MetLife 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

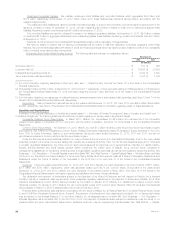

MetLife, Inc.’s ability to maintain regular access to competitively priced wholesale funds is fostered by its current credit ratings from the major credit

rating agencies. We view our capital ratios, credit quality, stable and diverse earnings streams, diversity of liquidity sources and our liquidity monitoring

procedures as critical to retaining such credit ratings. See “— The Company — Capital — Rating Agencies.”

Liquid Assets. At December 31, 2012 and 2011, MetLife, Inc. and other MetLife holding companies had $5.7 billion and $4.2 billion,

respectively, in liquid assets. Of these amounts, $5.0 billion and $3.8 billion were held by MetLife, Inc. and $0.7 billion and $0.4 billion were held by

other MetLife holding companies, at December 31, 2012 and 2011, respectively. Liquid assets include cash and cash equivalents, short-term

investments and publicly-traded securities, excluding: (i) cash collateral received under our securities lending program; (ii) cash collateral received

from counterparties in connection with derivatives; and (iii) securities held in trust in support of collateral financing arrangements and pledged in

support of advances agreements and derivatives.

Liquid assets held in non-U.S. holding companies are generated in part through dividends from non-U.S. insurance operations determined to be

available after application of local insurance regulatory requirements, as discussed in “— MetLife, Inc. — Liquidity and Capital Sources — Dividends

from Subsidiaries.” The cumulative earnings of certain active non-U.S. operations have been reinvested indefinitely in such non-U.S. operations, as

described in Note 19 of the Notes to the Consolidated Financial Statements. Under current tax laws, should we repatriate such earnings, we may be

subject to additional U.S. income taxes and foreign withholding taxes.

Liquidity

For a summary of MetLife, Inc.’s liquidity, see “— The Company — Liquidity.”

Capital

Potential Restrictions and Limitations on Non-Bank SIFIs. MetLife Bank has terminated its Federal Deposit Insurance Corporation (“FDIC”)

insurance and MetLife, Inc. de-registered as a bank holding company. As a result, MetLife, Inc. is no longer subject to enhanced supervision and

prudential standards as a bank holding company with assets of $50 billion or more. However, if, in the future, MetLife, Inc. is designated by the

FSOC as a non-bank systemically important financial institution (“non-bank SIFI”), it could once again be subject to regulation by the Federal Reserve

and enhanced supervision and prudential standards. In addition, if MetLife, Inc. is designated as a non-bank SIFI or a G-SII, its ability to pay

dividends, repurchase common stock or other securities or engage in other transactions that could affect its capital or need for capital could be

reduced by any additional capital requirements that might be imposed. See “Business — U.S. Regulation — Potential Regulation as a Non-Bank

SIFI” and “— International Regulation” in the 2012 Form 10-K.

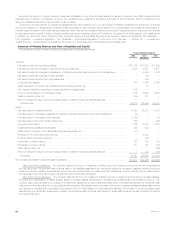

Liquidity and Capital Sources

In addition to the description of liquidity and capital sources in “— The Company — Summary of Primary Sources and Uses of Liquidity and Capital,”

the following additional information is provided regarding MetLife, Inc.’s primary sources of liquidity and capital:

Dividends from Subsidiaries. MetLife, Inc. relies in part on dividends from its subsidiaries to meet its cash requirements. MetLife, Inc.’s

insurance subsidiaries are subject to regulatory restrictions on the payment of dividends imposed by the regulators of their respective domiciles. The

dividend limitation for U.S. insurance subsidiaries is generally based on the surplus to policyholders at the end of the immediately preceding calendar

year and statutory net gain from operations for the immediately preceding calendar year. Statutory accounting practices, as prescribed by insurance

regulators of various states in which we conduct business, differ in certain respects from accounting principles used in financial statements prepared

in conformity with GAAP. The significant differences relate to the treatment of DAC, certain deferred income tax, required investment liabilities,

statutory reserve calculation assumptions, goodwill and surplus notes.

