MetLife 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

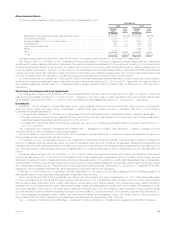

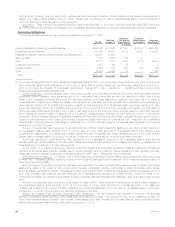

Financing Cash Flows. The principal cash inflows from our financing activities come from issuances of debt, issuances of MetLife, Inc.’s

securities, and deposit funds associated with PABs. The principal cash outflows come from repayments of debt, payments of dividends on MetLife,

Inc.’s securities and withdrawals associated with PABs. A primary liquidity concern with respect to these cash flows is the risk of early contractholder

and policyholder withdrawal.

Liquidity and Capital Sources

In addition to the general description of liquidity and capital sources in “— Summary of Primary Sources and Uses of Liquidity and Capital,” the

following additional information is provided regarding our primary sources of liquidity and capital:

Global Funding Sources. Liquidity is provided by a variety of short-term instruments, including funding agreements, credit facilities and

commercial paper. Capital is provided by a variety of instruments, including short-term and long-term debt, collateral financing arrangements, junior

subordinated debt securities, preferred securities and equity and equity-linked securities. The diversity of our funding sources enhances our funding

flexibility, limits dependence on any one market or source of funds and generally lowers the cost of funds. Our primary global funding sources

include:

Common Stock. In October 2012, MetLife, Inc. issued 28,231,956 shares of its common stock for $1.0 billion in connection with the

remarketing of senior debt securities and settlement of stock purchase contracts.

In November 2010, MetLife, Inc. issued to AM Holdings in connection with the financing of the ALICO Acquisition 78,239,712 new shares

of its common stock at $40.90 per share. In March 2011, AM Holdings sold the 78,239,712 shares of common stock in a public offering

concurrent with a public offering by MetLife, Inc. of 68,570,000 new shares of its common stock at a price of $43.25 per share for proceeds of

$2.9 billion, net of $16 million of issuance costs.

In August 2010, in connection with the financing of the ALICO Acquisition, MetLife, Inc. issued 86,250,000 new shares of its common

stock at a price of $42.00 per share for proceeds of $3.5 billion, net of $94 million of issuance costs.

Commercial Paper, Reported in Short-term Debt. MetLife, Inc. and MetLife Funding, Inc. (“MetLife Funding”) each have commercial paper

programs supported by $4.0 billion in general corporate credit facilities (see “— Credit and Committed Facilities”). MetLife Funding, a subsidiary

of Metropolitan Life Insurance Company (“MLIC”), serves as our centralized finance unit. MetLife Funding raises cash from its commercial paper

program and uses the proceeds to extend loans, through MetLife Credit Corp., another subsidiary of MLIC, to MetLife, Inc., MLIC and other

affiliates in order to enhance the financial flexibility and liquidity of these companies. Outstanding balances for the commercial paper program

fluctuate in line with changes to affiliates’ financing arrangements.

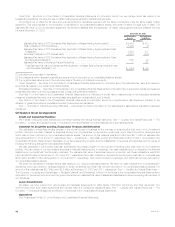

Federal Home Loan Bank Funding Agreements, Reported in Policyholder Account Balances. Certain of our domestic insurance

subsidiaries are members of various FHLB state associations. During the years ended December 31, 2012, 2011 and 2010, we issued $17.4

billion, $8.8 billion and $10.8 billion, respectively, and repaid $14.8 billion, $8.7 billion and $12.0 billion, respectively, under funding agreements

with the certain state FHLBs. At December 31, 2012 and 2011, total obligations outstanding under these funding agreements were $15.4

billion and $12.8 billion, respectively. See Note 4 of the Notes to the Consolidated Financial Statements.

Special Purpose Entity Funding Agreements, Reported in Policyholder Account Balances. We issue fixed and floating rate funding

agreements, which are denominated in either U.S. dollars or foreign currencies, to certain special purpose entities (“SPEs”) that have issued

either debt securities or commercial paper for which payment of interest and principal is secured by such funding agreements. During the years

ended December 31, 2012, 2011 and 2010, we issued $35.1 billion, $39.9 billion and $34.1 billion, respectively, and repaid $31.1 billion,

$41.6 billion and $30.9 billion, respectively, under such funding agreements. At December 31, 2012 and 2011, total obligations outstanding

under these funding agreements were $30.0 billion and $25.5 billion, respectively. See Note 4 of the Notes to the Consolidated Financial

Statements.

Federal Agricultural Mortgage Corporation Funding Agreements, Reported in Policyholder Account Balances. We issue funding

agreements to the Federal Agricultural Mortgage Corporation (“Farmer Mac”), as well as to certain SPEs that have issued debt securities for

which payment of interest and principal is secured by such funding agreements; such debt securities are also guaranteed as to payment of

interest and principal by Farmer Mac. The obligations under all such funding agreements are secured by a pledge of certain eligible agricultural

real estate mortgage loans and may, under certain circumstances, be secured by other qualified collateral. During the years ended

December 31, 2012, 2011 and 2010, we issued $0, $1.5 billion and $250 million, respectively, and repaid $0, $1.5 billion and $0,

respectively, under such funding agreements. At both December 31, 2012 and 2011, total obligations outstanding under these funding

agreements were $2.8 billion. See Note 4 of the Notes to the Consolidated Financial Statements.

Debt Issuances and Other Borrowings. See Note 12 of the Notes to the Consolidated Financial Statements for further information on the

following issuances of debt and other borrowings:

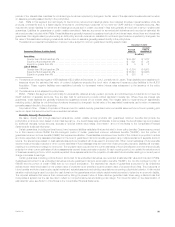

‰In August 2012, MetLife, Inc. issued $750 million of senior notes for general corporate purposes, which may include repayment of certain

senior notes due in 2013;

‰In November 2010, in connection with the financing of the ALICO Acquisition, MetLife, Inc. issued to AM Holdings $3.0 billion of senior

debt securities, which constitute a part of the MetLife, Inc. common equity units more fully described in Note 15 of the Notes to the

Consolidated Financial Statements;

‰In August 2010, in anticipation of the ALICO Acquisition, MetLife, Inc. issued $3.0 billion of senior notes;

‰During the years ended December 31, 2012, 2011 and 2010, MetLife Bank received advances related to long-term borrowings totaling

$0, $1.3 billion and $2.1 billion, and short-term borrowings totaling $150 million, $10.1 billion and $12.5 billion, respectively, from the

FHLB of New York (“FHLB of NY”).

Remarketing of Senior Debt Securities and Settlement of Stock Purchase Contracts. In October 2012, MetLife, Inc. closed the successful

remarketing of $1.0 billion of senior debt securities underlying the common equity units, which were issued in November 2010 in connection

with the ALICO Acquisition. MetLife, Inc. did not receive any proceeds from the remarketing. Common equity unit holders used the remarketing

proceeds to settle their payment obligations under the applicable stock purchase contracts. The subsequent settlement of the stock purchase

contracts occurred in October 2012, providing proceeds to MetLife, Inc. of $1.0 billion in exchange for shares of MetLife, Inc.’s common stock.

MetLife, Inc. delivered 28,231,956 shares of its newly issued common stock to settle the stock purchase contracts. See Note 15 of the Notes

to the Consolidated Financial Statements for additional information.

MetLife, Inc. 57