MetLife 2012 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

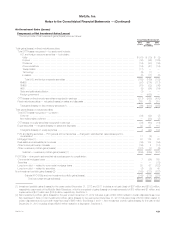

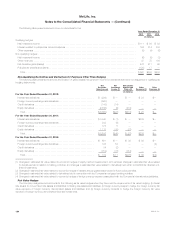

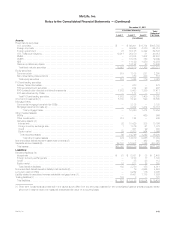

The following table presents the effects of derivatives in cash flow hedging relationships on the consolidated statements of operations and the

consolidated statements of equity:

Derivatives in Cash Flow

Hedging Relationships

Amount of Gains (Losses)

Deferred in Accumulated

Other Comprehensive Income

(Loss) on Derivatives

Amount and Location of Gains

(Losses) Reclassified from

Accumulated Other Comprehensive

Income (Loss) into Income (Loss)

Amount and Location

of Gains (Losses)

Recognized in Income (Loss)

on Derivatives

(Effective Portion) (Effective Portion) (Ineffective Portion)

Net Derivative

Gains (Losses) Net Investment

Income Other

Expenses Net Derivative

Gains (Losses)

(In millions)

For the Year Ended December 31, 2012:

Interest rate swaps ...................................... $ (34) $ 1 $ 4 $ (3) $ 2

Interest rate forwards ..................................... (17) 1 2 (1) —

Foreign currency swaps .................................. (164) 23 (5) 1 (6)

Credit forwards ......................................... — — 1 — —

Total ................................................ $ (215) $25 $ 2 $ (3) $(4)

For the Year Ended December 31, 2011:

Interest rate swaps ...................................... $1,023 $(42) $ 1 $(10) $ 1

Interest rate forwards ..................................... 336 31 1 (1) 2

Foreign currency swaps .................................. 175 — (6) 2 2

Credit forwards ......................................... 18 2 1 — —

Total ................................................ $1,552 $ (9) $ (3) $ (9) $ 5

For the Year Ended December 31, 2010:

Interest rate swaps ...................................... $ 13 $ — $— $ (1) $ 3

Interest rate forwards ..................................... (117) 14 2 — (2)

Foreign currency swaps .................................. 34 (79) (6) 2 —

Credit forwards ......................................... 19 — — — —

Total ................................................ $ (51) $(65) $ (4) $ 1 $ 1

All components of each derivative’s gain or loss were included in the assessment of hedge effectiveness.

At December 31, 2012, ($6) million of deferred net gains (losses) on derivatives in accumulated other comprehensive income (loss) was expected to

be reclassified to earnings within the next 12 months.

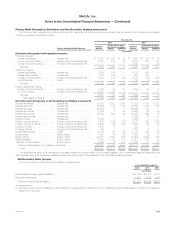

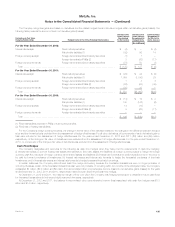

Hedges of Net Investments in Foreign Operations

The Company uses foreign exchange derivatives, which may include foreign currency forwards and currency options, to hedge portions of its net

investments in foreign operations against adverse movements in exchange rates. The Company measures ineffectiveness on these derivatives based

upon the change in forward rates. In addition, the Company may also use non-derivative financial instruments to hedge portions of its net investments in

foreign operations against adverse movements in exchange rates. The Company measures ineffectiveness on non-derivative financial instruments

based upon the change in spot rates.

When net investments in foreign operations are sold or substantially liquidated, the amounts in accumulated other comprehensive income (loss) are

reclassified to the consolidated statements of operations, while a pro rata portion will be reclassified upon partial sale of the net investments in foreign

operations.

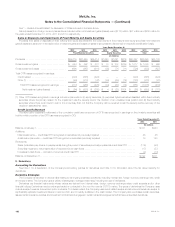

The following table presents the effects of derivatives and non-derivative financial instruments in net investment hedging relationships in the

consolidated statements of operations and the consolidated statements of equity:

Derivatives and Non-Derivative Hedging Instruments in Net

Investment Hedging Relationships (1), (2)

Amount of Gains (Losses) Deferred in Accumulated Other Comprehensive Income (Loss)

(Effective Portion)

Years Ended December 31,

2012 2011 2010

(In millions)

Foreign currency forwards .................................... $(50) $62 $(167)

Currency options ........................................... 36 — —

Non-derivative hedging instruments ............................. — 6 (16)

Total ................................................... $(14) $68 $(183)

(1) During the years ended December 31, 2012 and 2010, there were no sales or substantial liquidations of net investments in foreign operations that

would have required the reclassification of gains or losses from accumulated other comprehensive income (loss) into earnings. During the year

ended December 31, 2011, the Company sold its interest in MSI MetLife, which was a hedged item in a net investment hedging relationship. As a

result, the Company released losses of $71 million from accumulated other comprehensive income (loss) upon the sale. This release did not impact

net income for the year ended December 31, 2011 as such losses were considered in the overall impairment evaluation of the investment prior to

sale. See Note 3.

(2) There was no ineffectiveness recognized for the Company’s hedges of net investments in foreign operations. All components of each derivative and

non-derivative hedging instrument’s gain or loss were included in the assessment of hedge effectiveness.

At December 31, 2012 and 2011, the cumulative foreign currency translation gain (loss) recorded in accumulated other comprehensive income

(loss) related to hedges of net investments in foreign operations was ($98) million and ($84) million, respectively.

136 MetLife, Inc.