MetLife 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

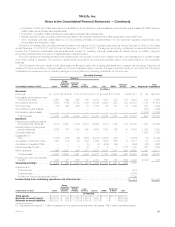

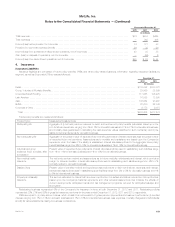

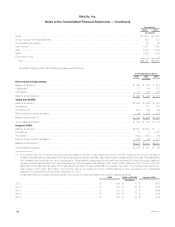

Guarantees

The Company issues variable annuity products with guaranteed minimum benefits. The non-life contingent portion of GMWB and the portion of

certain GMIB that does not require annuitization are accounted for as embedded derivatives in PABs and are further discussed in Note 9. Guarantees

accounted for as insurance liabilities include:

Guarantee: Measurement Assumptions:

GMDB ŠA return of purchase payment upon death even if the

account value is reduced to zero.

ŠAn enhanced death benefit may be available for an

additional fee.

ŠPresent value of expected death benefits in excess of the projected

account balance recognizing the excess ratably over the

accumulation period based on the present value of total expected

assessments.

ŠAssumptions are consistent with those used for amortizing DAC, and

are thus subject to the same variability and risk.

ŠInvestment performance and volatility assumptions are consistent with

the historical experience of the appropriate underlying equity index,

such as the S&P 500 Index.

ŠBenefit assumptions are based on the average benefits payable over

a range of scenarios.

GMIB ŠAfter a specified period of time determined at the time

of issuance of the variable annuity contract, a minimum

accumulation of purchase payments, even if the

account value is reduced to zero, that can be

annuitized to receive a monthly income stream that is

not less than a specified amount.

ŠCertain contracts also provide for a guaranteed lump

sum return of purchase premium in lieu of the

annuitization benefit.

ŠPresent value of expected income benefits in excess of the projected

account balance at any future date of annuitization and recognizing

the excess ratably over the accumulation period based on present

value of total expected assessments.

ŠAssumptions are consistent with those used for estimating GMDB

liabilities.

ŠCalculation incorporates an assumption for the percentage of the

potential annuitizations that may be elected by the contractholder.

GMWB ŠA return of purchase payment via partial withdrawals,

even if the account value is reduced to zero, provided

that cumulative withdrawals in a contract year do not

exceed a certain limit.

ŠCertain contracts include guaranteed withdrawals that

are life contingent.

ŠExpected value of the life contingent payments and expected

assessments using assumptions consistent with those used for

estimating the GMDB liabilities.

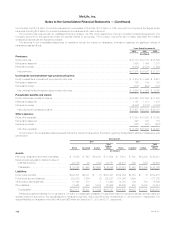

The Company also issues annuity contracts that apply a lower rate of funds deposited if the contractholder elects to surrender the contract for cash

and a higher rate if the contractholder elects to annuitize (“two tier annuities”). These guarantees include benefits that are payable in the event of death,

maturity or at annuitization. Additionally, the Company issues universal and variable life contracts where the Company contractually guarantees to the

contractholder a secondary guarantee or a guaranteed paid-up benefit.

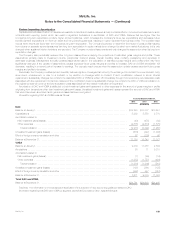

Information regarding the liabilities for guarantees (excluding base policy liabilities and embedded derivatives) relating to annuity and universal and

variable life contracts was as follows:

104 MetLife, Inc.