MetLife 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

Other Revenues

Other revenues include, in addition to items described elsewhere herein, advisory fees, broker-dealer commissions and fees, administrative service

fees, and changes in account value relating to corporate-owned life insurance (“COLI”). Such fees and commissions are recognized in the period in

which services are performed. Under certain COLI contracts, if the Company reports certain unlikely adverse results in its consolidated financial

statements, withdrawals would not be immediately available and would be subject to market value adjustment, which could result in a reduction of the

account value.

Policyholder Dividends

Policyholder dividends are approved annually by the insurance subsidiaries’ boards of directors. The aggregate amount of policyholder dividends is

related to actual interest, mortality, morbidity and expense experience for the year, as well as management’s judgment as to the appropriate level of

statutory surplus to be retained by the insurance subsidiaries.

Foreign Currency

Assets, liabilities and operations of foreign affiliates and subsidiaries are recorded based on the functional currency of each entity. The determination

of the functional currency is made based on the appropriate economic and management indicators. With the exception of certain foreign operations,

primarily Japan, where multiple functional currencies exist, the local currencies of foreign operations are the functional currencies. Assets and liabilities of

foreign affiliates and subsidiaries are translated from the functional currency to U.S. dollars at the exchange rates in effect at each year-end and income

and expense accounts are translated at the average exchange rates during the year. The resulting translation adjustments are charged or credited

directly to OCI, net of applicable taxes. Gains and losses from foreign currency transactions, including the effect of re-measurement of monetary assets

and liabilities to the appropriate functional currency, are reported as part of net investment gains (losses) in the period in which they occur.

Earnings Per Common Share

Basic earnings per common share are computed based on the weighted average number of common shares, or their equivalent, outstanding during

the period. The difference between the number of shares assumed issued and number of shares assumed purchased represents the dilutive shares.

Diluted earnings per common share include the dilutive effect of the assumed: (i) exercise or issuance of stock-based awards using the treasury stock

method; (ii) settlement of stock purchase contracts underlying common equity units using the treasury stock method; and (iii) settlement of accelerated

common stock repurchase contracts. Under the treasury stock method, exercise or issuance of stock-based awards and settlement of the stock

purchase contracts underlying common equity units is assumed to occur with the proceeds used to purchase common stock at the average market

price for the period.

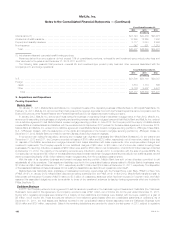

Adoption of New Accounting Pronouncements

On January 1, 2012, the Company adopted new guidance regarding accounting for DAC, which was retrospectively applied. The guidance

specifies that only costs related directly to successful acquisition of new or renewal contracts can be capitalized as DAC; all other acquisition-related

costs must be expensed as incurred. Under the new guidance, advertising costs may only be included in DAC if the capitalization criteria in the direct-

response advertising guidance in Subtopic 340-20, Other Assets and Deferred Costs—Capitalized Advertising Costs, are met. As a result, certain direct

marketing, sales manager compensation and administrative costs previously capitalized by the Company will no longer be deferred. The cumulative

effect adjustment of adopting the guidance on accounting for DAC was a decrease in total equity of $1.8 billion, net of income tax, as of January 1,

2010, which is reflected in the opening balance of equity in the consolidated statement of equity.

On January 1, 2012, the Company adopted new guidance regarding comprehensive income, which was retrospectively applied, that provides

companies with the option to present the total of comprehensive income, components of net income, and the components of OCI either in a single

continuous statement of comprehensive income or in two separate but consecutive statements in annual financial statements. The standard eliminates

the option to present components of OCI as part of the statement of changes in stockholders’ equity. The Company adopted the two-statement

approach for annual financial statements.

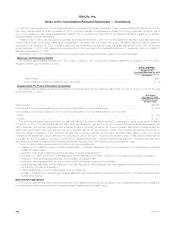

Effective January 1, 2012, the Company adopted new guidance on goodwill impairment testing that simplifies how an entity tests goodwill for

impairment. This new guidance allows an entity to first assess qualitative factors to determine whether it is more likely than not that the fair value ofa

reporting unit is less than its carrying value as a basis for determining whether it needs to perform the quantitative two-step goodwill impairment test.

Only if an entity determines, based on qualitative assessment, that it is more likely than not that a reporting unit’s fair value is less than its carrying value

will it be required to calculate the fair value of the reporting unit. The qualitative assessment is optional and the Company is permitted to bypass it for any

reporting unit in any period and begin its impairment analysis with the quantitative calculation. In 2012, the Company proceeded to Step 1 of the two-

step impairment analysis for all of the Company’s reporting units. The Company is permitted to perform the qualitative assessment in any subsequent

period.

Effective January 1, 2012, the Company adopted new guidance regarding fair value measurements that establishes common requirements for

measuring fair value and for disclosing information about fair value measurements in accordance with GAAP and International Financial Reporting

Standards. Some of the amendments clarify the Financial Accounting Standards Board’s (“FASB”) intent on the application of existing fair value

measurement requirements. Other amendments change a particular principle or requirement for measuring fair value or for disclosing information about

fair value measurements. The adoption did not have a material impact on the Company’s consolidated financial statements other than the expanded

disclosures in Note 10.

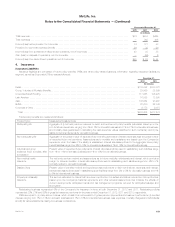

Effective July 1, 2010, the Company adopted guidance regarding accounting for embedded credit derivatives within structured securities. This

guidance clarifies the type of embedded credit derivative that is exempt from embedded derivative bifurcation requirements. Specifically, embedded

credit derivatives resulting only from subordination of one financial instrument to another continue to qualify for the scope exception. Embedded credit

derivative features other than subordination must be analyzed to determine whether they require bifurcation and separate accounting. As a result of the

adoption of this guidance, the Company elected FVO for certain structured securities that were previously accounted for as fixed maturity securities.

Upon adoption, the Company reclassified $50 million of securities from fixed maturity securities to FVO and trading securities. These securities had

cumulative unrealized losses of $10 million, net of income tax, which was recognized as a cumulative effect adjustment to decrease retained earnings

with a corresponding increase to AOCI as of July 1, 2010.

94 MetLife, Inc.