MetLife 2012 Annual Report Download - page 198

Download and view the complete annual report

Please find page 198 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

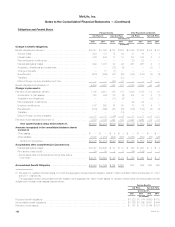

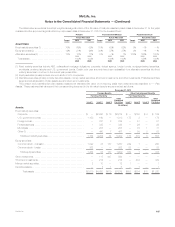

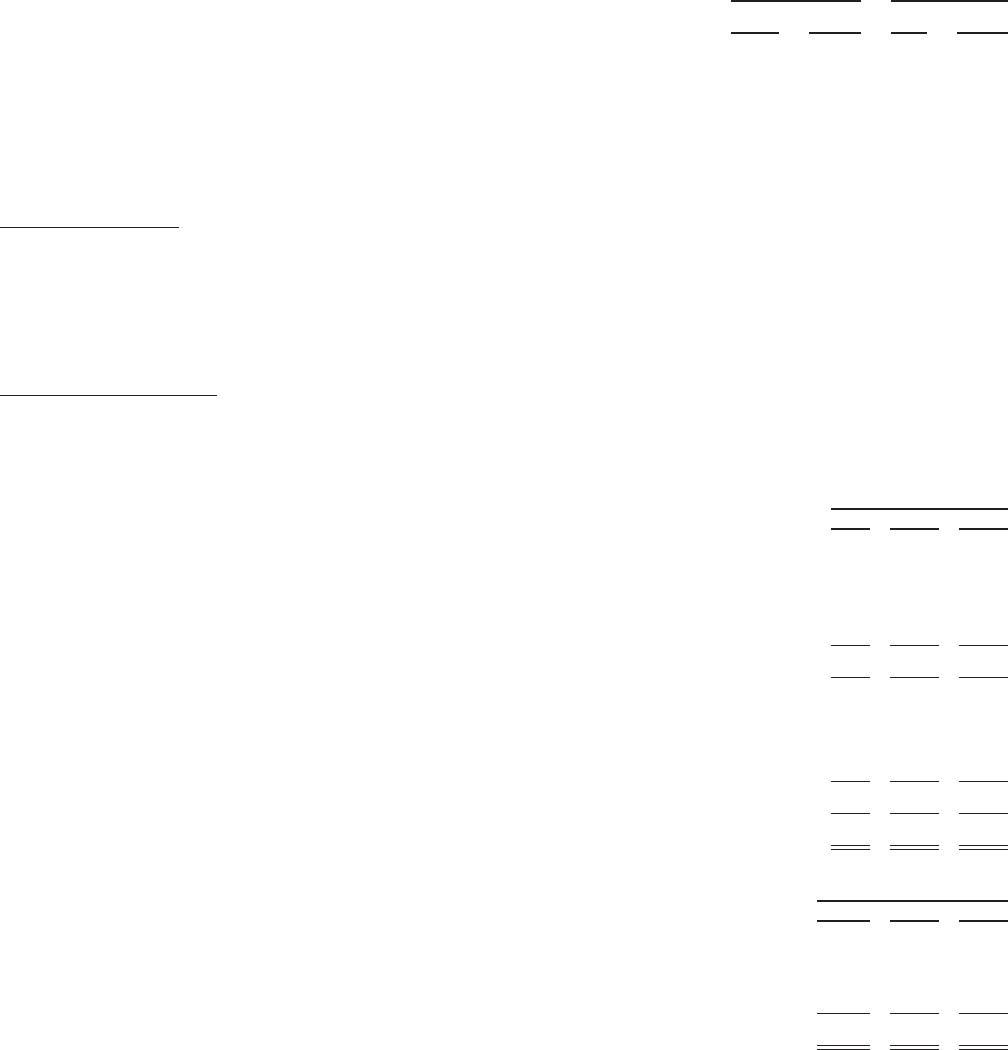

Gross benefit payments for the next 10 years, which reflect expected future service where appropriate, are expected to be as follows:

Pension Benefits

Other

Postretirement

Benefits

U.S.

Plans Non-U.S.

Plans U.S.

Plans Non-U.S.

Plans

(In millions)

2013 ............................................................................... $ 436 $ 42 $112 $ 4

2014 ............................................................................... $ 473 $ 44 $115 $ 3

2015 ............................................................................... $ 470 $ 48 $117 $ 3

2016 ............................................................................... $ 489 $ 54 $119 $ 3

2017 ............................................................................... $ 517 $ 57 $119 $ 3

2018-2022 .......................................................................... $2,866 $311 $613 $15

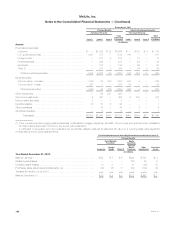

Additional Information

As previously discussed, most of the assets of the U.S. pension and other postretirement benefit plans are held in group annuity and life insurance

contracts issued by the Subsidiaries. Total revenues from these contracts recognized in the consolidated statements of operations were $54 million,

$47 million and $46 million for the years ended December 31, 2012, 2011 and 2010, respectively, and included policy charges and net investment

income from investments backing the contracts and administrative fees. Total investment income (loss), including realized and unrealized gains (losses),

credited to the account balances was $867 million, $885 million and $767 million for the years ended December 31, 2012, 2011 and 2010,

respectively. The terms of these contracts are consistent in all material respects with those the Subsidiaries offer to unaffiliated parties that are similarly

situated.

Defined Contribution Plans

The Subsidiaries sponsor defined contribution plans for substantially all U.S. employees under which a portion of employee contributions are

matched. The Subsidiaries contributed $96 million, $95 million and $86 million for the years ended December 31, 2012, 2011 and 2010, respectively.

19. Income Tax

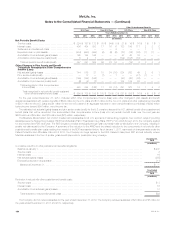

The provision for income tax from continuing operations was as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Current:

Federal ........................................................................................ $ (29) $ (200) $ 121

State and local .................................................................................. 6 (1) 21

Foreign ........................................................................................ 846 614 203

Subtotal ...................................................................................... 823 413 345

Deferred:

Federal ........................................................................................ (244) 2,241 643

State and local .................................................................................. (1) (3) (7)

Foreign ........................................................................................ (450) 142 129

Subtotal ...................................................................................... (695) 2,380 765

Provision for income tax expense (benefit) ......................................................... $128 $2,793 $1,110

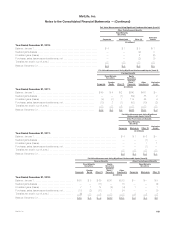

The Company’s income (loss) from continuing operations before income tax expense (benefit) from domestic and foreign operations were as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Income (loss) from continuing operations:

Domestic ..................................................................................... $(1,496) $6,869 $3,126

Foreign ....................................................................................... 2,938 2,315 603

Total ....................................................................................... $1,442 $9,184 $3,729

192 MetLife, Inc.