MetLife 2012 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

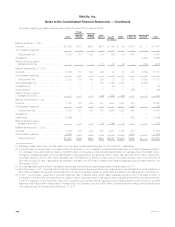

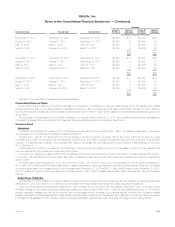

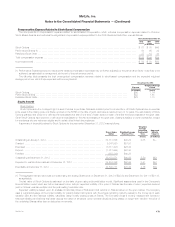

Dividends

The table below presents declaration, record and payment dates, as well as per share and aggregate dividend amounts, for common stock:

Dividend

Declaration Date Record Date Payment Date Per Share Aggregate

(In millions, except per

share data)

October 23, 2012 .................. November 9, 2012 December 14, 2012 $0.74 $811

October 25, 2011 .................. November 9, 2011 December 14, 2011 $0.74 $787

October 26, 2010 .................. November 9, 2010 December 14, 2010 $0.74 $784 (1)

(1) Includes dividends on convertible preferred stock (see “— Convertible Preferred Stock”)

See Note 23 for information on subsequent dividends declared.

The funding of the cash dividends and operating expenses of MetLife, Inc. is primarily provided by cash dividends from MetLife, Inc.’s insurance

subsidiaries. The statutory capital and surplus, or net assets, of MetLife, Inc.’s insurance subsidiaries are subject to regulatory restrictions except to the

extent that dividends are allowed to be paid in a given year without prior regulatory approval. Dividends exceeding these limitations can generally be

made subject to regulatory approval. The nature and amount of these dividend restrictions, as well as the statutory capital and surplus of MetLife, Inc.’s

U.S. insurance subsidiaries, are disclosed in “— Statutory Equity and Income” and “— Dividend Restrictions — Insurance Operations.” MetLife, Inc.’s

principal non-U.S. insurance operations are branches or subsidiaries of American Life, a U.S. insurance subsidiary of the Company. In addition, the

payment of dividends by MetLife, Inc. to its shareholders is also subject to restrictions. See “— Dividend Restrictions — MetLife, Inc.”

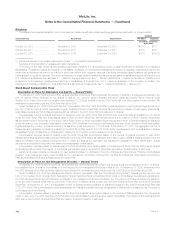

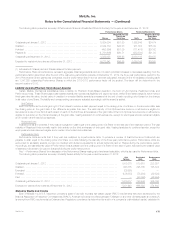

Stock-Based Compensation Plans

Description of Plans for Employees and Agents — General Terms

The MetLife, Inc. 2000 Stock Incentive Plan, as amended (the “2000 Stock Plan”) authorized the granting of awards to employees and agents in the

form of options (“Stock Options”) to buy shares of MetLife, Inc. common stock (“Shares”) that either qualify as incentive Stock Options under

Section 422A of the Code or are non-qualified. By December 31, 2009 all awards under the 2000 Stock Plan had either vested or been forfeited. No

awards have been made under the 2000 Stock Plan since 2005.

Under the MetLife, Inc. 2005 Stock and Incentive Compensation Plan (the “2005 Stock Plan”), awards granted to employees and agents may be in

the form of Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock Units, Performance Shares or Performance Share Units,

Cash-Based Awards and Stock-Based Awards (each as defined in the 2005 Stock Plan with reference to Shares).

The aggregate number of shares authorized for issuance under the 2005 Stock Plan is 68,000,000, plus those shares available but not utilized

under the 2000 Stock Plan and those shares utilized under the 2000 Stock Plan that are recovered due to forfeiture of Stock Options. Each share

issued under the 2005 Stock Plan in connection with a Stock Option or Stock Appreciation Right reduces the number of Shares remaining for issuance

under that plan by one, and each Share issued under the 2005 Stock Plan in connection with awards other than Stock Options or Stock Appreciation

Rights reduces the number of Shares remaining for issuance under that plan by 1.179 Shares. At December 31, 2012, the aggregate number of

Shares remaining available for issuance pursuant to the 2005 Stock Plan was 24,715,318. Stock Option exercises and other awards settled in Shares

are satisfied through the issuance of Shares held in treasury by the Company or by the issuance of new Shares.

Compensation expense related to awards under the 2005 Stock Plan is recognized based on the number of awards expected to vest, which

represents the awards granted less expected forfeitures over the life of the award, as estimated at the date of grant. Unless a material deviation from the

assumed forfeiture rate is observed during the term in which the awards are expensed, any adjustment necessary to reflect differences in actual

experience is recognized in the period the award becomes payable or exercisable.

Compensation expense related to awards under the 2005 Stock Plan is principally related to the issuance of Stock Options, Performance Shares

and Restricted Stock Units. The majority of the awards granted each year under the 2005 Stock Plan are made in the first quarter of each year.

Certain stock-based awards provide solely for cash settlement based on changes in the price of Shares and other factors (“Phantom Stock-Based

Awards”). Such awards are made under the MetLife, Inc. International Unit Option Incentive Plan, the MetLife International Performance Unit Incentive

Plan, and the MetLife International Restricted Unit Incentive Plan.

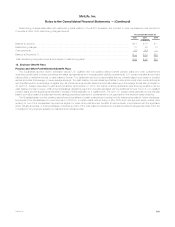

Description of Plans for Non-Management Directors — General Terms

The MetLife, Inc. 2000 Directors Stock Plan, as amended (the “2000 Directors Stock Plan”) authorized the granting of awards in the form of Shares,

non-qualified Stock Options, or a combination of the foregoing to non-management Directors of MetLife, Inc. At December 31, 2009, all awards under

the 2000 Directors Stock Plan had either vested or been forfeited. No awards have been made under the 2000 Directors Stock Plan since 2004.

Under the MetLife, Inc. 2005 Non-Management Director Stock Compensation Plan (the “2005 Directors Stock Plan”), awards granted may be in the

form of non-qualified Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock Units, or Stock-Based Awards (each as defined in

the 2005 Directors Stock Plan with reference to Shares) to non-management Directors of MetLife, Inc. The number of Shares authorized for issuance

under the 2005 Directors Stock Plan is 2,000,000. There were no Shares carried forward from the 2000 Directors Stock Plan to the 2005 Directors

Stock Plan. At December 31, 2012, the aggregate number of Shares remaining available for issuance pursuant to the 2005 Directors Stock Plan was

1,733,758. Stock Option exercises and other awards settled in Shares are satisfied through the issuance of Shares held in treasury by the Company or

by the issuance of new Shares.

Compensation expense related to awards under the 2005 Directors Plan is recognized based on the number of Shares awarded. The only awards

made to date under the 2005 Directors Stock Plan have been Stock-Based Awards that have vested immediately. The majority of the awards granted

each year under the 2005 Directors Stock Plan are made in the second quarter of each year.

172 MetLife, Inc.