MetLife 2012 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Outside the U.S., we operate in Latin America, Asia, Europe and the Middle East. MetLife is the largest life insurer in both Mexico and Chile and also

holds leading market positions in Japan, Poland and Korea. Our businesses outside the U.S. provide life insurance, accident & health insurance, credit

insurance, annuities, endowment and retirement & savings products to both individuals and groups. We believe these businesses will continue to grow

more quickly than our U.S. businesses.

In the Americas, excluding Latin America, we market our products and services through various distribution channels. Our retail life, disability and

annuities products targeted to individuals are sold via sales forces, comprised of MetLife employees, in addition to third-party organizations. Our group

and corporate benefit funding products are sold via sales forces primarily comprised of MetLife employees. Personal lines property & casualty insurance

products are directly marketed to employees at their employer’s worksite. Personal lines property & casualty insurance products are also marketed and

sold to individuals by independent agents and property & casualty specialists through a direct marketing channel and the individual distribution sales

group. MetLife sales employees work with all distribution groups to better reach and service customers, brokers, consultants and other intermediaries.

In Asia, Latin America, and EMEA, we market our products and services through a multi-distribution strategy which varies by geographic region and

stage of market development. The various distribution channels include: career agency, bancassurance, direct marketing, brokerage, other third-party

distribution, and e-commerce. In developing countries, the career agency channel covers the needs of the emerging middle class with primarily

traditional products (e.g., whole life, term, endowment and accident & health). In more developed and mature markets, career agents, while continuing

to serve their existing customers to keep pace with their developing financial needs, also target upper middle class and mass affluent customer bases

with a more sophisticated product set including more investment-sensitive products, such as universal life insurance, unit-linked life insurance, mutual

funds and single premium deposit insurance. In the bancassurance channel, we leverage partnerships that span all regions and have developed

extensive and far reaching capabilities in all regions. Our direct marketing operations, the largest of which is in Japan, deploy both broadcast marketing

approaches (e.g. direct response TV, web-based lead generation) and traditional direct marketing techniques such as inbound and outbound

telemarketing.

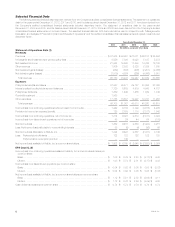

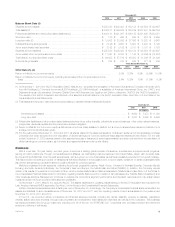

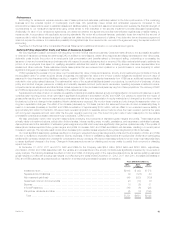

Revenues derived from any customer did not exceed 10% of consolidated premiums, universal life and investment-type product policy fees and

other revenues for the last three years. Financial information, including revenues, expenses, operating earnings, and total assets by segment, as well as

premiums, universal life and investment-type product policy fees and other revenues by major product groups, is provided in Note 2 of the Notes to the

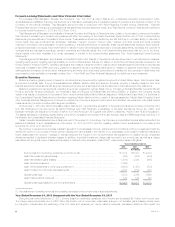

Consolidated Financial Statements. Operating revenues and operating earnings are performance measures that are not based on accounting principles

generally accepted in the United States of America (“GAAP”). See “Management’s Discussion and Analysis of Financial Condition and Results of

Operations — Non-GAAP and Other Financial Disclosures” for definitions of such measures.

MetLife’s operations in the United States and in other jurisdictions are subject to regulation. Each of MetLife’s insurance subsidiaries operating in the

United States is licensed and regulated in each U.S. jurisdiction where it conducts insurance business. The extent of such regulation varies, but most

jurisdictions have laws and regulations governing the financial aspects and business conduct of insurers. MetLife, Inc. and its U.S. insurance

subsidiaries are subject to regulation under the insurance holding company laws of various U.S. jurisdictions. The insurance holding company laws and

regulations vary from jurisdiction to jurisdiction, but generally require a controlled insurance company (insurers that are subsidiaries of insurance holding

companies) to register with state regulatory authorities and to file with those authorities certain reports, including information concerning its capital

structure, ownership, financial condition, certain intercompany transactions and general business operations. State insurance statutes also typically

place restrictions and limitations on the amount of dividends or other distributions payable by insurance company subsidiaries to their parent companies,

as well as on transactions between an insurer and its affiliates. See “Business — U.S. Regulation” and Business — International Regulation” in the 2012

Form 10-K and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources —

MetLife, Inc. — Liquidity and Capital Sources — Dividends from Subsidiaries.”

MetLife, Inc. has de-registered as a bank holding company. As a result, MetLife, Inc. is no longer regulated as a bank holding company or subject to

enhanced supervision and prudential standards as a bank holding company with assets of $50 billion or more. However, if, in the future, MetLife, Inc. is

designated by the FSOC as a nonbank systemically important financial institution (“non-bank SIFI”), it could once again be subject to regulation by the

Board of Governors of the Federal Reserve System and the Federal Reserve Bank of New York and to enhanced supervision and prudential standards.

See “Business — U.S. Regulation — Enhanced Prudential Standards” in the 2012 Form 10-K.

4MetLife, Inc.