MetLife 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

U.S. withholding tax will arise from Covered Payments made by American Life’s foreign branches to foreign customers after the Deferral Period. Such

plan, which was submitted to the IRS on January 29, 2011, involves the transfer of businesses from certain of the foreign branches of American Life to

one or more existing or newly-formed subsidiaries of MetLife, Inc. or American Life. See Note 19 for additional information regarding the valuation

allowance related to branch restructuring.

A liability of $277 million was recognized in purchase accounting at November 1, 2010 for the anticipated and estimated costs associated with

restructuring American Life’s foreign branches into subsidiaries in connection with the Closing Agreement. This liability has been reduced based on

payments through December 31, 2012. In addition, based on revised estimates of anticipated costs, this liability was reduced by $51 million for the year

ended December 31, 2012, which was recorded as a reduction in other expenses in the consolidated statement of operations, resulting in a liability of

$62 million at December 31, 2012.

See Notes 11 and 17 for additional information on goodwill and other expenses, respectively, related to the ALICO Acquisition.

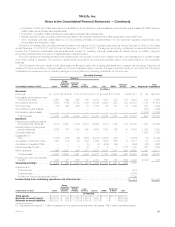

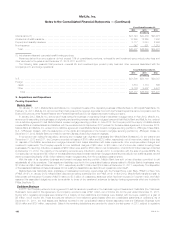

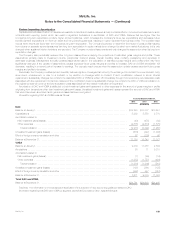

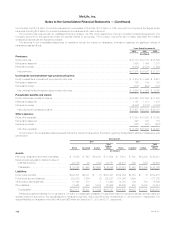

Revenues and Earnings of ALICO

The following table presents information for ALICO that is included in the Company’s consolidated statement of operations from the ALICO

Acquisition Date through November 30, 2010:

ALICO’s Operations

Included in MetLife’s

Results for the

Year Ended December 31, 2010

(In millions)

Total revenues ............................................................................ $950

Income (loss) from continuing operations, net of income tax ......................................... $ (2)

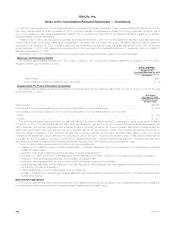

Supplemental Pro Forma Information (unaudited)

The following table presents unaudited supplemental pro forma information as if the ALICO Acquisition had occurred on January 1, 2010 for the year

ended December 31, 2010.

Year Ended

December 31, 2010

(In millions, except

per share data)

Total revenues ........................................................................................... $64,680

Income (loss) from continuing operations, net of income tax, attributable to common shareholders .......................... $ 3,888

Income (loss) from continuing operations, net of income tax, attributable to common shareholders per common share:

Basic ................................................................................................. $ 3.60

Diluted ................................................................................................ $ 3.57

The pro forma information was derived from the historical financial information of MetLife and ALICO, reflecting the results of operations of MetLife

and ALICO for 2010. The historical financial information has been adjusted to give effect to the pro forma events that are directly attributable to the

ALICO Acquisition and factually supportable and expected to have a continuing impact on the combined results. Discontinued operations and the

related earnings per share have been excluded from the presentation as they are non-recurring in nature. The pro forma information is not intended to

reflect the results of operations of the combined company that would have resulted had the ALICO Acquisition been effective during the periods

presented or the results that may be obtained by the combined company in the future. The pro forma information does not reflect future events that may

occur after the ALICO Acquisition, including, but not limited to, expense efficiencies or revenue enhancements arising from the ALICO Acquisition and

also does not give effect to certain one-time charges that MetLife expects to incur, such as restructuring and integration costs.

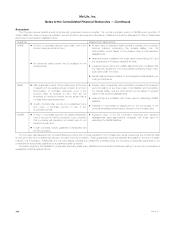

The pro forma information primarily reflects the following pro forma adjustments:

‰reduction in net investment income to reflect the amortization or accretion associated with the new cost basis of the acquired fixed maturities

available-for-sale portfolio;

‰elimination of amortization associated with the elimination of ALICO’s historical DAC;

‰amortization of VOBA, VODA and VOCRA associated with the establishment of VOBA, VODA and VOCRA arising from the ALICO Acquisition;

‰reduction in other expenses associated with the amortization of negative VOBA;

‰reduction in revenues associated with the elimination of ALICO’s historical unearned revenue liability;

‰interest expense associated with the issuance of the Debt Securities to AM Holdings and the public issuance of senior notes in connection with

the financing of the ALICO Acquisition;

‰certain adjustments to conform to MetLife’s accounting policies; and

‰reversal of investment and derivative gains (losses) associated with certain transactions that were completed prior to the ALICO Acquisition Date

(conditions of closing).

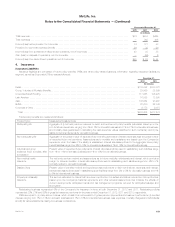

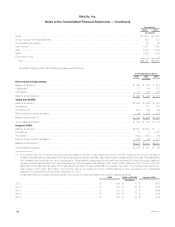

Discontinued Operations

The following table summarizes the amounts that have been reflected as discontinued operations in the consolidated statements of operations.

Income (loss) from discontinued operations includes real estate classified as held-for-sale or sold.

102 MetLife, Inc.