MetLife 2012 Annual Report Download - page 73

Download and view the complete annual report

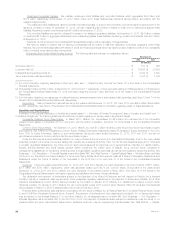

Please find page 73 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rates) as fixed maturity securities. We employ product design, pricing and ALM strategies to reduce the potential effects of interest rate movements.

Product design and pricing strategies include the use of surrender charges or restrictions on withdrawals in some products and the ability to reset

crediting rates for certain products. ALM strategies include the use of derivatives and duration mismatch limits. See “Risk Factors — Economic

Environment and Capital Markets-Related Risks — We Are Exposed to Significant Financial and Capital Markets Risk Which May Adversely Affect Our

Results of Operations, Financial Condition and Liquidity, and May Cause Our Net Investment Income to Vary from Period to Period” in the 2012 Form

10-K.

Foreign Currency Exchange Rates. Our exposure to fluctuations in foreign currency exchange rates against the U.S. dollar results from our

holdings in non-U.S. dollar denominated fixed maturity and equity securities, mortgage loans, and certain liabilities, as well as through our investments in

foreign subsidiaries. The principal currencies that create foreign currency exchange rate risk in our investment portfolios and liabilities are the Euro, the

Japanese yen and the British pound. Selectively, we use U.S. dollar assets to support certain long duration foreign currency liabilities. Through our

investments in foreign subsidiaries and joint ventures, we are primarily exposed to the Japanese yen, the British pound, the Australian dollar, the

Mexican peso and the Korean won. In addition to hedging with foreign currency swaps, forwards and options, local surplus in some countries is held

entirely or in part in U.S. dollar assets which further minimizes exposure to foreign currency exchange rate fluctuation risk. We have matched much of

our foreign currency liabilities in our foreign subsidiaries with their respective foreign currency assets, thereby reducing our risk to foreign currency

exchange rate fluctuation. See “Risk Factors — Risks Related to Our Business — Fluctuations in Foreign Currency Exchange Rates Could Negatively

Affect Our Profitability” in the 2012 Form 10-K.

Equity Market. We have exposure to equity market risk through certain liabilities that involve long-term guarantees on equity performance such as

net embedded derivatives on variable annuities with guaranteed minimum benefits, certain PABs, along with investments in equity securities. We

manage this risk on an integrated basis with other risks through our ALM strategies including the dynamic hedging of certain variable annuity guarantee

benefits. We also manage equity market risk exposure in our investment portfolio through the use of derivatives. Equity exposures associated with other

limited partnership interests are excluded from this section as they are not considered financial instruments under GAAP.

Management of Market Risk Exposures

We use a variety of strategies to manage interest rate, foreign currency exchange rate and equity market risk, including the use of derivatives.

Interest Rate Risk Management. To manage interest rate risk, we analyze interest rate risk using various models, including multi-scenario cash flow

projection models that forecast cash flows of the liabilities and their supporting investments, including derivatives. These projections involve evaluating

the potential gain or loss on most of our in-force business under various increasing and decreasing interest rate environments. The Department of

Financial Services regulations require that we perform some of these analyses annually as part of our review of the sufficiency of our regulatory reserves.

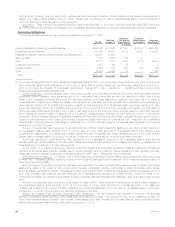

For several of our legal entities, we maintain segmented operating and surplus asset portfolios for the purpose of ALM and the allocation of investment

income to product lines. For each segment, invested assets greater than or equal to the GAAP liabilities and any non-invested assets allocated to the

segment are maintained, with any excess swept to Corporate & Other. The business segments may reflect differences in legal entity, statutory line of

business and any product market characteristic which may drive a distinct investment strategy with respect to duration, liquidity or credit quality of the

invested assets. Certain smaller entities make use of unsegmented general accounts for which the investment strategy reflects the aggregate

characteristics of liabilities in those entities. We measure relative sensitivities of the value of our assets and liabilities to changes in key assumptions

utilizing internal models. These models reflect specific product characteristics and include assumptions based on current and anticipated experience

regarding lapse, mortality and interest crediting rates. In addition, these models include asset cash flow projections reflecting interest payments, sinking

fund payments, principal payments, bond calls, mortgage loan prepayments and defaults.

Common industry metrics, such as duration and convexity, are also used to measure the relative sensitivity of assets and liability values to changes

in interest rates. In computing the duration of liabilities, consideration is given to all policyholder guarantees and to how we intend to set indeterminate

policy elements such as interest credits or dividends. Each asset portfolio has a duration target based on the liability duration and the investment

objectives of that portfolio. Where a liability cash flow may exceed the maturity of available assets, as is the case with certain retirement and group

products, we may support such liabilities with equity investments, derivatives or interest rate curve mismatch strategies.

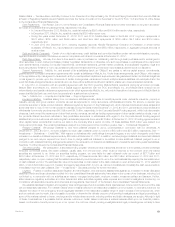

Foreign Currency Exchange Rate Risk Management. Foreign currency exchange rate risk is assumed primarily in three ways: investments in foreign

subsidiaries, purchases of foreign currency denominated investments and the sale of certain insurance products.

‰The Foreign Exchange Committee, in coordination with the Treasury Department, is responsible for managing the exposure to investments in

foreign subsidiaries. Limits to exposures are established and monitored by the Treasury Department and managed by the Investments

Department.

‰The Investments Department is responsible for managing the exposure to foreign currency denominated investments. Exposure limits to

unhedged foreign currency investments are incorporated into the standing authorizations granted to management by the Board of Directors and

are reported to the Board of Directors on a periodic basis.

‰Management of each of the Company’s segments is responsible for establishing limits and managing any foreign currency exchange rate

exposure caused by the sale or issuance of insurance products.

We use foreign currency swaps, forwards and options to mitigate the liability exposure, risk of loss and the volatility of net income associated with its

investments in foreign subsidiaries, foreign currency denominated fixed income investments and the sale of certain insurance products.

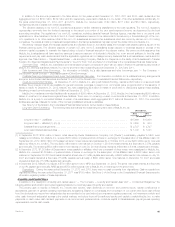

Equity Market Risk Management. Equity market risk exposure through the issuance of variable annuities is managed by our Asset/Liability

Management Unit in partnership with the Investments Department. Equity market risk is realized through its investment in equity securities and is

managed by our Investments Department. We use derivatives to mitigate our equity exposure both in certain liability guarantees such as variable

annuities with guaranteed minimum benefit and equity securities. These derivatives include exchange-traded equity futures, equity index options

contracts and equity variance swaps. We also employ reinsurance to manage these exposures.

MetLife, Inc. 67