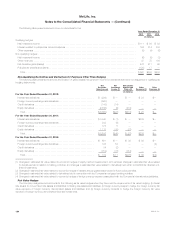

Net Investment Gains (Losses)

Components of Net Investment Gains (Losses)

The components of net investment gains (losses) were as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Total gains (losses) on fixed maturity securities:

Total OTTI losses recognized — by sector and industry:

U.S. and foreign corporate securities — by industry:

Utility ........................................................................................ $ (61) $ (10) $ (3)

Finance ...................................................................................... (32) (56) (126)

Consumer .................................................................................... (19) (50) (36)

Communications ............................................................................... (19) (41) (16)

Transportation ................................................................................. (17) — —

Technology ................................................................................... (6) (1) —

Industrial ...................................................................................... (5) (11) (2)

Total U.S. and foreign corporate securities ......................................................... (159) (169) (183)

RMBS ......................................................................................... (97) (214) (117)

CMBS ......................................................................................... (51) (32) (86)

ABS ........................................................................................... (9) (54) (84)

State and political subdivision ....................................................................... (1) — —

Foreign government ............................................................................... — (486) —

OTTI losses on fixed maturity securities recognized in earnings ............................................... (317) (955) (470)

Fixed maturity securities — net gains (losses) on sales and disposals .......................................... 253 25 215

Total gains (losses) on fixed maturity securities (1) ........................................................ (64) (930) (255)

Total gains (losses) on equity securities:

Total OTTI losses recognized — by sector:

Common ....................................................................................... (34) (22) (7)

Non-redeemable preferred ......................................................................... — (38) (7)

OTTI losses on equity securities recognized in earnings ..................................................... (34) (60) (14)

Equity securities — net gains (losses) on sales and disposals ................................................ 38 37 118

Total gains (losses) on equity securities ................................................................ 4 (23) 104

FVO and trading securities — FVO general account securities — changes in estimated fair value subsequent to

consolidation .................................................................................... 17 (2) —

Mortgage loans (1) .................................................................................. 57 175 22

Real estate and real estate joint ventures ................................................................ (36) 134 (54)

Other limited partnership interests ...................................................................... (36) 4 (18)

Other investment portfolio gains (losses) ................................................................. (151) (7) (6)

Subtotal — investment portfolio gains (losses) (1) ...................................................... (209) (649) (207)

FVO CSEs — changes in estimated fair value subsequent to consolidation:

Commercial mortgage loans .......................................................................... 7 (84) 758

Securities ......................................................................................... — — (78)

Long-term debt — related to commercial mortgage loans ................................................... 25 97 (722)

Long-term debt — related to securities .................................................................. (7) (8) 48

Non-investment portfolio gains (losses) (2) ................................................................. (168) (223) (207)

Subtotal FVO CSEs and non-investment portfolio gains (losses) ......................................... (143) (218) (201)

Total net investment gains (losses) ............................................................. $(352) $(867) $(408)

(1) Investment portfolio gains (losses) for the years ended December 31, 2012 and 2011 includes a net gain (loss) of $37 million and ($153) million,

respectively, as a result of the MetLife Bank Divestiture, which is comprised of gains (losses) on investments sold of $78 million and $1 million, and

impairments of ($41) million and ($154) million, respectively. See Note 3.

(2) Non-investment portfolio gains (losses) for the year ended December 31, 2012 includes a gain of $33 million related to certain dispositions as more

fully described in Note 3. Non-investment portfolio gains (losses) for the year ended December 31, 2011 includes a loss of $106 million related to

certain dispositions and a goodwill impairment loss of $65 million. See Notes 3 and 11. Non-investment portfolio gains (losses) for the year ended

December 31, 2010 includes a loss of $209 million related to a disposition. See Note 3.

MetLife, Inc. 129