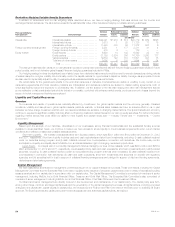

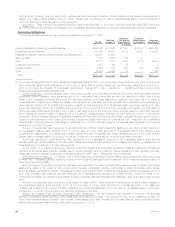

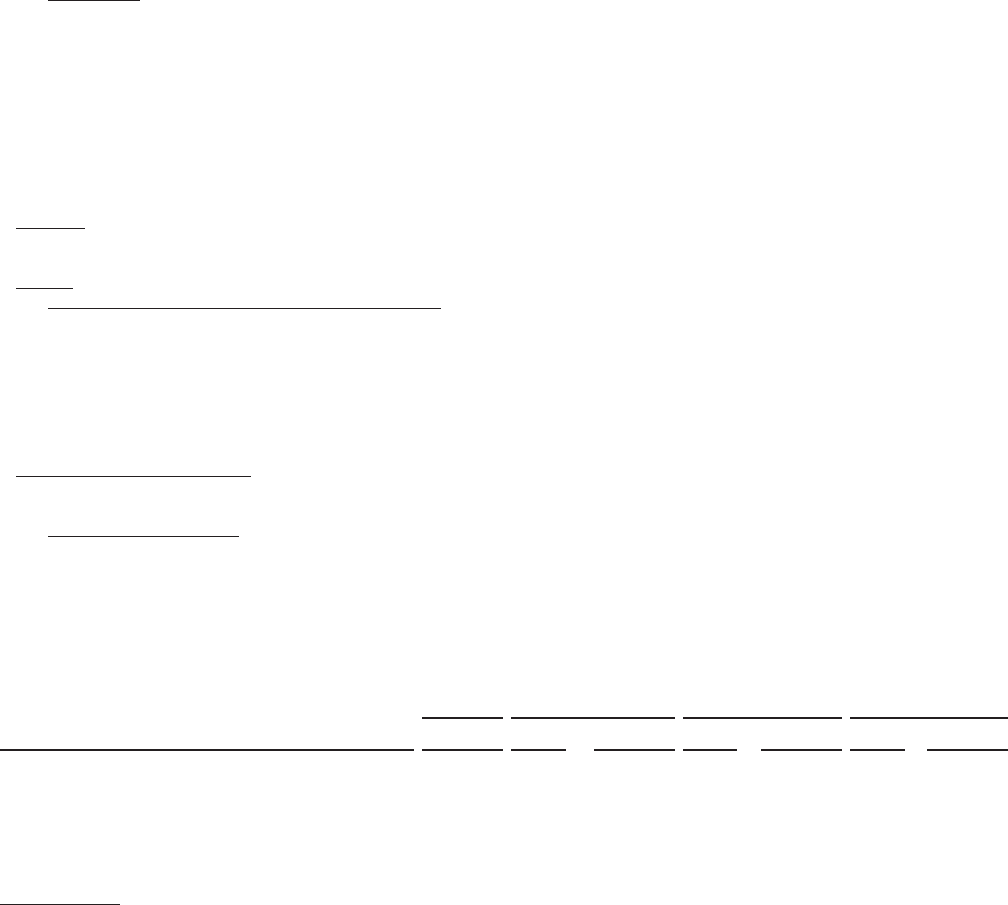

The table below sets forth the dividends permitted to be paid by the respective insurance subsidiary without insurance regulatory approval and

the respective dividends paid:

2013 2012 2011 2010

Company Permitted w/o

Approval (1) Paid (2) Permitted w/o

Approval (3) Paid (2) Permitted w/o

Approval (3) Paid (2) Permitted w/o

Approval (3)

(In millions)

Metropolitan Life Insurance Company ................... $ 1,428 $ 1,023 $ 1,350 $1,321(4) $ 1,321 $ 631(4) $ 1,262

American Life Insurance Company ...................... $ 523 $ 1,300(5) $ 168 $ 661 $ 661 $ —(6) $ 511

MetLife Insurance Company of Connecticut ............... $ 1,330 $ 706(7) $ 504 $ 517 $ 517 $ 330 $ 659

Metropolitan Property and Casualty Insurance Company ..... $ 74 $ 100 $ — $ 30 $ — $ 260 $ —

Metropolitan Tower Life Insurance Company .............. $ 77 $ 82 $ 82 $ 80 $ 80 $ 569(8) $ 93

MetLife Investors Insurance Company ................... $ 129 $ 18 $ 18 $ — $ — $ — $ —

Delaware American Life Insurance Company .............. $ 7 $ — $ 12 $ — $ — $ — $ —

(1) Reflects dividend amounts that may be paid during 2013 without prior regulatory approval. However, because dividend tests may be based on

dividends previously paid over rolling 12-month periods, if paid before a specified date during 2013, some or all of such dividends may require

regulatory approval.

(2) Reflects all amounts paid, including those requiring regulatory approval.

(3) Reflects dividend amounts that could have been paid during the relevant year without prior regulatory approval.

(4) Includes securities transferred to MetLife, Inc. of $170 million and $399 million during the years ended December 31, 2011 and 2010, respectively.

(5) During May 2012, American Life received regulatory approval to pay an extraordinary dividend for an amount up to the funds remitted in connection

with the restructuring of American Life’s business in Japan. Subsequently, $1.5 billion was remitted to American Life. See Note 19 of the Notes to

the Consolidated Financial Statements. Of this approved amount, $1.3 billion was paid to MetLife, Inc., as an extraordinary dividend.

(6) No dividends were paid to MetLife, Inc. from the ALICO Acquisition Date through December 31, 2010. See Note 3 of the Notes to the Consolidated

Financial Statements.

(7) During June 2012, MICC distributed shares of an affiliate to its shareholders as an in-kind extraordinary dividend of $202 million, as calculated on a

statutory basis. Regulatory approval for this extraordinary dividend was obtained due to the timing of payment. During December 2012, MICC paid a

dividend to its shareholders in the amount of $504 million, which represented its ordinary dividend capacity at December 31, 2012. Due to the June

2012 in-kind dividend, a portion of this was extraordinary and regulatory approval was obtained.

(8) Reflects shares of an affiliate distributed to MetLife, Inc. as an in-kind dividend of $475 million.

62 MetLife, Inc.