MetLife 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

the Company had $13.5 billion of net ceded reinsurance recoverables. Of this total, $10.3 billion, or 76%, were with the Company’s five largest ceded

reinsurers, including $3.2 billion of net ceded reinsurance recoverables which were unsecured.

The Company has reinsured with an unaffiliated third-party reinsurer, 49.25% of the closed block through a modified coinsurance agreement. The

Company accounts for this agreement under the deposit method of accounting. The Company, having the right of offset, has offset the modified

coinsurance deposit with the deposit recoverable.

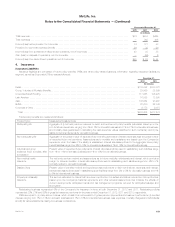

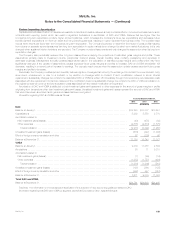

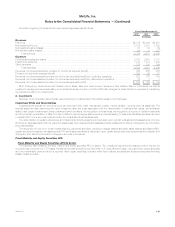

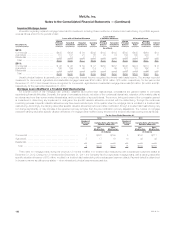

The amounts in the consolidated statements of operations include the impact of reinsurance. Information regarding the significant effects of

reinsurance was as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Premiums:

Direct premiums ................................................................................ $38,719 $ 37,185 $ 27,596

Reinsurance assumed ........................................................................... 1,488 1,484 1,377

Reinsurance ceded .............................................................................. (2,232) (2,308) (1,902)

Net premiums ................................................................................ $37,975 $ 36,361 $ 27,071

Universal life and investment-type product policy fees:

Direct universal life and investment-type product policy fees .............................................. $ 9,216 $ 8,455 $ 6,621

Reinsurance assumed ........................................................................... 155 154 138

Reinsurance ceded .............................................................................. (815) (803) (731)

Net universal life and investment-type product policy fees .............................................. $ 8,556 $ 7,806 $ 6,028

Policyholder benefits and claims:

Direct policyholder benefits and claims ............................................................... $39,262 $ 37,588 $ 31,402

Reinsurance assumed ........................................................................... 1,167 1,101 1,275

Reinsurance ceded .............................................................................. (2,442) (3,218) (3,490)

Net policyholder benefits and claims ............................................................... $37,987 $ 35,471 $ 29,187

Other expenses:

Direct other expenses ............................................................................ $17,848 $ 18,672 $ 13,035

Reinsurance assumed ........................................................................... 228 168 116

Reinsurance ceded .............................................................................. (321) (303) (224)

Net other expenses ............................................................................ $17,755 $ 18,537 $ 12,927

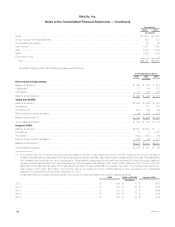

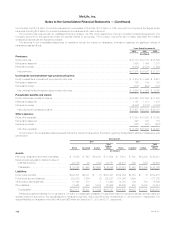

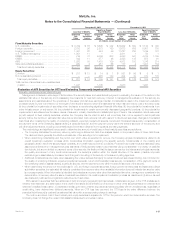

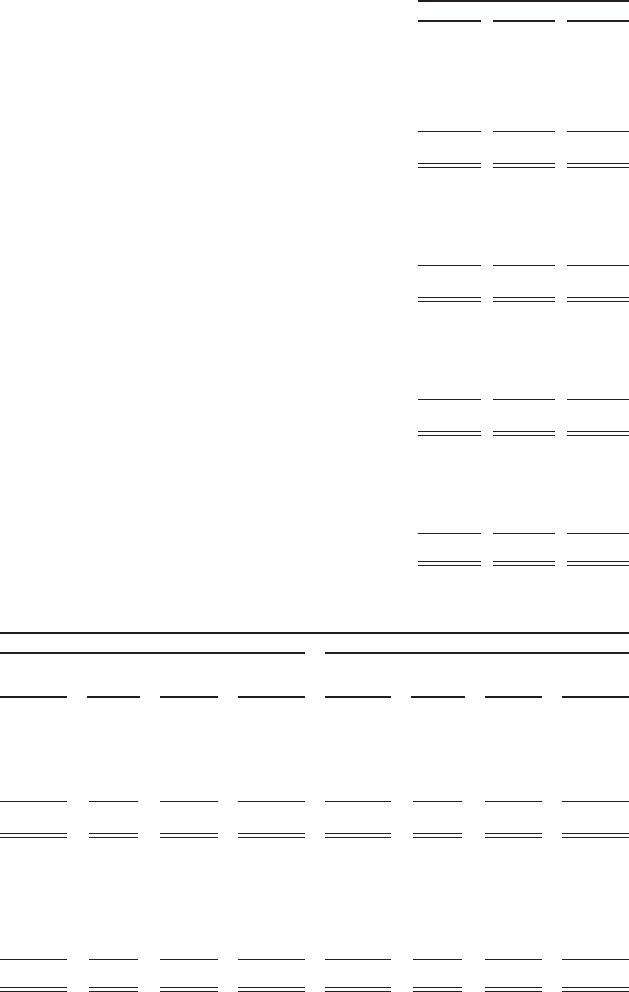

The amounts in the consolidated balance sheets include the impact of reinsurance. Information regarding the significant effects of reinsurance was

as follows at:

December 31,

2012 2011

Direct Assumed Ceded

Total

Balance

Sheet Direct Assumed Ceded

Total

Balance

Sheet

(In millions)

Assets:

Premiums, reinsurance and other receivables ....... $ 6,286 $ 548 $14,800 $ 21,634 $ 5,601 $ 641 $16,239 $ 22,481

Deferred policy acquisition costs and value of

business acquired .......................... 24,789 92 (120) 24,761 24,412 340 (133) 24,619

Total assets ............................... $ 31,075 $ 640 $14,680 $ 46,395 $ 30,013 $ 981 $16,106 $ 47,100

Liabilities:

Future policy benefits ......................... $190,321 $2,031 $ (1) $192,351 $182,304 $1,972 $ (1) $184,275

Policyholder account balances .................. 223,229 2,594 (2) 225,821 214,206 3,494 — 217,700

Other policy-related balances ................... 15,142 313 8 15,463 14,880 339 380 15,599

Other liabilities ............................... 18,925 543 3,024 22,492 25,245 630 5,039 30,914

Total liabilities .............................. $447,617 $5,481 $ 3,029 $456,127 $436,635 $6,435 $ 5,418 $448,488

Reinsurance agreements that do not expose the Company to a reasonable possibility of a significant loss from insurance risk are recorded using the

deposit method of accounting. The deposit assets on reinsurance were $2.3 billion and $2.4 billion at December 31, 2012 and 2011, respectively. The

deposit liabilities on reinsurance were $45 million and $66 million at December 31, 2012 and 2011, respectively.

112 MetLife, Inc.