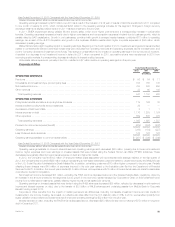

MetLife 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

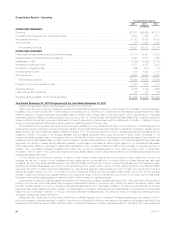

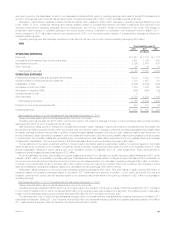

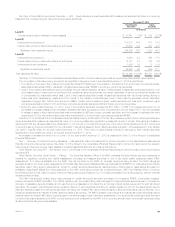

investment income. This growth in premiums, deposits and funding agreement issuances also increased the interest credited on future policyholder

liabilities and policyholder account balances. The net result of these increases contributed $114 million to operating earnings.

Market factors, including the current low interest rate environment, have negatively impacted our investment returns. However, the low interest rate

environment also decreased interest credited to policyholders and the interest credited expense associated with insurance liabilities. Many of our

funding agreement and guaranteed interest contract liabilities are tied to market indices. Interest rates on new business were set lower, as were the

rates on existing business with terms that can fluctuate. The lower investment returns were more than offset by the decrease in interest credited

expense, resulting in an increase in operating earnings of $75 million. The lower investment returns also includes the impact of returns on invested

economic capital, and the decrease in interest credited is impacted by derivatives that are used to hedge certain liabilities in our funding agreement

business.

The Company’s use of the U.S. Social Security Administration’s Death Master File in connection with our post-retirement benefit business resulted in

a charge in the third quarter of the current year of $8 million. Other insurance liability refinements and mortality results negatively impacted our year-over-

year operating earnings by $34 million.

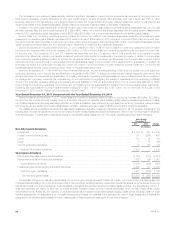

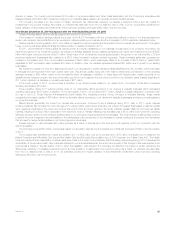

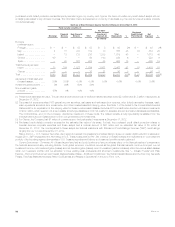

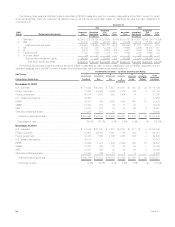

Latin America

Years Ended December 31,

2012 2011 2010

(In millions)

OPERATING REVENUES

Premiums ....................................................................................... $2,578 $2,514 $1,969

Universal life and investment-type product policy fees ..................................................... 785 757 630

Net investment income ............................................................................. 1,198 1,025 927

Other revenues ................................................................................... 16 15 12

Total operating revenues .......................................................................... 4,577 4,311 3,538

OPERATING EXPENSES

Policyholder benefits and claims and policyholder dividends ................................................ 2,231 2,064 1,829

Interest credited to policyholder account balances ........................................................ 393 371 370

Capitalization of DAC .............................................................................. (353) (295) (221)

Amortization of DAC and VOBA ...................................................................... 224 207 144

Amortization of negative VOBA ....................................................................... (5) (6) (1)

Interest expense on debt ........................................................................... (1) 1 1

Other expenses .................................................................................. 1,375 1,305 901

Total operating expenses ......................................................................... 3,864 3,647 3,023

Provision for income tax expense (benefit) .............................................................. 130 150 92

Operating earnings ................................................................................ $ 583 $ 514 $ 423

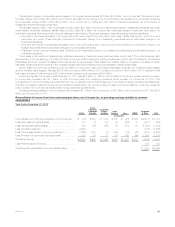

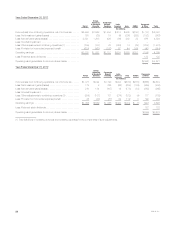

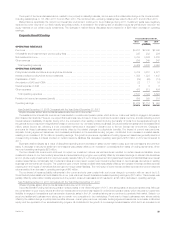

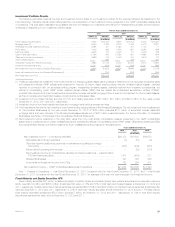

Year Ended December 31, 2012 Compared with the Year Ended December 31, 2011

Unless otherwise stated, all amounts discussed below are net of income tax.

Operating earnings increased by $69 million over the prior year. The impact of changes in foreign currency exchange rates reduced operating

earnings by $30 million for 2012 compared to 2011.

Latin America experienced strong sales growth primarily driven by retirement products in Mexico, Chile and Brazil and by accident and health

products in Argentina and Chile. Changes in premiums for these products were almost entirely offset by the related changes in policyholder benefits and

unfavorable claims experience. The growth in our businesses drove an increase in average invested assets, which generated higher net investment

income and higher policy fee income, partially offset by an increase in interest credited to policyholders. The increase in sales also generated higher

commission expense, which was partially offset by a corresponding increase in DAC capitalization. The items discussed above, coupled with a change

in allocated equity, were the primary drivers of a $41 million improvement in operating earnings.

Market factors increased operating earnings by $15 million. An increase in investment yields primarily reflects higher returns on fixed maturities from a

repositioning of the portfolio in Argentina and higher returns on variable rate investments in Brazil, partially offset by a corresponding increase in interest

credited expense. A decrease in net investment income from lower inflation in the prior year was substantially offset by a corresponding decrease in

policyholder benefits.

Current year results include various favorable income tax items of $38 million in Argentina, Mexico and Chile. In addition, the current year results

benefited from liability refinements of $22 million in Chile and Mexico which were partially offset by an unfavorable DAC capitalization adjustment in Chile

and a write-off of capitalized software in Mexico.

Year Ended December 31, 2011 Compared with the Year Ended December 31, 2010

Unless otherwise stated, all amounts discussed below are net of income tax.

Operating earnings increased by $91 million over 2010 primarily as a result of the inclusion of a full year of results of ALICO’s operations for 2011

compared to one month of results for 2010, which contributed $36 million to the operating earnings increase for the segment. The positive impact of

changes in foreign currency exchange rates improved reported earnings by $15 million for 2011 compared to the prior year.

Latin America experienced strong sales growth driven primarily by accident & health products. In addition, sales of retirement products in Mexico as

well as immediate annuity products in Chile increased over the prior year. Net investment income increased due to increased average invested assets

and higher fee income on universal life products, primarily in Mexico, also favorably impacted operating earnings. Commissions and compensation

expenses were higher in Mexico and Brazil due to business growth, which is offset by DAC capitalization. Other expenses also increased over the prior

30 MetLife, Inc.