MetLife 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

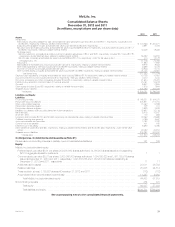

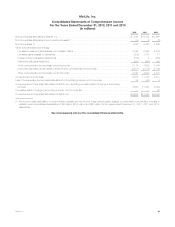

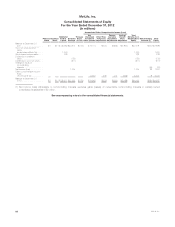

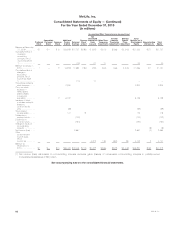

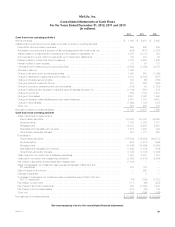

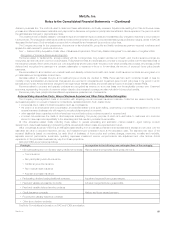

MetLife, Inc.

Consolidated Statements of Cash Flows

For the Years Ended December 31, 2012, 2011 and 2010

(In millions)

2012 2011 2010

Cash flows from operating activities

Net income (loss) ......................................................................... $ 1,362 $ 6,415 $ 2,663

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Depreciation and amortization expenses ...................................................... 596 679 585

Amortization of premiums and accretion of discounts associated with investments, net ................. (426) (477) (1,078)

(Gains) losses on investments and derivatives and from sales of businesses, net ...................... 3,197 (3,181) 854

(Income) loss from equity method investments, net of dividends or distributions ....................... 108 315 48

Interest credited to policyholder account balances .............................................. 7,729 5,603 4,925

Interest credited to bank deposits ........................................................... 78 95 137

Universal life and investment-type product policy fees ........................................... (8,556) (7,806) (6,037)

Goodwill impairment ..................................................................... 1,868 — —

Change in fair value option and trading securities ............................................... 1,900 648 (1,369)

Change in residential mortgage loans held-for-sale, net .......................................... 3,370 (4,530) (487)

Change in mortgage servicing rights ......................................................... 153 (60) (165)

Change in accrued investment income ....................................................... 219 525 (206)

Change in premiums, reinsurance and other receivables ......................................... (109) 58 (1,023)

Change in deferred policy acquisition costs and value of business acquired, net ...................... (1,139) (591) (370)

Change in income tax .................................................................... (883) 1,742 1,231

Change in other assets ................................................................... 2,951 2,360 1,948

Change in insurance-related liabilities and policy-related balances .................................. 5,918 7,081 6,491

Change in other liabilities .................................................................. (1,699) 1,136 (315)

Other, net ............................................................................. 523 261 153

Net cash provided by operating activities ....................................................... 17,160 10,273 7,985

Cash flows from investing activities

Sales, maturities and repayments of:

Fixed maturity securities ................................................................. 103,823 104,302 86,529

Equity securities ....................................................................... 1,140 2,006 1,371

Mortgage loans ....................................................................... 14,673 13,486 6,361

Real estate and real estate joint ventures ................................................... 1,018 1,296 322

Other limited partnership interests ......................................................... 974 1,121 522

Purchases of:

Fixed maturity securities ................................................................. (115,793) (116,939) (100,713)

Equity securities ....................................................................... (627) (1,481) (949)

Mortgage loans ....................................................................... (11,442) (14,694) (8,967)

Real estate and real estate joint ventures ................................................... (1,942) (1,534) (786)

Other limited partnership interests ......................................................... (1,323) (1,147) (1,008)

Cash received in connection with freestanding derivatives ........................................ 1,933 2,815 1,814

Cash paid in connection with freestanding derivatives ........................................... (3,258) (3,478) (2,548)

Net change in securitized reverse residential mortgage loans ...................................... (1,198) — —

Sales of businesses, net of cash and cash equivalents disposed of $29, $54 and

$0, respectively ....................................................................... 576 126 —

Sale of interest in joint venture .............................................................. — 265 —

Disposal of subsidiary .................................................................... — 4 —

Purchases of businesses, net of cash and cash equivalents acquired of $33, $70 and

$4,175, respectively ................................................................... (16) (163) (3,021)

Net change in policy loans ................................................................ (111) (66) (225)

Net change in short-term investments ........................................................ 593 (7,949) 3,033

Net change in other invested assets ......................................................... (791) (19) 148

Other, net ............................................................................. (158) (169) (186)

Net cash used in investing activities ........................................................... $ (11,929) $ (22,218) $ (18,303)

See accompanying notes to the consolidated financial statements.

MetLife, Inc. 83