MetLife 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

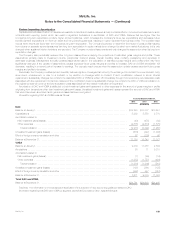

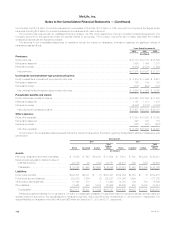

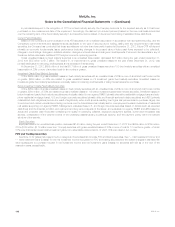

Information regarding the closed block liabilities and assets designated to the closed block was as follows:

December 31,

2012 2011

(In millions)

Closed Block Liabilities

Future policy benefits .................................................................................... $42,586 $43,169

Other policy-related balances .............................................................................. 298 358

Policyholder dividends payable ............................................................................. 466 514

Policyholder dividend obligation ............................................................................ 3,828 2,919

Other liabilities .......................................................................................... 602 613

Total closed block liabilities .............................................................................. 47,780 47,573

Assets Designated to the Closed Block

Investments:

Fixed maturity securities available-for-sale, at estimated fair value ................................................ 30,546 30,407

Equity securities available-for-sale, at estimated fair value ...................................................... 41 35

Mortgage loans ....................................................................................... 6,192 6,206

Policy loans .......................................................................................... 4,670 4,657

Real estate and real estate joint ventures ................................................................... 459 364

Other invested assets .................................................................................. 953 857

Total investments ................................................................................... 42,861 42,526

Cash and cash equivalents ................................................................................ 381 249

Accrued investment income ............................................................................... 481 509

Premiums, reinsurance and other receivables ................................................................. 107 109

Current income tax recoverable ............................................................................ 2 53

Deferred income tax assets ............................................................................... 319 362

Total assets designated to the closed block ................................................................ 44,151 43,808

Excess of closed block liabilities over assets designated to the closed block ......................................... 3,629 3,765

Amounts included in accumulated other comprehensive income (loss):

Unrealized investment gains (losses), net of income tax .......................................................... 2,891 2,394

Unrealized gains (losses) on derivatives, net of income tax ....................................................... 9 11

Allocated to policyholder dividend obligation, net of income tax .................................................... (2,488) (1,897)

Total amounts included in accumulated other comprehensive income (loss) ....................................... 412 508

Maximum future earnings to be recognized from closed block assets and liabilities ..................................... $ 4,041 $ 4,273

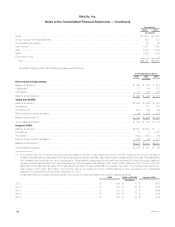

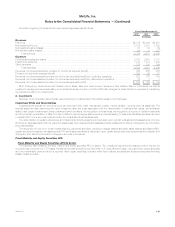

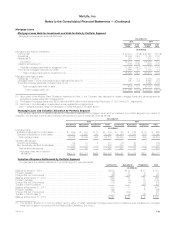

Information regarding the closed block policyholder dividend obligation was as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Balance at January 1, ............................................................................... $2,919 $ 876 $ —

Change in unrealized investment and derivative gains (losses) ................................................ 909 2,043 876

Balance at December 31, ............................................................................ $3,828 $2,919 $876

114 MetLife, Inc.