MetLife 2012 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

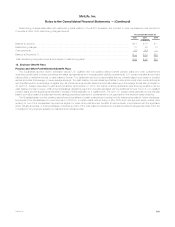

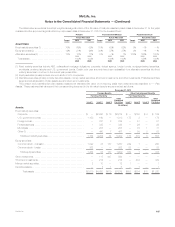

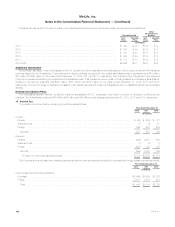

December 31, 2011

Pension Benefits Other Postretirement Benefits

Fair Value Hierarchy Fair Value Hierarchy

Level 1 Level 2 Level 3

Total

Estimated

Fair Value Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets:

Fixed maturity securities:

Corporate .............................................. $ — $1,932 $ 32 $1,964 $ — $139 $ 4 $ 143

U.S. government bonds ................................... 1,007 187 — 1,194 160 1 — 161

Foreign bonds ........................................... — 213 5 218 — 13 — 13

Federal agencies ......................................... 1 286 — 287 — 29 — 29

Municipals .............................................. — 184 — 184 — 59 1 60

Other (1) ............................................... — 473 2 475 — 84 5 89

Total fixed maturity securities .............................. 1,008 3,275 39 4,322 160 325 10 495

Equity securities:

Common stock - domestic ................................. 1,149 38 206 1,393 240 2 — 242

Common stock - foreign ................................... 287 — — 287 55 — — 55

Total equity securities ................................... 1,436 38 206 1,680 295 2 — 297

Other investments .......................................... — 69 531 600 — — — —

Short-term investments ...................................... 4 401 — 405 6 435 — 441

Money market securities ..................................... 2 — — 2 — 1 — 1

Derivative assets ........................................... 30 10 4 44 — — 1 1

Other receivables .......................................... — 47 — 47 — 4 — 4

Securities receivable ........................................ — 8 — 8 — 1 — 1

Total assets ......................................... $2,480 $3,848 $780 $7,108 $461 $768 $11 $1,240

(1) Other primarily includes mortgage-backed securities, collateralized mortgage obligations, and ABS. The prior year amounts have been reclassified

into fixed maturity securities to conform to the current year presentation.

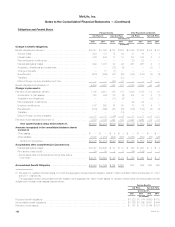

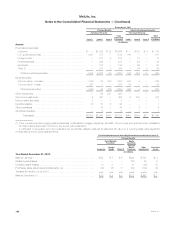

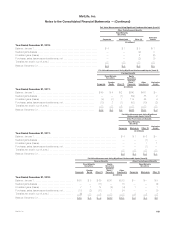

A rollforward of all pension and other postretirement benefit plan assets measured at estimated fair value on a recurring basis using significant

unobservable (Level 3) inputs was as follows:

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Pension Benefits

Fixed Maturity

Securities: Equity

Securities:

Corporate Foreign

Bonds Other (1)

Common

Stock-

Domestic Other

Investments Derivative

Assets

(In millions)

Year Ended December 31, 2012:

Balance, January 1, ................................................. $32 $ 5 $ 2 $206 $ 531 $ 4

Realized gains (losses) ............................................... — — — (27) 55 6

Unrealized gains (losses) ............................................. (1) 8 — 10 (36) (7)

Purchases, sales, issuances and settlements, net .......................... (12) (5) 5 (52) (103) (2)

Transfers into and/or out of Level 3 ..................................... — — — — — —

Balance, December 31, .............................................. $19 $ 8 $ 7 $137 $ 447 $ 1

188 MetLife, Inc.