MetLife 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

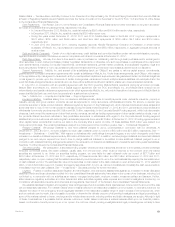

contributions, if necessary, to MRC so that MRC may at all times maintain its total adjusted capital in an amount that is equal to or greater than 200%

of the company action level RBC, as defined in South Carolina state insurance statutes as in effect on the date of determination or December 31,

2007, whichever calculation produces the greater capital requirement, or as otherwise required by the South Carolina Department of Insurance. See

Note 13 of the Notes to the Consolidated Financial Statements.

MetLife, Inc., in connection with the collateral financing arrangement associated with MetLife Reinsurance Company of South Carolina’s

(“MRSC”) reinsurance of universal life secondary guarantees, committed to the South Carolina Department of Insurance to take necessary action to

cause MRSC to maintain the greater of capital and surplus of $250,000 or total adjusted capital in an amount that is equal to or greater than 100%

of authorized control level RBC, as defined in South Carolina state insurance statutes. See Note 13 of the Notes to the Consolidated Financial

Statements.

MetLife, Inc. has net worth maintenance agreements with two of its insurance subsidiaries, MetLife Investors Insurance Company and First

MetLife Investors Insurance Company. Under these agreements, as amended, MetLife, Inc. agreed, without limitation as to the amount, to cause

each of these subsidiaries to have capital and surplus of $10 million, total adjusted capital in an amount that is equal to or greater than 150% of the

company action level RBC, as defined by applicable state insurance statutes, and liquidity necessary to enable it to meet its current obligations on a

timely basis.

MetLife, Inc. guarantees obligations arising from derivatives of the following subsidiaries: Exeter, MetLife Bank, MetLife International Holdings, Inc.

and MetLife Worldwide Holdings, Inc. These subsidiaries are exposed to various risks relating to their ongoing business operations, including interest

rate, foreign currency exchange rate, credit and equity market. These subsidiaries use a variety of strategies to manage these risks, including the use

of derivatives. Further, all of the subsidiaries’ derivatives are subject to industry standard netting agreements and collateral agreements that limit the

unsecured portion of any open derivative position. On a net counterparty basis at December 31, 2012 and 2011, derivative transactions with

positive mark-to-market values (in-the-money) were $3.2 billion and $4.9 billion, respectively, and derivative transactions with negative mark-to-

market values (out-of-the-money) were $22 million and $51 million, respectively. To secure the obligations represented by the out of-the-money

transactions, the subsidiaries had provided collateral to their counterparties with an estimated fair value of $12 million and $47 million at

December 31, 2012 and 2011, respectively. Accordingly, unsecured derivative liabilities guaranteed by MetLife, Inc. were $10 million and $4 million

at December 31, 2012 and 2011, respectively.

MetLife, Inc. also guarantees the obligations of certain of its subsidiaries under committed facilities with third-party banks. See Note 12 of the

Notes to the Consolidated Financial Statements.

Acquisitions. During the years ended December 31, 2012 and 2011, there were no cash outflows for acquisitions. Cash outflows for

acquisitions during the year ended December 31, 2010 were $7.2 billion. See Note 3 of the Notes to the Consolidated Financial Statements for

information regarding certain of these acquisitions. See Note 23 of the Notes to the Consolidated Financial Statements for information regarding a

pending acquisition.

Adoption of New Accounting Pronouncements

See Note 1 of the Notes to the Consolidated Financial Statements.

Future Adoption of New Accounting Pronouncements

See Note 1 of the Notes to the Consolidated Financial Statements.

Non-GAAP and Other Financial Disclosures

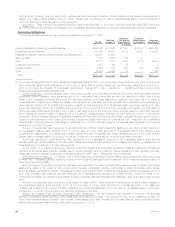

Operating earnings is defined as operating revenues less operating expenses, both net of income tax. Operating earnings available to common

shareholders is defined as operating earnings less preferred stock dividends.

Operating revenues and operating expenses exclude results of Divested Businesses. Operating revenues also excludes net investment gains

(losses) and net derivative gains (losses). Operating expenses also excludes goodwill impairments.

The following additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

‰Universal life and investment-type product policy fees excludes the amortization of unearned revenue related to net investment gains (losses) and

net derivative gains (losses) and certain variable annuity GMIB fees (“GMIB Fees”);

‰Net investment income: (i) includes amounts for scheduled periodic settlement payments and amortization of premium on derivatives that are

hedges of investments but do not qualify for hedge accounting treatment, (ii) includes income from discontinued real estate operations,

(iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for under the equity method, (iv) excludes

certain amounts related to contractholder-directed unit-linked investments, and (v) excludes certain amounts related to securitization entities that

are VIEs consolidated under GAAP; and

‰Other revenues are adjusted for settlements of foreign currency earnings hedges.

The following additional adjustments are made to GAAP expenses, in the line items indicated, in calculating operating expenses:

‰Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder dividend obligation related to net investment

gains (losses) and net derivative gains (losses), (ii) inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed

investments and amounts associated with periodic crediting rate adjustments based on the total return of a contractually referenced pool of

assets, (iii) benefits and hedging costs related to GMIBs (“GMIB Costs”), and (iv) market value adjustments associated with surrenders or

terminations of contracts (“Market Value Adjustments”);

‰Interest credited to policyholder account balances includes adjustments for scheduled periodic settlement payments and amortization of premium

on derivatives that are hedges of PABs but do not qualify for hedge accounting treatment and excludes amounts related to net investment income

earned on contractholder-directed unit-linked investments;

‰Amortization of DAC and VOBA excludes amounts related to: (i) net investment gains (losses) and net derivative gains (losses), (ii) GMIB Fees and

GMIB Costs, and (iii) Market Value Adjustments;

‰Amortization of negative VOBA excludes amounts related to Market Value Adjustments;

‰Interest expense on debt excludes certain amounts related to securitization entities that are VIEs consolidated under GAAP; and

‰Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new insurance regulatory requirements, and

(iii) acquisition and integration costs.

Also, operating return on common equity is defined as operating earnings available to common shareholders, divided by average GAAP common

equity.

All references to “operating earnings per share” and “operating return on equity” should be read as references to “operating earnings available to

common shareholders per diluted common share” and “operating return on common equity.” “Operating premiums, fees and other revenues” is defined

as GAAP premium, fees and other revenues less the applicable adjustments made to GAAP revenues in calculating operating revenues, as described

above. See “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for additional

information.

MetLife, Inc. 65