MetLife 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

“In these days of fierce competition, we are apt to disregard the old landmarks in the wild anxiety for business, but the

management of this Company are determined to be guided only by those sound and conservative principles which

can be the only basis of a permanent success; among them is the necessity of more solicitude for the character of its

business than for its mere volume.”

—Metropolitan Life Insurance Company, Annual Report, 1870

To my fellow shareholders:

One year ago in this space, I outlined the principles MetLife would follow in developing its new corporate strategy,

among them, that we would strike the right balance between growth, profitability and risk. So I was pleased to learn of the

above quote from the company’s founding era. Our managers then knew what we still know today—that compromising

on any one of these will defeat your chances for permanent success.

The task for the current management of MetLife is clear. We must ensure that we conduct business in a way that

creates value for our shareholders, customers, employees and the communities where we do business.

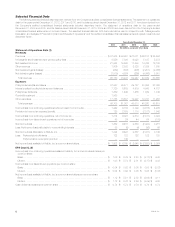

Our financial results and management actions in 2012 demonstrate that we are on the right path. For the year, we

grew operating earnings per share (EPS) by 21% over 2011. We achieved an operating return on equity of 11.3%. And

our operating premiums, fees and other revenues rose by 5% in the face of continuing economic headwinds.1

Even more important than our strong 2012 financial results are the steps we took to position MetLife for long-term

profitable growth. In May of last year, we introduced our new corporate strategy to guide MetLife through the current

environment. We have made significant progress on each of the four cornerstone initiatives.

Refocus the U.S. Business

A top priority for MetLife is to shift our business mix from market-sensitive, capital-intensive products toward

protection-oriented, lower-risk products. To be clear, this does not mean that MetLife will stop providing customers with

long-term income solutions. But in a period of prolonged low interest rates and potentially higher capital requirements for

large life insurance companies, we must achieve the correct balance.

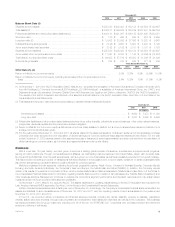

From a high-water mark of approximately $28 billion in 2011, MetLife managed its sales of variable annuity products

downward to $17.7 billion in 2012. For 2013, we plan to sell between $10 billion and $11 billion of variable annuities. We

believe our newest product, which includes a 4% roll-up rate and a 4% withdrawal rate, will improve the risk profile of our

variable annuity sales and generate a higher expected return on economic capital, while still helping customers meet their

retirement security goals.

Similarly, a new Voluntary and Worksite Benefits solution is consistent with our strategic shift toward low-capital-

intensity products. We are now cross-selling protection-oriented accident and health products in Group offerings for mid-

sized employers, which can generate revenue with lower risk. A dedicated team was established within our U.S.

business specifically to drive growth in this area.

Grow Emerging Markets

By capitalizing on an expanding global middle class, we expect to increase MetLife’s share of operating earnings from

emerging markets to more than 20% by 2016, up from 14% today. Our existing emerging-market businesses performed

well in 2012 and contributed to overall operating earnings growth of 18% in Asia, 13% in Latin America, and 8% in

Europe, the Middle East, and Africa (EMEA).

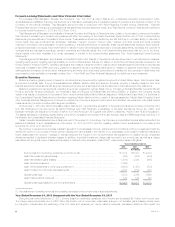

1See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP and Other Financial Disclosures” for non-

GAAP definitions and financial information.