MetLife 2012 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

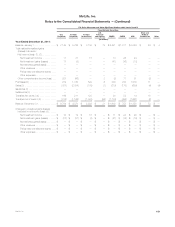

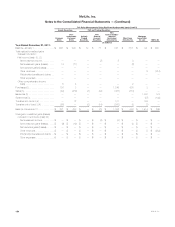

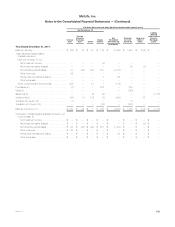

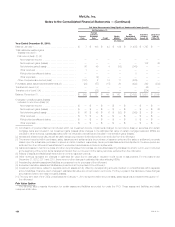

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

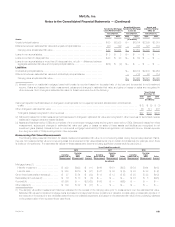

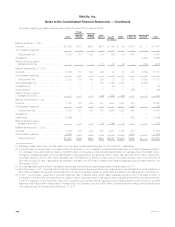

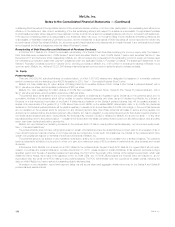

Mortgage Loan Commitments and Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond

Investments

The estimated fair values for mortgage loan commitments that will be held for investment and commitments to fund bank credit facilities, bridge loans

and private corporate bonds that will be held for investment reflected in the above tables represent the difference between the discounted expected

future cash flows using interest rates that incorporate current credit risk for similar instruments on the reporting date and the principal amounts of the

commitments.

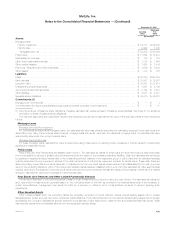

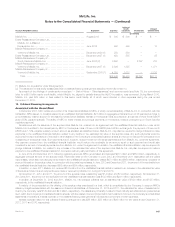

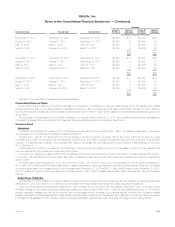

11. Goodwill

Goodwill is the excess of cost over the estimated fair value of net assets acquired. Goodwill is not amortized but is tested for impairment at least

annually or more frequently if events or circumstances, such as adverse changes in the business climate, indicate that there may be justification for

conducting an interim test. Step 1 of the goodwill impairment process requires a comparison of the fair value of a reporting unit to its carrying value. In

performing the Company’s goodwill impairment tests, the estimated fair values of the reporting units are first determined using a market multiple valuation

approach. When further corroboration is required, the Company uses a discounted cash flow valuation approach. For reporting units which are

particularly sensitive to market assumptions, such as the Retail Annuities and Life & Other reporting units, the Company may use additional valuation

methodologies to estimate the reporting units’ fair values.

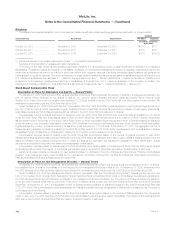

The market multiple valuation approach utilizes market multiples of companies with similar businesses and the projected operating earnings of the

reporting unit. The discounted cash flow valuation approach requires judgments about revenues, operating earnings projections, capital market

assumptions and discount rates. The key inputs, judgments and assumptions necessary in determining estimated fair value of the reporting units include

projected operating earnings, current book value, the level of economic capital required to support the mix of business, long-term growth rates,

comparative market multiples, the account value of in-force business, projections of new and renewal business, as well as margins on such business,

the level of interest rates, credit spreads, equity market levels, and the discount rate that the Company believes is appropriate for the respective

reporting unit. The estimated fair values of the Retail Annuities and Life & Other reporting units are particularly sensitive to equity market levels.

When testing goodwill for impairment, the Company also considers its market capitalization in relation to the aggregate estimated fair value of its

reporting units. The Company applies significant judgment when determining the estimated fair value of the Company’s reporting units and when

assessing the relationship of market capitalization to the aggregate estimated fair value of its reporting units. As of December 31, 2012, the Company’s

market capitalization was below its consolidated book value. The Company reviewed the assumptions used in the valuation of its reporting units and

concluded that the assumptions were reasonable. In addition, the Company concluded that the control premium in relation to the lower market

environment reflected an amount which management believes is within an acceptable range.

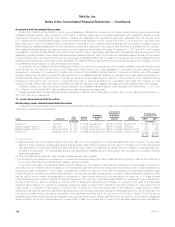

The valuation methodologies utilized are subject to key judgments and assumptions that are sensitive to change. Estimates of fair value are

inherently uncertain and represent only management’s reasonable expectation regarding future developments. These estimates and the judgments and

assumptions upon which the estimates are based will, in all likelihood, differ in some respects from actual future results. Declines in the estimated fair

value of the Company’s reporting units could result in goodwill impairments in future periods which could materially adversely affect the Company’s

results of operations or financial position.

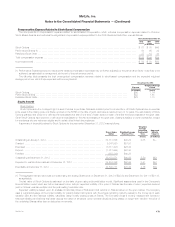

In connection with its annual goodwill impairment testing, the market multiple and discounted cash flow valuation approaches indicated that the fair

value of the Retail Annuities reporting unit was below its carrying value. As a result, an actuarial appraisal, which estimates the net worth of the reporting

unit, the value of existing business and the value of new business, was also performed. This appraisal also resulted in a fair value of the Retail Annuities

reporting unit that was less than the carrying value, indicating a potential for goodwill impairment. The growing concern regarding an extended period of

low interest rates was reflected in the fair value estimate, particularly on the returns a market buyer would assume on the fixed income portion of

separate account annuity products. In addition, industry-wide inquiries by regulators on the use of affiliated captive reinsurers for off-shore entities to

reinsure insurance risks may limit access to this type of capital structure. As a result, a market buyer may discount the ability to fully utilize these

structures, which also affected the fair value estimate of the reporting unit. Accordingly, the Company performed Step 2 of the goodwill impairment

process, which compares the implied fair value of goodwill with the carrying value of that goodwill in the reporting unit to calculate the amount of

goodwill impairment. The Company determined that all of the recorded goodwill associated with the Retail Annuities reporting unit was not recoverable

and recorded a non-cash charge of $1.9 billion ($1.6 billion, net of income tax) for the impairment of the entire goodwill balance in the consolidated

statements of operations for the year ended December 31, 2012. Of this amount, $1.4 billion was impaired at MetLife, Inc. There was no impact on

income taxes.

In addition, the Company performed its annual goodwill impairment tests of its other reporting units and concluded that the fair values of all such

reporting units were in excess of their carrying values and, therefore, their goodwill was not impaired.

MetLife, Inc. 163