MetLife 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

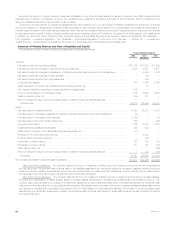

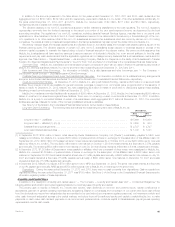

Affiliated Capital Transactions. During the years ended December 31, 2012, 2011 and 2010, MetLife, Inc. invested an aggregate of $3.5

billion, $1.9 billion and $699 million (excluding the ALICO Acquisition), respectively, in various subsidiaries.

MetLife, Inc. lends funds, as necessary, to its subsidiaries and affiliates, some of which are regulated, to meet their capital requirements. In

December 2012, MetLife Reinsurance Company of Delaware (“MRD”) issued a $750 million surplus note to MetLife, Inc. due September 2032. The

surplus note bears interest at a fixed rate of 5.13%, payable semi-annually. MetLife, Inc. issued a $750 million senior note to MRD in exchange for

the surplus note. MetLife, Inc. had loans to subsidiaries outstanding of $750 million at December 31, 2012. At December 31, 2011, MetLife, Inc. did

not have any loans to subsidiaries outstanding.

Debt Repayments. For information on MetLife, Inc.’s debt repayments, see “— The Company — Liquidity and Capital Uses — Debt

Repayments.” MetLife, Inc. intends to repay all or refinance in whole or in part the debt that is due in 2013.

Debt and Facility Covenants. Certain of MetLife, Inc.’s debt instruments, credit facilities and committed facilities contain various administrative,

reporting, legal and financial covenants. MetLife, Inc. believes it was in compliance with all such covenants at December 31, 2012.

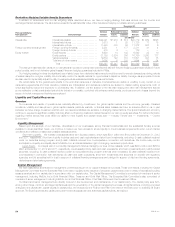

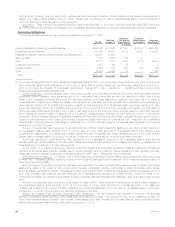

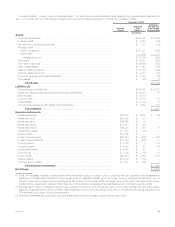

Maturities of Senior Notes. The following table summarizes MetLife, Inc.’s outstanding senior notes series by year of maturity through 2017 and

2018 to 2045, excluding any premium or discount, at December 31, 2012:

Year of Maturity Principal Interest Rate

(In millions)

2013 ................................................................. $ 500 5.00%

2013 ................................................................. $ 250 three-month LIBOR + 1.25%

2014 ................................................................. $ 350 5.50%

2014 ................................................................. $ 500 6.44%

2014 ................................................................. $ 1,000 2.38%

2015 ................................................................. $ 1,000 5.00%

2016 ................................................................. $ 250 7.44%

2016 ................................................................. $ 1,250 6.75%

2017 ................................................................. $ 500 1.76%

2018 - 2045 ........................................................... $13,023 Ranging from 1.92% - 7.72%

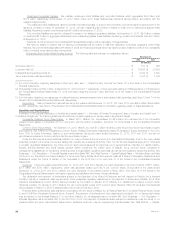

Support Agreements. MetLife, Inc. is party to various capital support commitments and guarantees with certain of its subsidiaries. Under these

arrangements, MetLife, Inc. has agreed to cause each such entity to meet specified capital and surplus levels or has guaranteed certain contractual

obligations.

In December 2012, MetLife, Inc., in connection with MRD’s reinsurance of certain universal life and term life risks, entered into a capital

maintenance agreement pursuant to which MetLife, Inc. agreed, without limitation as to amount, to cause the initial protected cell of MRD to maintain

total adjusted capital equal to or greater than 200% of such protected cell’s company action level RBC, as defined in state insurance statutes.

