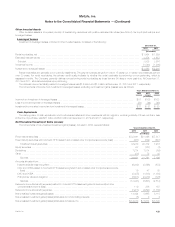

MetLife 2012 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

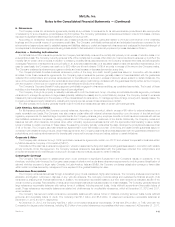

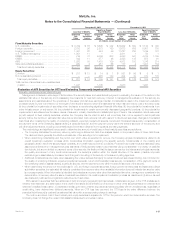

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

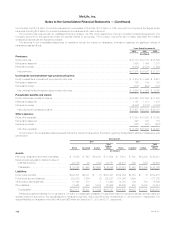

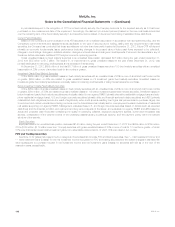

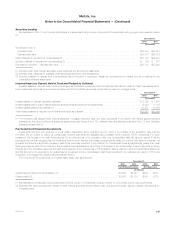

Recorded Investment

Estimated

Fair Value %of

Total

Debt Service Coverage Ratios

Total %of

Total> 1.20x 1.00x - 1.20x < 1.00x

(In millions) (In millions)

December 31, 2012:

Loan-to-value ratios:

Less than 65% .............................................. $29,839 $ 730 $ 722 $31,291 77.3% $33,730 78.3%

65%to75% ................................................ 5,057 672 153 5,882 14.6 6,129 14.2

76%to80% ................................................ 938 131 316 1,385 3.4 1,436 3.3

Greater than 80% ............................................ 1,085 552 277 1,914 4.7 1,787 4.2

Total ..................................................... $36,919 $2,085 $1,468 $40,472 100.0% $43,082 100.0%

December 31, 2011:

Loan-to-value ratios:

Less than 65% .............................................. $24,983 $ 448 $ 564 $25,995 64.3% $27,581 65.5%

65%to75% ................................................ 8,275 336 386 8,997 22.3 9,387 22.3

76%to80% ................................................ 1,150 98 226 1,474 3.6 1,473 3.5

Greater than 80% ............................................ 2,714 880 380 3,974 9.8 3,664 8.7

Total ..................................................... $37,122 $1,762 $1,556 $40,440 100.0% $42,105 100.0%

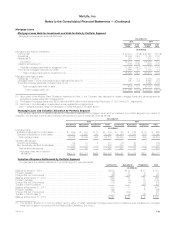

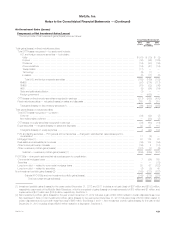

Credit Quality of Agricultural Mortgage Loans

Information about the credit quality of agricultural mortgage loans held-for-investment is presented below at:

December 31,

2012 2011

Recorded

Investment %of

Total Recorded

Investment %of

Total

(In millions) (In millions)

Loan-to-value ratios:

Less than 65% ......................................................................... $11,908 92.7% $11,802 89.9%

65%to75% ........................................................................... 590 4.6 874 6.7

76%to80% ........................................................................... 92 0.7 76 0.6

Greater than 80% ....................................................................... 253 2.0 377 2.8

Total ................................................................................ $12,843 100.0% $13,129 100.0%

The estimated fair value of agricultural mortgage loans held-for-investment was $13.3 billion and $13.6 billion at December 31, 2012 and 2011,

respectively.

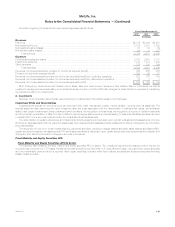

Credit Quality of Residential Mortgage Loans

Information about the credit quality of residential mortgage loans held-for-investment is presented below at:

December 31,

2012 2011

Recorded

Investment %of

Total Recorded

Investment %of

Total

(In millions) (In millions)

Performance indicators:

Performing ............................................................................ $929 97.0% $671 97.4%

Non-performing ......................................................................... 29 3.0 18 2.6

Total ................................................................................ $958 100.0% $689 100.0%

The estimated fair value of residential mortgage loans held-for-investment was $1.0 billion and $737 million at December 31, 2012 and 2011,

respectively.

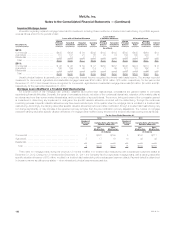

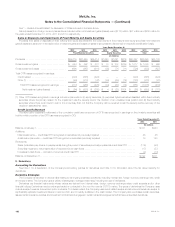

Past Due and Interest Accrual Status of Mortgage Loans

The Company has a high quality, well performing, mortgage loan portfolio, with 99% of all mortgage loans classified as performing at both

December 31, 2012 and 2011. The Company defines delinquent mortgage loans consistent with industry practice, when interest and principal

payments are past due as follows: commercial and residential mortgage loans – 60 days; and agricultural mortgage loans – 90 days. The recorded

investment in mortgage loans held-for-investment, prior to valuation allowances, past due according to these aging categories, greater than 90 days

past due and still accruing interest and in nonaccrual status, by portfolio segment, were as follows at:

Past Due Greater than 90 Days Past Due

and Still Accruing Interest Nonaccrual Status

December 31, 2012 December 31, 2011 December 31, 2012 December 31, 2011 December 31, 2012 December 31, 2011

(In millions)

Commercial .................. $ 2 $ 63 $— $— $ 84 $ 63

Agricultural ................... 116 146 53 29 67 157

Residential ................... 29 8 — — 18 17

Total ...................... $147 $217 $53 $29 $169 $237

MetLife, Inc. 121