MetLife 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

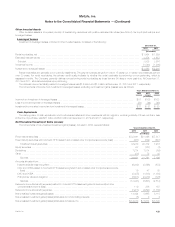

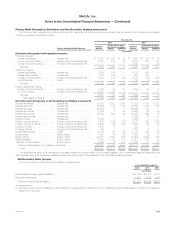

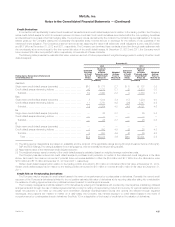

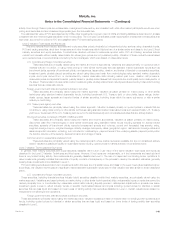

Primary Risks Managed by Derivatives and Non-Derivative Hedging Instruments

The following table presents the gross notional amount, estimated fair value and primary underlying risk exposure of the Company’s derivatives,

excluding embedded derivatives, held at:

Primary Underlying Risk Exposure

December 31,

2012 2011

Notional

Amount

Estimated Fair Value Notional

Amount

Estimated Fair Value

Assets Liabilities Assets Liabilities

(In millions)

Derivatives Designated as Hedging Instruments

Fair value hedges:

Interest rate swaps ............... Interest rate ................... $ 5,397 $ 1,921 $ 90 $ 4,580 $ 1,884 $ 92

Foreign currency swaps ........... Foreign currency exchange rate . . . 3,187 332 85 3,220 500 98

Foreign currency forwards ......... Foreign currency exchange rate . . . — — — 1,830 2 10

Subtotal .................................................... 8,584 2,253 175 9,630 2,386 200

Cash flow hedges:

Interest rate swaps ............... Interest rate ................... 3,642 705 — 3,230 947 —

Interest rate forwards ............. Interest rate ................... 675 139 — 965 210 —

Foreign currency swaps ........... Foreign currency exchange rate . . . 9,038 219 355 6,370 352 306

Credit forwards .................. Credit ....................... — — — 20 4 —

Subtotal .................................................... 13,355 1,063 355 10,585 1,513 306

Foreign operations hedges:

Foreign currency forwards ......... Foreign currency exchange rate . . . 2,552 43 61 1,689 53 12

Currency options ................ Foreign currency exchange rate . . . 4,375 43 3 — — —

Subtotal .................................................... 6,927 86 64 1,689 53 12

Total qualifying hedges ....................................... 28,866 3,402 594 21,904 3,952 518

Derivatives Not Designated or Not Qualifying as Hedging Instruments

Interest rate swaps ................. Interest rate ................... 83,250 5,201 2,043 71,923 5,410 2,107

Interest rate floors .................. Interest rate ................... 56,246 1,174 837 23,866 1,246 165

Interest rate caps .................. Interest rate ................... 49,465 74 — 49,665 102 —

Interest rate futures ................. Interest rate ................... 11,684 1 38 14,965 25 19

Interest rate options ................ Interest rate ................... 16,328 640 60 16,988 896 6

Interest rate forwards ............... Interest rate ................... — — — 13,068 76 91

Synthetic GICs .................... Interest rate ................... 4,162 — — 4,454 — —

Foreign currency swaps ............. Foreign currency exchange rate . . . 8,208 199 736 6,871 320 656

Foreign currency forwards ........... Foreign currency exchange rate . . . 9,202 26 288 6,630 145 38

Currency futures ................... Foreign currency exchange rate . . . 1,408 4 — 633 — —

Currency options .................. Foreign currency exchange rate . . . 129 1 — 1,321 6 —

Credit default swaps ............... Credit ....................... 12,553 90 39 13,136 326 113

Equity futures ..................... Equity market ................. 7,008 14 132 7,053 26 10

Equity options ..................... Equity market ................. 22,920 2,825 356 17,099 3,263 179

Variance swaps ................... Equity market ................. 19,830 122 310 18,801 397 75

Total rate of return swaps ............ Equity market ................. 3,092 4 103 1,644 10 34

Total non-designated or non-qualifying derivatives ...................... 305,485 10,375 4,942 268,117 12,248 3,493

Total ....................................................... $334,351 $13,777 $5,536 $290,021 $16,200 $4,011

The estimated fair value of all derivatives in an asset position is reported within other invested assets in the consolidated balance sheets and the

estimated fair value of all derivatives in a liability position is reported within other liabilities in the consolidated balance sheets.

