MetLife 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife has been actively growing its emerging-markets business both organically and through acquisitions and

partnerships. We have expanded in Eastern Europe with the acquisition of Aviva’s life businesses in Hungary, Romania

and the Czech Republic, which added a large, diverse distribution network and expanded MetLife’s product capabilities,

further solidifying the company’s market position in the region.

We recently finalized our partnership agreement with Punjab National Bank (PNB) in India that will give us access to

over 70 million PNB customers across the nation. This partnership is an important step forward in a large market with a

rapidly growing middle class.

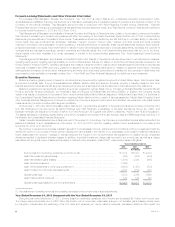

Most recently, we announced our agreement to acquire AFP Provida, the largest pension provider in Chile. MetLife is

already the leading life insurer in Chile, and the acquisition of AFP Provida for approximately $2 billion in cash will further

strengthen our position in the market. With this acquisition, MetLife’s operating earnings from emerging markets are

expected to grow from 14% today to approximately 17%, which puts us halfway toward our 2016 target.

In addition to being an excellent strategic fit, the Provida acquisition is very attractive on a financial basis. We

anticipate that the transaction will be immediately accretive to operating earnings. While accretion from a cash acquisition

is one metric to consider, it does not necessarily determine if the transaction creates shareholder value. Therefore, we

modeled the long-term operating EPS impact of Provida assuming we financed the transaction using 75% equity and

25% debt. On this basis, we forecast that the transaction would be essentially neutral for operating EPS during the first

few years and then become accretive. This analysis gave us comfort that the return on this transaction is likely to exceed

our weighted-average cost of capital.

Build the Global Employee Benefits Business

MetLife will build on its strong U.S. employee benefits business to help companies around the world provide benefit

solutions to their employees. Whether the market is U.S. citizens living abroad or the local workforces of large

multinational firms, MetLife has the capabilities to provide benefit solutions that help companies win in the global war for

talent.

In its first year of operations, Global Employee Benefits grew year-over-year expatriate sales by 189% and

multinational sales by 54%. We are leveraging MetLife’s scale, global footprint and existing relationships to secure deals

of increasing size and scope. For example, in April we won a contract with a Korean-based manufacturer to provide

benefits to 350 expatriates in seven countries, and in December we struck a deal to cover a multinational bank’s 13,500

employees in the United Kingdom. From new products to enhanced technology, we are making prudent investments to

continue growing our employee benefits businesses outside of the U.S.

Drive Toward Customer Centricity and a Global Brand

For MetLife, customer centricity is not a fad or a buzzword. It is a central organizing principle for how we are going to

do business. The life insurance industry is not known for providing exceptional customer experiences, which is one of the

reasons insurers have lost market share over the decades to banks and asset managers. We are working hard to make

customer centricity a powerful competitive advantage for MetLife across all products and markets.

In 2012, we launched a customer empathy initiative with participation by all of our senior leaders. For example, every

member of the Executive Group and I are personally calling dissatisfied customers to learn how we can do better. We

also introduced metrics to track MetLife’s performance on 100 customer touch points in 10 countries. The reason is

simple: Research confirms that customer-centric companies achieve higher organic growth rates and lower costs.

Another way to create a meaningful and enduring competitive advantage is to build consumer preference for our

brand above all others. MetLife’s brand is formidable in the United States and parts of Latin America, but is not as

well-known in some of the new markets we entered through the Alico acquisition. So we are building the brand’s

familiarity and appeal around the world. In Japan, using the popular Peanuts characters, we are promoting the diversity of

MetLife’s distribution channels. In Turkey, we recently announced the new availability of our products at nearly 600

DenizBank branches with the aid of popular celebrity spokespersons.

ii MetLife, Inc.