MetLife 2012 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

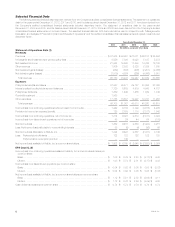

Selected Financial Data

The following selected financial data has been derived from the Company’s audited consolidated financial statements. The statement of operations

data for the years ended December 31, 2012, 2011 and 2010, and the balance sheet data at December 31, 2012 and 2011 have been derived from

the Company’s audited consolidated financial statements included elsewhere herein. The statement of operations data for the years ended

December 31, 2009 and 2008, and the balance sheet data at December 31, 2010, 2009 and 2008 have been derived from the Company’s audited

consolidated financial statements not included herein. The selected financial data set forth below should be read in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and the audited consolidated financial statements and related notes included

elsewhere herein.

Years Ended December 31,

2012 2011 2010 2009 2008

(In millions, except per share data)

Statement of Operations Data (1)

Revenues

Premiums ................................................................... $37,975 $ 36,361 $ 27,071 $ 26,157 $ 25,604

Universal life and investment-type product policy fees ................................. 8,556 7,806 6,028 5,197 5,373

Net investment income ......................................................... 21,984 19,585 17,493 14,726 16,168

Other revenues ............................................................... 1,906 2,532 2,328 2,329 1,585

Net investment gains (losses) .................................................... (352) (867) (408) (2,901) (2,085)

Net derivative gains (losses) ..................................................... (1,919) 4,824 (265) (4,866) 3,910

Total revenues .............................................................. 68,150 70,241 52,247 40,642 50,555

Expenses

Policyholder benefits and claims .................................................. 37,987 35,471 29,187 28,005 27,095

Interest credited to policyholder account balances .................................... 7,729 5,603 4,919 4,845 4,787

Policyholder dividends .......................................................... 1,369 1,446 1,485 1,649 1,749

Goodwill impairment ........................................................... 1,868 ————

Other expenses ............................................................... 17,755 18,537 12,927 10,761 11,988

Total expenses ............................................................. 66,708 61,057 48,518 45,260 45,619

Income (loss) from continuing operations before provision for income tax ................... 1,442 9,184 3,729 (4,618) 4,936

Provision for income tax expense (benefit) ........................................... 128 2,793 1,110 (2,107) 1,542

Income (loss) from continuing operations, net of income tax ............................. 1,314 6,391 2,619 (2,511) 3,394

Income (loss) from discontinued operations, net of income tax ........................... 48 24 44 64 (179)

Net income (loss) .............................................................. 1,362 6,415 2,663 (2,447) 3,215

Less: Net income (loss) attributable to noncontrolling interests ........................... 38 (8) (4) (36) 66

Net income (loss) attributable to MetLife, Inc. ........................................ 1,324 6,423 2,667 (2,411) 3,149

Less: Preferred stock dividends ................................................. 122 122 122 122 125

Preferred stock redemption premium ........................................ — 146 — — —

Net income (loss) available to MetLife, Inc.’s common shareholders ....................... $ 1,202 $ 6,155 $ 2,545 $ (2,533) $ 3,024

EPS Data (1), (5)

Income (loss) from continuing operations available to MetLife, Inc.’s common shareholders per

common share:

Basic ..................................................................... $ 1.08 $ 5.79 $ 2.83 $ (3.17) $ 4.48

Diluted .................................................................... $ 1.08 $ 5.74 $ 2.81 $ (3.17) $ 4.43

Income (loss) from discontinued operations per common share:

Basic ..................................................................... $ 0.04 $ 0.02 $ 0.05 $ 0.08 $ (0.37)

Diluted .................................................................... $ 0.04 $ 0.02 $ 0.05 $ 0.08 $ (0.37)

Net income (loss) available to MetLife, Inc.’s common shareholders per common share:

Basic ..................................................................... $ 1.12 $ 5.81 $ 2.88 $ (3.09) $ 4.11

Diluted .................................................................... $ 1.12 $ 5.76 $ 2.86 $ (3.09) $ 4.06

Cash dividends declared per common share ........................................ $ 0.74 $ 0.74 $ 0.74 $ 0.74 $ 0.74

2MetLife, Inc.