MetLife 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

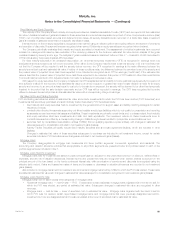

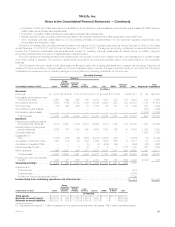

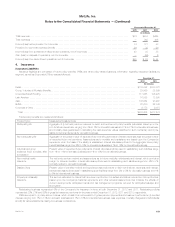

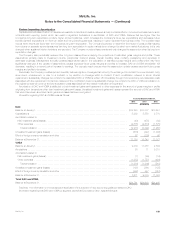

Operating Earnings

Americas

Year Ended

December 31, 2010 Retail

Group,

Voluntary

& Worksite

Benefits

Corporate

Benefit

Funding Latin

America Total Asia EMEA Corporate

& Other Total Adjustments Total

Consolidated

(In millions)

Revenues

Premiums ............ $ 6,491 $14,100 $2,345 $1,969 $24,905 $1,716 $ 439 $ 11 $27,071 $ — $27,071

Universal life and

investment-type

product policy fees . . . 3,655 616 226 630 5,127 502 50 138 5,817 211 6,028

Net investment

income ............ 7,644 1,702 5,280 927 15,553 497 155 650 16,855 638 17,493

Other revenues ........ 633 369 247 12 1,261 14 9 109 1,393 935 2,328

Net investment gains

(losses) ............ — — — — — — — — — (408) (408)

Net derivative gains

(losses) ............ — — — — — — — — — (265) (265)

Total revenues ...... 18,423 16,787 8,098 3,538 46,846 2,729 653 908 51,136 1,111 52,247

Expenses

Policyholder benefits and

claims and

policyholder

dividends .......... 8,835 13,112 4,677 1,829 28,453 1,351 137 33 29,974 698 30,672

Interest credited to

policyholder account

balances ........... 2,381 192 1,447 370 4,390 183 124 — 4,697 222 4,919

Goodwill impairment .... — — — — — — — — — — —

Capitalization of DAC . . . (1,769) (187) (18) (221) (2,195) (459) (116) — (2,770) — (2,770)

Amortization of DAC and

VOBA ............. 1,724 181 16 144 2,065 290 87 1 2,443 34 2,477

Amortization of negative

VOBA ............. — — — (1) (1) (49) (7) — (57) (7) (64)

Interest expense on

debt .............. 2 — 8 1 11 1 1 1,124 1,137 413 1,550

Other expenses ....... 5,059 2,193 494 901 8,647 1,142 434 379 10,602 1,132 11,734

Total expenses ...... 16,232 15,491 6,624 3,023 41,370 2,459 660 1,537 46,026 2,492 48,518

Provision for income tax

expense (benefit) .... 735 427 516 92 1,770 46 — (402) 1,414 (304) 1,110

Operating earnings .. $ 1,456 $ 869 $ 958 $ 423 $ 3,706 $ 224 $ (7) $ (227) 3,696

Adjustments to:

Total revenues .......................................................................... 1,111

Total expenses .......................................................................... (2,492)

Provision for income tax (expense) benefit ..................................................... 304

Income (loss) from continuing operations, net of income tax ................................. $ 2,619 $ 2,619

Net investment income is based upon the actual results of each segment’s specifically identifiable investment portfolio adjusted for allocated equity.

Other costs are allocated to each of the segments based upon: (i) a review of the nature of such costs; (ii) time studies analyzing the amount of

employee compensation costs incurred by each segment; and (iii) cost estimates included in the Company’s product pricing.

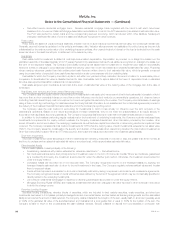

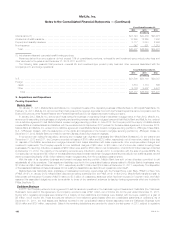

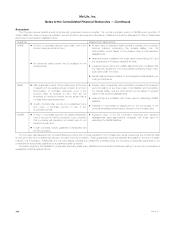

The following table presents total premiums, universal life and investment-type product policy fees and other revenues by major product groups of

the Company’s segments as well as Corporate & Other:

MetLife, Inc. 99