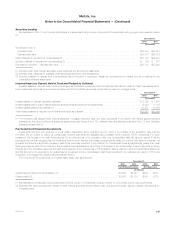

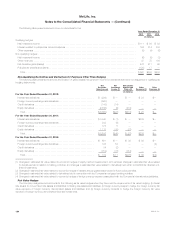

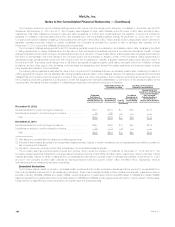

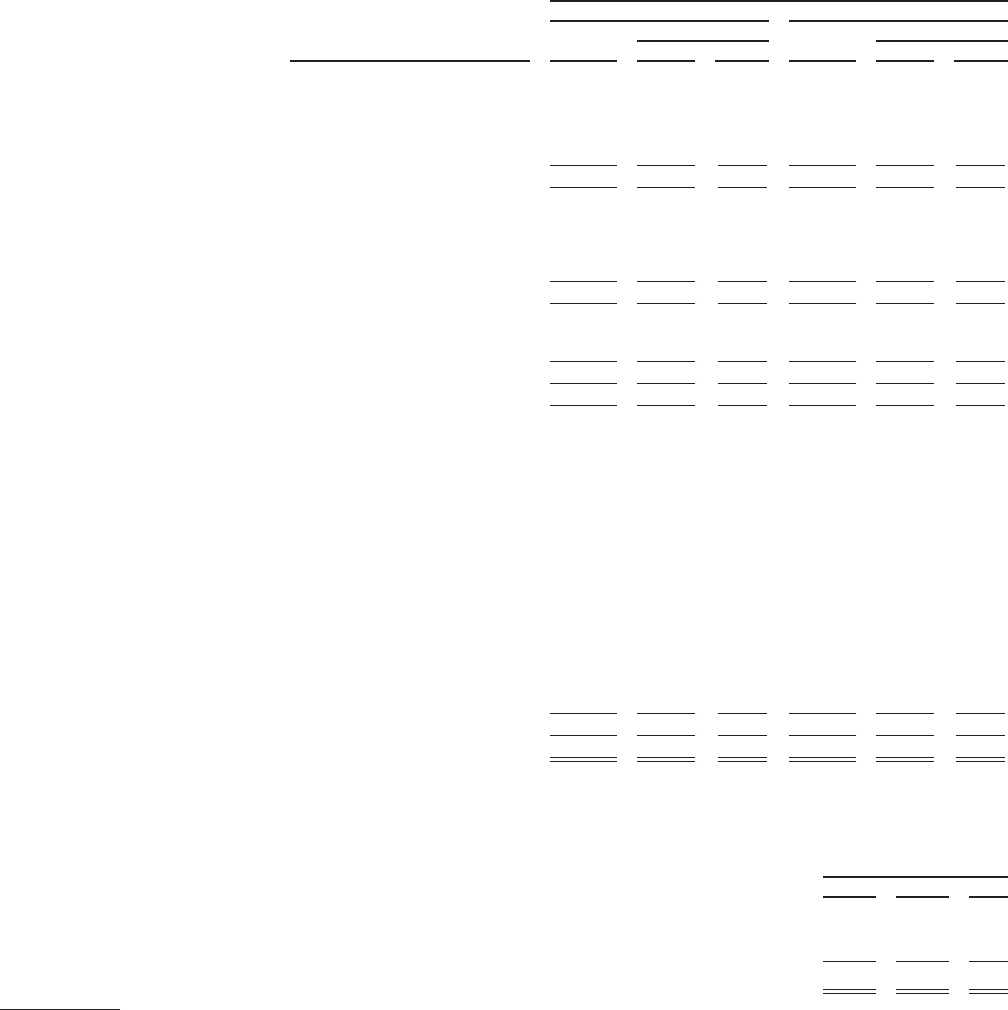

Net Derivative Gains (Losses)

The components of net derivative gains (losses) were as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Derivatives and hedging gains (losses) (1) .............................................................. $(3,158) $ 6,108 $ 122

Embedded derivatives .............................................................................. 1,239 (1,284) (387)

Total net derivative gains (losses) ................................................................... $(1,919) $ 4,824 $(265)

(1) Includes foreign currency transaction gains (losses) on hedged items in cash flow and non-qualifying hedging relationships, which are not presented

elsewhere in this note.

MetLife, Inc. 133