In July 2012, in connection with an operating agreement with the OCC governing MetLife Bank’s operations during its wind-down process,

MetLife Bank and MetLife, Inc. entered into a capital support agreement with the OCC and MetLife, Inc. and MetLife Bank entered into an

indemnification and capital maintenance agreement under which agreements MetLife, Inc. will provide financial and other support to MetLife Bank to

ensure that MetLife Bank can wind down its operations in a safe and sound manner. Pursuant to the agreements, MetLife, Inc. is required to ensure

that MetLife Bank meets or exceeds certain minimum capital and liquidity requirements once its FDIC insurance has been terminated and make

indemnification payments to MetLife Bank in connection with MetLife Bank’s obligation under the April 2011 consent decree between MetLife Bank

and the OCC. In February 2013, MetLife Bank’s FDIC insurance was terminated. During the year ended December 31, 2012, MetLife, Inc. invested

$34 million in cash in MetLife Bank in connection with these agreements. In January 2013, MetLife, Inc. entered into an 18-month agreement with

MetLife Bank to lend up to $500 million to MetLife Bank on a revolving basis. In January 2013, MetLife Bank both drew down and repaid $400

million under the agreement, which bore interest at a rate of three-month LIBOR plus 1.75%. In February 2013, the agreement was amended to

reduce borrowing capacity to $100 million.

MetLife, Inc. guarantees the obligations of its subsidiary, DelAm, under a stop loss reinsurance agreement with RGA Reinsurance (Barbados) Inc.

(“RGARe”), pursuant to which RGARe retrocedes to DelAm a portion of the whole life medical insurance business that RGARe assumed from

American Life on behalf of its Japan operations.

Prior to the sale in April 2011 of its 50% interest in Mitsui Sumitomo MetLife Insurance Co., Ltd. (“MSI MetLife”) to a third party, MetLife, Inc.

guaranteed the obligations of its subsidiary, Exeter, under a reinsurance agreement with MSI MetLife, under which Exeter reinsures variable annuity

business written by MSI MetLife. This guarantee will remain in place until such time as the reinsurance agreement between Exeter and MSI MetLife is

terminated, notwithstanding the April 2011 disposition of MetLife, Inc.’s interest in MSI MetLife as described in Note 3 of the Notes to the

Consolidated Financial Statements.

MetLife, Inc. guarantees the obligations of its subsidiary, Missouri Reinsurance, Inc. (“MoRe”), under a retrocession agreement with RGARe,

pursuant to which MoRe retrocedes a portion of the closed block liabilities associated with industrial life and ordinary life insurance policies thatit

assumed from MLIC.

MetLife, Inc. guarantees the obligations of Exeter in an aggregate amount up to $1.0 billion, under a reinsurance agreement with MetLife Europe

Limited (“MEL”), under which Exeter reinsures the guaranteed living benefits and guaranteed death benefits associated with certain unit-linked

annuity contracts issued by MEL.

MetLife, Inc. guarantees the obligations of MoRe, under a retrocession agreement with RGARe, pursuant to which MoRe retrocedes certain

group term life insurance liabilities that it assumed from MLIC.

MetLife, Inc., in connection with MetLife Reinsurance Company of Vermont’s (“MRV”) reinsurance of certain universal life and term life insurance

risks, committed to the Vermont Department of Banking, Insurance, Securities and Health Care Administration to take necessary action to cause the

three protected cells of MRV to maintain total adjusted capital in an amount that is equal to or greater than 200% of each such protected cell’s

authorized control level RBC, as defined in Vermont state insurance statutes. See “— The Company — Liquidity and Capital Sources — Credit and

Committed Facilities” and Note 12 of the Notes to the Consolidated Financial Statements.

MetLife, Inc., in connection with the collateral financing arrangement associated with MetLife Reinsurance Company of Charleston’s (“MRC”)

reinsurance of a portion of the liabilities associated with the closed block, committed to the South Carolina Department of Insurance to make capital

64 MetLife, Inc.