MetLife 2012 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

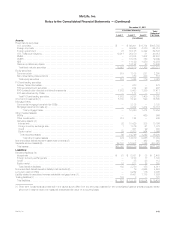

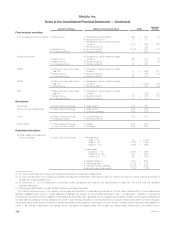

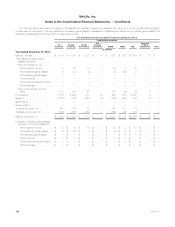

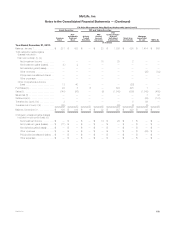

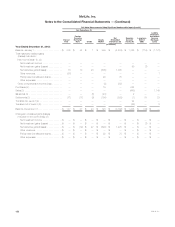

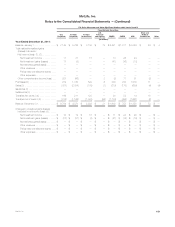

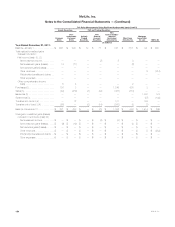

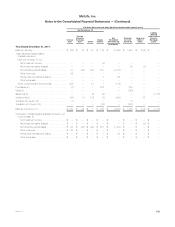

Valuation Techniques Significant Unobservable Inputs Range Weighted

Average

Fixed maturity securities:

U.S. corporate and foreign corporate • Matrix pricing • Delta spread adjustments (1) (50) — 500 90

• Illiquidity premium (1) 30 — 30

• Spreads from below investment grade

curves (1) (157) — 876 205

• Offered quotes (2) — — 348

• Market pricing • Quoted prices (2) (1,416) — 830 132

• Consensus pricing • Offered quotes (2) — — 555

Foreign government

• Matrix pricing

• Spreads from below investment grade

curves (1) (58) — 150 72

• Market pricing • Quoted prices (2) 77 146 99

• Consensus pricing • Offered quotes (2) 82 — 200

RMBS • Matrix pricing and discounted

cash flow

• Spreads from below investment grade

curves (1) 9 — 2,980 521

• Market pricing • Quoted prices (2) 13 — 109 100

• Consensus pricing • Offered quotes (2) 28 — 100

CMBS • Matrix pricing and discounted

cash flow

• Spreads from below investment grade

curves (1) 1 — 9,164 374

• Market pricing • Quoted prices (2) 1 — 106 99

ABS • Matrix pricing and discounted

cash flow

• Spreads from below investment grade

curves (1) — — 1,829 109

• Market pricing • Quoted prices (2) 40 — 105 100

• Consensus pricing • Offered quotes (2) — — 111

Derivatives:

Interest rate • Present value techniques • Swap yield (1) 186 — 353

Foreign currency exchange rate • Present value techniques • Swap yield (1) 228 — 795

• Currency correlation 43% — 57%

Credit • Present value techniques • Credit spreads (1) 100 — 100

• Consensus pricing • Offered quotes (3)

Equity market • Present value techniques • Volatility 13% — 32%

or option pricing models • Correlation 65% — 65%

Embedded derivatives:

Direct and assumed guaranteed

minimum benefits • Option pricing techniques • Mortality rates:

Ages 0 - 40 0% — 0.14%

Ages 41 - 60 0.05% — 0.88%

Ages 61 - 115 0.26% — 100%

• Lapse rates:

Durations 1 - 10 0.50% — 100%

Durations 11 - 20 2% — 100%

Durations 21 - 116 2% — 100%

• Utilization rates (4) 20% — 50%

• Withdrawal rates 0.07% — 20%

• Long-term equity volatilities 15.18% — 40%

• Nonperformance risk spread 0.10% — 1.72%

(1) For this unobservable input, range and weighted average are presented in basis points.

(2) For this unobservable input, range and weighted average are presented in accordance with the market convention for fixed maturity securities of

dollars per hundred dollars of par.

(3) At December 31, 2012, independent non-binding broker quotations were used in the determination of less than 1% of the total net derivative

estimated fair value.

(4) This range is attributable to certain GMIB and lifetime withdrawal benefits.

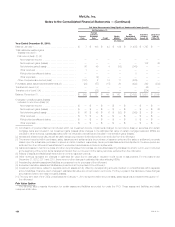

The following is a summary of the valuation techniques and significant unobservable inputs used in the fair value measurement for other assets and

liabilities classified within Level 3. These assets and liabilities are subject to the controls described under “—Investments – Valuation Controls and

Procedures.” Generally, all other classes of securities including those within separate account assets use the same valuation techniques and significant

unobservable inputs as previously described for Level 3 fixed maturity securities. This includes matrix pricing and discounted cash flow methodologies,

inputs such as quoted prices for identical or similar securities that are less liquid and based on lower levels of trading activity than securities classified in

Level 2, as well as independent non-binding broker quotations. Mortgage loans held-for-sale are valued using independent non-binding broker

148 MetLife, Inc.