MetLife 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

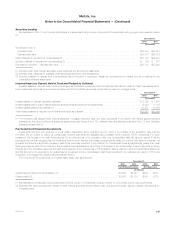

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

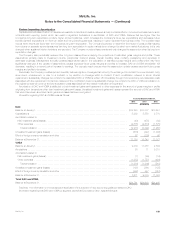

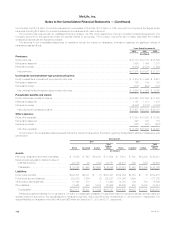

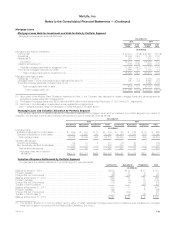

December 31, 2012 December 31, 2011

Less than 12 Months Equal to or Greater

than 12 Months Less than 12 Months Equal to or Greater

than 12 Months

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

Estimated

Fair

Value

Gross

Unrealized

Losses

(In millions, except number of securities)

Fixed Maturity Securities:

U.S. corporate ................................ $ 3,799 $ 88 $ 3,695 $ 342 $15,642 $ 590 $ 5,135 $ 790

Foreign corporate .............................. 2,783 96 2,873 180 12,618 639 5,957 700

Foreign government ............................ 1,431 22 543 49 11,227 230 1,799 127

U.S. Treasury and agency ....................... 1,951 11 — — 2,611 1 50 1

RMBS ....................................... 735 31 4,098 633 4,040 547 4,724 1,189

CMBS ....................................... 842 11 577 46 2,825 135 678 91

ABS ........................................ 1,920 30 1,410 139 4,972 103 1,316 214

State and political subdivision ..................... 260 4 251 66 177 2 1,007 154

Total fixed maturity securities .................... $13,721 $293 $13,447 $1,455 $54,112 $2,247 $20,666 $3,266

Equity Securities:

Common .................................... $ 201 $ 18 $ 14 $ 1 $ 581 $ 96 $ 5 $ 1

Non-redeemable preferred ....................... — — 295 140 204 30 370 172

Total equity securities .......................... $ 201 $ 18 $ 309 $ 141 $ 785 $ 126 $ 375 $ 173

Total number of securities in an unrealized loss

position .................................... 1,941 1,335 3,978 1,963

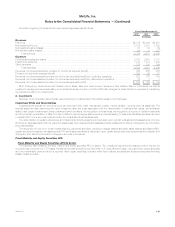

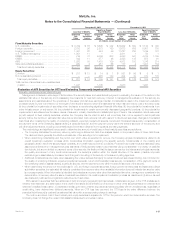

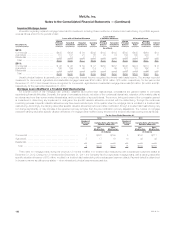

Evaluation of AFS Securities for OTTI and Evaluating Temporarily Impaired AFS Securities

Evaluation and Measurement Methodologies

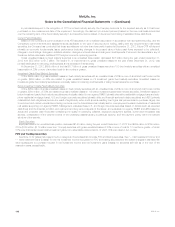

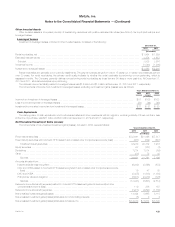

Management considers a wide range of factors about the security issuer and uses its best judgment in evaluating the cause of the decline in the

estimated fair value of the security and in assessing the prospects for near-term recovery. Inherent in management’s evaluation of the security are

assumptions and estimates about the operations of the issuer and its future earnings potential. Considerations used in the impairment evaluation

process include, but are not limited to: (i) the length of time and the extent to which the estimated fair value has been below cost or amortized cost;

(ii) the potential for impairments of securities when the issuer is experiencing significant financial difficulties; (iii) the potential for impairments in an

entire industry sector or sub-sector; (iv) the potential for impairments in certain economically depressed geographic locations; (v) the potential for

impairments of securities where the issuer, series of issuers or industry has suffered a catastrophic type of loss or has exhausted natural resources;

(vi) with respect to fixed maturity securities, whether the Company has the intent to sell or will more likely than not be required to sell a particular

security before the decline in estimated fair value below amortized cost recovers; (vii) with respect to structured securities, changes in forecasted

cash flows after considering the quality of underlying collateral, expected prepayment speeds, current and forecasted loss severity, consideration of

the payment terms of the underlying assets backing a particular security, and the payment priority within the tranche structure of the security; and

(viii) other subjective factors, including concentrations and information obtained from regulators and rating agencies.

The methodology and significant inputs used to determine the amount of credit loss on fixed maturity securities are as follows:

‰The Company calculates the recovery value by performing a discounted cash flow analysis based on the present value of future cash flows.

The discount rate is generally the effective interest rate of the security prior to impairment.

‰When determining collectability and the period over which value is expected to recover, the Company applies considerations utilized in its

overall impairment evaluation process which incorporates information regarding the specific security, fundamentals of the industry and

geographic area in which the security issuer operates, and overall macroeconomic conditions. Projected future cash flows are estimated using

assumptions derived from management’s best estimates of likely scenario-based outcomes after giving consideration to a variety of variables

that include, but are not limited to: payment terms of the security; the likelihood that the issuer can service the interest and principal payments;

the quality and amount of any credit enhancements; the security’s position within the capital structure of the issuer; possible corporate

restructurings or asset sales by the issuer; and changes to the rating of the security or the issuer by rating agencies.

‰Additional considerations are made when assessing the unique features that apply to certain structured securities including, but not limited to:

the quality of underlying collateral, expected prepayment speeds; current and forecasted loss severity, consideration of the payment terms of

the underlying loans or assets backing a particular security, and the payment priority within the tranche structure of the security.

‰When determining the amount of the credit loss for U.S. and foreign corporate securities, foreign government securities and state and political

subdivision securities, the estimated fair value is considered the recovery value when available information does not indicate that another value

is more appropriate. When information is identified that indicates a recovery value other than estimated fair value, management considers in the

determination of recovery value the same considerations utilized in its overall impairment evaluation process as described in (ii) above, as well

as private and public sector programs to restructure such securities.

With respect to securities that have attributes of debt and equity (perpetual hybrid securities), consideration is given in the OTTI analysis as to

whether there has been any deterioration in the credit of the issuer and the likelihood of recovery in value of the securities that are in a severe and

extended unrealized loss position. Consideration is also given as to whether any perpetual hybrid securities, with an unrealized loss, regardless of

credit rating, have deferred any dividend payments. When an OTTI loss has occurred, the OTTI loss is the entire difference between the

perpetual hybrid security’s cost and its estimated fair value with a corresponding charge to earnings.

The cost or amortized cost of fixed maturity and equity securities is adjusted for OTTI in the period in which the determination is made. The

Company does not change the revised cost basis for subsequent recoveries in value.

MetLife, Inc. 117