MetLife 2012 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

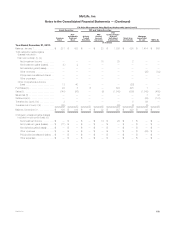

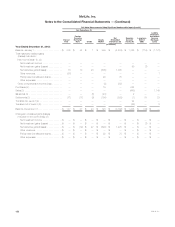

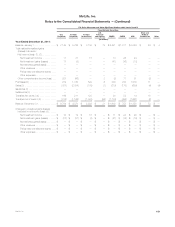

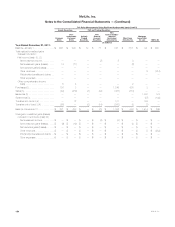

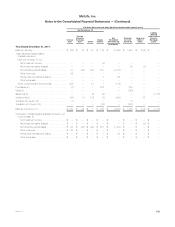

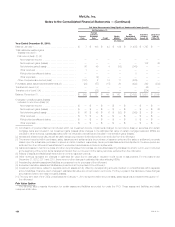

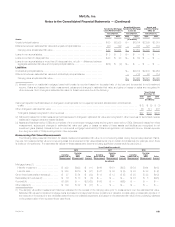

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

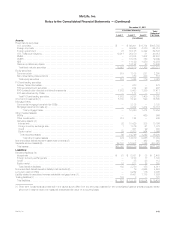

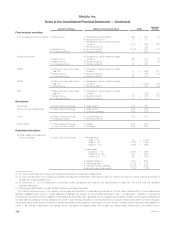

quotations and internal models such as discounted cash flow methodologies using current interest rates. MSRs are valued using discounted cash flow

methodologies using inputs such as discount rates, loan prepayments and servicing costs. The long-term debt of CSEs is valued using independent

non-binding broker quotations and internal models including matrix pricing and discounted cash flow methodologies using current interest rates. The

liability related to securitized reverse residential mortgage loans is valued using quoted prices. The sensitivity of the estimated fair value to changes in the

significant unobservable inputs for these other assets and liabilities is similar in nature to that described below. The valuation techniques and significant

unobservable inputs used in the fair value measurement for the more significant assets measured at estimated fair value on a nonrecurring basis and

determined using significant unobservable inputs (Level 3) are summarized in “—Nonrecurring Fair Value Measurements” and Note 11.

A description of the sensitivity of the estimated fair value to changes in the significant unobservable inputs for certain of the major asset and liability

classes described above is as follows:

Securities

Significant spread widening in isolation will adversely impact the overall valuation, while significant spread tightening will lead to substantial

valuation increases. Significant increases (decreases) in expected default rates in isolation would result in substantially lower (higher) valuations.

Significant increases (decreases) in offered quotes in isolation would result in substantially higher (lower) valuations. For U.S. and foreign corporate

securities, significant increases (decreases) in illiquidity premiums in isolation would result in substantially lower (higher) valuations. For RMBS, CMBS

and ABS, changes in the assumptions used for the probability of default is accompanied by a directionally similar change in the assumption used for

the loss severity and a directionally opposite change in the assumptions used for prepayment rates.

Interest rate derivatives

Significant increases (decreases) in the unobservable portion of the swap yield curve in isolation will result in substantial valuation changes.

Foreign currency exchange rate derivatives

Significant increases (decreases) in the unobservable portion of the swap yield curve in isolation will result in substantial valuation changes.

Increases (decreases) in currency correlation in isolation will increase (decrease) the significance of the change in valuations.

Credit derivatives

Credit derivatives with significant unobservable inputs are primarily comprised of credit default swaps written by the Company. Significant credit

spread widening in isolation will result in substantially higher adverse valuations, while significant spread tightening will result in substantially lower

adverse valuations. Significant increases (decreases) in offered quotes in isolation will result in substantially higher (lower) valuations.

Equity market derivatives

Significant decreases in equity volatility in isolation will adversely impact overall valuation, while significant increases in equity volatility will result in

substantial valuation increases. Increases (decreases) in correlation in isolation will increase (decrease) the significance of the change in valuations.

Significant increases (decreases) in offered quotes in isolation will result in substantially higher (lower) valuations.

Direct and assumed guaranteed minimum benefits

For any increase (decrease) in mortality and lapse rates, the fair value of the guarantees will decrease (increase). For any increase (decrease) in

utilization and volatility, the fair value of the guarantees will increase (decrease). Specifically for GMWBs, for any increase (decrease) in withdrawal

rates, the fair value of the guarantees will increase (decrease). Specifically for GMABs and GMIBs, for any increase (decrease) in withdrawal rates,

the fair value of the guarantees will decrease (increase).

MetLife, Inc. 149