MetLife 2012 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

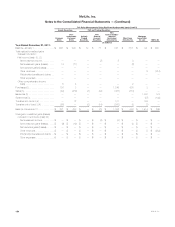

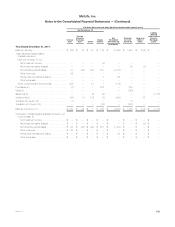

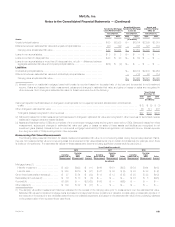

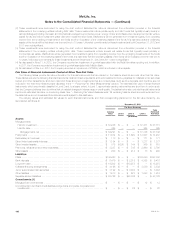

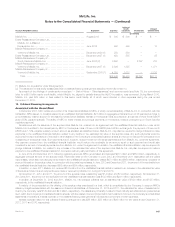

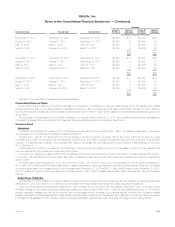

Information regarding goodwill by segment, as well as Corporate & Other, was as follows:

Retail

Group,

Voluntary &

Worksite

Benefits

Corporate

Benefit

Funding Latin

America Asia (1) EMEA Corporate

& Other (2) Unallocated

Goodwill Total

(In millions)

Balance at January 1, 2010

Goodwill ............................... $3,125 $138 $900 $214 $ 160 $ 40 $ 470 $ — $ 5,047

Accumulated impairment .................. — — — — — — — — —

Total goodwill, net ..................... 3,125 138 900 214 160 40 470 — 5,047

Acquisitions ............................ — — — — — — — 6,959 6,959

Effect of foreign currency

translation and other .................... — — — 15 (88) (2) — (150) (225)

Balance at December 31, 2010

Goodwill ............................... 3,125 138 900 229 72 38 470 6,809 11,781

Accumulated impairment .................. — — — — — — — — —

Total goodwill, net ..................... 3,125 138 900 229 72 38 470 6,809 11,781

Goodwill allocation (3) .................... — — — 312 5,163 1,334 — (6,809) —

Acquisitions (4) ......................... — — — — 39 — — — 39

Impairments (5) ......................... — — — — — — (65) — (65)

Effect of foreign currency

translation and other .................... — — — (40) 259 (39) — — 180

Balance at December 31, 2011

Goodwill ............................... 3,125 138 900 501 5,533 1,333 470 — 12,000

Accumulated impairment .................. — — — — — — (65) — (65)

Total goodwill, net ..................... 3,125 138 900 501 5,533 1,333 405 — 11,935

Acquisitions ............................ — — — — — 1 — — 1

Impairments ............................ (1,692) — — — — — (176) — (1,868)

Effect of foreign currency

translation and other .................... — — — 26 (146) 5 — — (115)

Balance at December 31, 2012

Goodwill ............................... 3,125 138 900 527 5,387 1,339 470 — 11,886

Accumulated impairment .................. (1,692) — — — — — (241) — (1,933)

Total goodwill, net ..................... $1,433 $138 $900 $527 $5,387 $1,339 $ 229 $ — $ 9,953

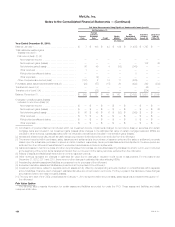

(1) Includes goodwill of $5.2 billion and $5.4 billion from the Japan operations at December 31, 2012 and 2011, respectively.

(2) The $405 million of net goodwill in Corporate & Other at December 31, 2011 relates to goodwill acquired as a part of the 2005 Travelers acquisition.

For purposes of goodwill impairment testing, the $405 million of Corporate & Other goodwill was allocated to business units of the Retail; Group,

Voluntary & Worksite Benefits; and Corporate Benefit Funding segments in the amounts of $210 million, $9 million and $186 million, respectively.

The Retail segment amount was further allocated within the segment to the Life & Other and the Annuities reporting units in the amounts of

$34 million and $176 million, respectively. As reflected in the table, the $176 million related to the Retail Annuities reporting unit was impaired in the

third quarter of 2012.

(3) Goodwill associated with the ALICO Acquisition was allocated among the Company’s segments in the first quarter of 2011.

(4) As of November 1, 2011, American Life’s current and deferred income taxes were affected by measurement period adjustments, which resulted in a

$39 million increase to the goodwill recorded as part of the ALICO Acquisition related to Japan which is included in the Asia segment. See Note 19.

(5) In 2011, the Company performed a goodwill impairment test on MetLife Bank, which was a separate reporting unit in Corporate & Other. A

comparison of the fair value of the reporting unit, using a market multiple approach, to its carrying value indicated a potential for goodwill impairment.

A further comparison of the implied fair value of the reporting unit’s goodwill with its carrying amount indicated that the entire amount of goodwill

associated with MetLife Bank was impaired. Consequently, the Company recorded a $65 million goodwill impairment charge that is reflected as a

net investment loss for the year ended December 31, 2011.

164 MetLife, Inc.