MetLife 2012 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

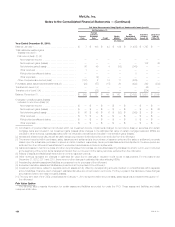

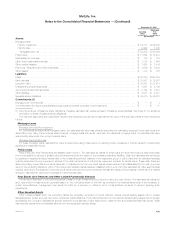

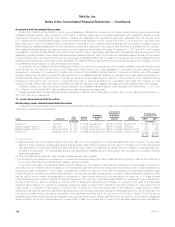

(2) These investments were accounted for using the cost method. Estimated fair value is determined from information provided in the financial

statements of the underlying entities including NAV data. These investments include private equity and debt funds that typically invest primarily in

various strategies including domestic and international leveraged buyout funds; power, energy, timber and infrastructure development funds; venture

capital funds; and below investment grade debt and mezzanine debt funds. Distributions will be generated from investment gains, from operating

income from the underlying investments of the funds and from liquidation of the underlying assets of the funds. It is estimated that the underlying

assets of the funds will be liquidated over the next two to 10 years. Unfunded commitments for these investments at both December 31, 2012 and

2011 were not significant.

(3) These investments were accounted for using the cost method. Estimated fair value is determined from information provided in the financial

statements of the underlying entities including NAV data. These investments include several real estate funds that typically invest primarily in

commercial real estate. Distributions will be generated from investment gains, from operating income from the underlying investments of the funds

and from liquidation of the underlying assets of the funds. It is estimated that the underlying assets of the funds will be liquidated over the next two to

10 years. Unfunded commitments for these investments at both December 31, 2012 and 2011 were not significant.

(4) As discussed in Note 11, in 2012, the Company recorded an impairment of goodwill associated with the Retail Annuities reporting unit. In addition,

in 2011, the Company recorded an impairment of goodwill associated with MetLife Bank.

(5) As discussed in Note 5, in 2012, the Company recorded an impairment of VOCRA, which is included in other assets.

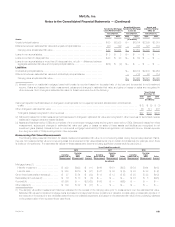

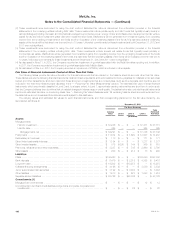

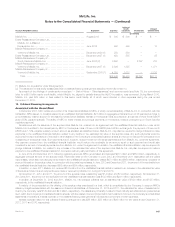

Fair Value of Financial Instruments Carried at Other Than Fair Value

The following tables provide fair value information for financial instruments that are carried on the balance sheet at amounts other than fair value.

These tables exclude the following financial instruments: cash and cash equivalents, accrued investment income, payables for collateral under securities

loaned and other transactions, short-term debt and those short-term investments that are not securities, such as time deposits, and therefore are not

included in the three level hierarchy table disclosed in the “— Recurring Fair Value Measurements” section. The estimated fair value of these financial

instruments, which are primarily classified in Level 2 and, to a lesser extent, in Level 1, approximate carrying value as they are short-term in nature such

that the Company believes there is minimal risk of material changes in interest rates or credit quality. The tables below also exclude financial instruments

reported at estimated fair value on a recurring basis. See “—Recurring Fair Value Measurements.” All remaining balance sheet amounts excluded from

the table below are not considered financial instruments subject to this disclosure.

The carrying values and estimated fair values for such financial instruments, and their corresponding placement in the fair value hierarchy, are

summarized as follows at:

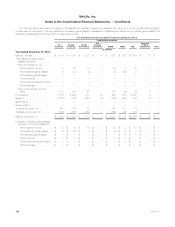

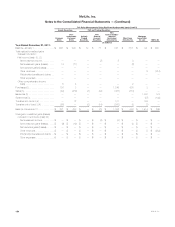

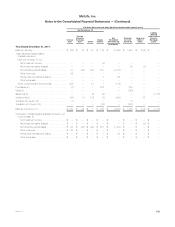

December 31, 2012

Fair Value Hierarchy

Carrying

Value Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets:

Mortgage loans:

Held-for-investment ....................................................... $ 53,926 $ — $ — $ 57,381 $ 57,381

Held-for-sale ............................................................ 365 — — 365 365

Mortgage loans, net ..................................................... $ 54,291 $ — $ — $ 57,746 $ 57,746

Policy loans ............................................................... $ 11,884 $ — $ 1,690 $ 12,567 $ 14,257

Real estate joint ventures .................................................... $ 113 $ — $ — $ 171 $ 171

Other limited partnership interests .............................................. $ 1,154 $ — $ — $ 1,277 $ 1,277

Other invested assets ....................................................... $ 815 $305 $ 144 $ 366 $ 815

Premiums, reinsurance and other receivables ..................................... $ 3,287 $ — $ 745 $ 2,960 $ 3,705

Other assets .............................................................. $ 260 $ — $ 214 $ 78 $ 292

Liabilities:

PABs .................................................................... $149,928 $ — $ — $158,040 $158,040

Bank deposits ............................................................. $ 6,416 $ — $ 2,018 $ 4,398 $ 6,416

Long-term debt ............................................................ $ 16,502 $ — $18,978 $ — $ 18,978

Collateral financing arrangements .............................................. $ 4,196 $ — $ — $ 3,839 $ 3,839

Junior subordinated debt securities ............................................ $ 3,192 $ — $ 3,984 $ — $ 3,984

Other liabilities ............................................................. $ 1,913 $ — $ 673 $ 1,243 $ 1,916

Separate account liabilities ................................................... $ 58,726 $ — $58,726 $ — $ 58,726

Commitments: (1)

Mortgage loan commitments ................................................. $ — $ — $ — $ 12 $ 12

Commitments to fund bank credit facilities, bridge loans and private corporate bond

investments ............................................................. $ — $ — $ 22 $ — $ 22

160 MetLife, Inc.