MetLife 2012 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

Italy Fund Redemption Suspension Complaints and Litigation

As a result of suspension of withdrawals and diminution in value in certain funds offered within certain unit-linked policies sold by the Italian branch of

Alico Life International, Ltd. (“ALIL”), a number of policyholders invested in those funds have either commenced or threatened litigation against ALIL,

alleging misrepresentation, inadequate disclosures and other related claims. These policyholders contacted ALIL beginning in July 2009 alleging that the

funds operated at variance to the published prospectus and that prospectus risk disclosures were allegedly wrong, unclear, and misleading. The limited

number of lawsuits that have been filed to date have either been resolved or are proceeding through litigation. In March 2011, ALIL began implementing

a plan to resolve policyholder claims. Under the plan, ALIL will provide liquidity to the suspended funds so that policyholders may withdraw investments

in these funds, and ALIL will offer policyholders amounts in addition to the liquidation value of the suspended funds based on the performance of other

relevant financial products. The settlement program achieved a 97% acceptance rate. Those policyholders who did not accept the settlement may still

pursue other remedies or commence individual litigation. Under the terms of the Stock Purchase Agreement, AIG has agreed to indemnify MetLife, Inc.

and its affiliates for third party claims and regulatory fines associated with ALIL’s suspended funds.

Summary

Putative or certified class action litigation and other litigation and claims and assessments against the Company, in addition to those discussed

previously and those otherwise provided for in the Company’s consolidated financial statements, have arisen in the course of the Company’s business,

including, but not limited to, in connection with its activities as an insurer, mortgage lending bank, employer, investor, investment advisor and taxpayer.

Further, state insurance regulatory authorities and other federal and state authorities regularly make inquiries and conduct investigations concerning the

Company’s compliance with applicable insurance and other laws and regulations.

It is not possible to predict the ultimate outcome of all pending investigations and legal proceedings. In some of the matters referred to previously,

very large and/or indeterminate amounts, including punitive and treble damages, are sought. Although in light of these considerations it is possible that

an adverse outcome in certain cases could have a material effect upon the Company’s financial position, based on information currently known by the

Company’s management, in its opinion, the outcomes of such pending investigations and legal proceedings are not likely to have such an effect.

However, given the large and/or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that

an adverse outcome in certain matters could, from time to time, have a material effect on the Company’s consolidated net income or cash flows in

particular quarterly or annual periods.

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require insurers doing business within the jurisdiction to participate in

guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by impaired, insolvent or failed

insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular state on the basis of the proportionate

share of the premiums written by member insurers in the lines of business in which the impaired, insolvent or failed insurer engaged. Some states permit

member insurers to recover assessments paid through full or partial premium tax offsets. In addition, Japan has established the Life Insurance

Policyholders Protection Corporation of Japan as a contingency to protect policyholders against the insolvency of life insurance companies in Japan

through assessments to companies licensed to provide life insurance.

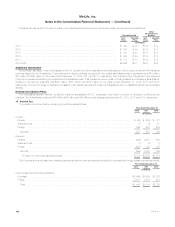

Assets and liabilities held for insolvency assessments were as follows:

December 31,

2012 2011

(In millions)

Other Assets:

Premium tax offset for future undiscounted assessments ............................................................ $114 $ 97

Premium tax offsets currently available for paid assessments ......................................................... 14 14

Receivable for reimbursement of paid assessments (1) ............................................................. 6 6

$134 $117

Other Liabilities:

Insolvency assessments ..................................................................................... $205 $193

(1) The Company holds a receivable from the seller of a prior acquisition in accordance with the purchase agreement.

On September 1, 2011, the Department of Financial Services filed a liquidation plan for ELNY, which had been under rehabilitation by the Liquidation

Bureau since 1991. The plan will involve the satisfaction of insurers’ financial obligations under a number of state life and health insurance guaranty

associations and also contemplates that additional industry support for certain ELNY policyholders will be provided. The Company recorded a net

charge of $40 million, after tax, during the year ended December 31, 2011, related to ELNY.

202 MetLife, Inc.