MetLife 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

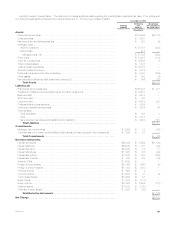

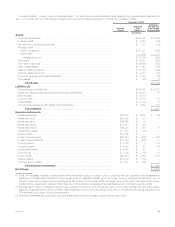

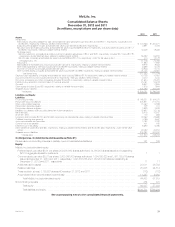

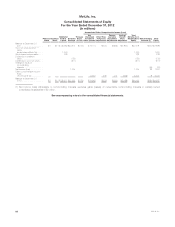

MetLife, Inc.

Consolidated Balance Sheets

December 31, 2012 and 2011

(In millions, except share and per share data)

2012 2011

Assets

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $340,870 and $329,811, respectively; includes $3,378

and $3,225, respectively, relating to variable interest entities) .............................................................. $ 374,266 $ 350,271

Equity securities available-for-sale, at estimated fair value (cost: $2,838 and $3,208, respectively) ................................... 2,891 3,023

Fair value option and trading securities, at estimated fair value (includes $659 and $473, respectively, of actively traded securities; and $112

and $280, respectively, relating to variable interest entities) ................................................................ 16,348 18,268

Mortgage loans:

Held-for-investment, principally at amortized cost (net of valuation allowances of $347 and $481, respectively; includes $2,715 and $3,187,

respectively, at estimated fair value, relating to variable interest entities) ..................................................... 56,592 56,915

Held-for-sale, principally at estimated fair value (includes $49 and $10,716, respectively, under the fair value option) ................... 414 15,178

Mortgage loans, net ............................................................................................. 57,006 72,093

Policy loans ...................................................................................................... 11,884 11,892

Real estate and real estate joint ventures (includes $10 and $15, respectively, relating to variable interest entities) ....................... 9,918 8,563

Other limited partnership interests (includes $274 and $259, respectively, relating to variable interest entities) .......................... 6,688 6,378

Short-term investments, principally at estimated fair value .................................................................. 16,906 17,310

Other invested assets, principally at estimated fair value (includes $81 and $98, respectively, relating to variable interest entities) ........... 21,145 23,581

Total investments ............................................................................................ 517,052 511,379

Cash and cash equivalents, principally at estimated fair value (includes $99 and $176, respectively, relating to variable interest entities) ....... 15,738 10,461

Accrued investment income (includes $13 and $16, respectively, relating to variable interest entities) .................................. 4,374 4,344

Premiums, reinsurance and other receivables (includes $5 and $12, respectively, relating to variable interest entities) ..................... 21,634 22,481

Deferred policy acquisition costs and value of business acquired .............................................................. 24,761 24,619

Goodwill ......................................................................................................... 9,953 11,935

Other assets (includes $5 and $5, respectively, relating to variable interest entities) ................................................ 7,876 7,984

Separate account assets ............................................................................................. 235,393 203,023

Total assets ................................................................................................. $ 836,781 $ 796,226

Liabilities and Equity

Liabilities

Future policy benefits ................................................................................................ $ 192,351 $ 184,275

Policyholder account balances ........................................................................................ 225,821 217,700

Other policy-related balances ......................................................................................... 15,463 15,599

Policyholder dividends payable ........................................................................................ 728 774

Policyholder dividend obligation ........................................................................................ 3,828 2,919

Payables for collateral under securities loaned and other transactions .......................................................... 33,687 33,716

Bank deposits ..................................................................................................... 6,416 10,507

Short-term debt .................................................................................................... 100 686

Long-term debt (includes $2,527 and $3,068, respectively, at estimated fair value, relating to variable interest entities) .................... 19,062 23,692

Collateral financing arrangements ...................................................................................... 4,196 4,647

Junior subordinated debt securities ..................................................................................... 3,192 3,192

Current income tax payable ........................................................................................... 401 193

Deferred income tax liability ........................................................................................... 8,693 6,395

Other liabilities (includes $40 and $60, respectively, relating to variable interest entities; and $0 and $7,626, respectively, under the fair value

option) ......................................................................................................... 22,492 30,914

Separate account liabilities ........................................................................................... 235,393 203,023

Total liabilities ................................................................................................ 771,823 738,232

Contingencies, Commitments and Guarantees (Note 21)

Redeemable noncontrolling interests in partially-owned consolidated subsidiaries ................................... 121 105

Equity

MetLife, Inc.’s stockholders’ equity: .......................................................................

Preferred stock, par value $0.01 per share; 200,000,000 shares authorized: 84,000,000 shares issued and outstanding;

$2,100 aggregate liquidation preference ............................................................... 1 1

Common stock, par value $0.01 per share; 3,000,000,000 shares authorized; 1,094,880,623 and 1,061,150,915 shares

issued at December 31, 2012 and 2011, respectively; 1,091,686,736 and 1,057,957,028 shares outstanding at

December 31, 2012 and 2011, respectively ............................................................ 11 11

Additional paid-in capital .............................................................................. 28,011 26,782

Retained earnings ................................................................................... 25,205 24,814

Treasury stock, at cost; 3,193,887 shares at December 31, 2012 and 2011 ..................................... (172) (172)

Accumulated other comprehensive income (loss) .......................................................... 11,397 6,083

Total MetLife, Inc.’s stockholders’ equity .............................................................. 64,453 57,519

Noncontrolling interests ................................................................................ 384 370

Total equity .................................................................................... 64,837 57,889

Total liabilities and equity .......................................................................... $836,781 $796,226

See accompanying notes to the consolidated financial statements.

MetLife, Inc. 77