MetLife 2012 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

See Note 3 for a discussion of branch restructuring in accordance with the Closing Agreement. As of the ALICO Acquisition Date, the Company had

established a valuation allowance of $671 million against the amount of U.S. deferred tax assets that was expected to reverse post-branch restructuring

of American Life. As of November 1, 2011 the Company finalized American Life’s current and deferred income tax liabilities based upon the

determination of the amount of taxes resulting from the Section 338 Election and the corresponding filing of the income tax return. Accordingly,

American Life’s current income tax receivable was increased by $12 million and deferred tax assets were reduced by $2 million with a corresponding

net decrease to goodwill. The Company also increased the valuation allowance recorded against U.S. deferred tax assets to $720 million. The increase

in the valuation allowance of $49 million, with a corresponding increase to goodwill, was a result of changes in estimates and assumptions relating to

the reversal of U.S. temporary differences prior to the completion of the anticipated restructuring of American Life’s foreign branches and filing of the

income tax return. See Note 23.

In accordance with the Closing Agreement, during 2012, the Company completed certain aspects of its plan to transfer foreign branch assets to

various MetLife foreign subsidiaries:

‰The Company transferred the business of the Japan branch to a newly formed wholly-owned subsidiary in Japan, MetLife Alico Life Insurance K.

K. (“MLKK”);

‰The Company transferred the remaining business of the U.K. branch to other wholly-owned subsidiaries; and

‰The Company converted the Greek branch to a wholly-owned subsidiary incorporated in Greece.

These completed transactions represent over 90% of the planned restructurings based on branch net equity. Furthermore, the Company expects to

complete its restructuring for the remaining branches in 2013.

As a result of these asset transfers and the filing of various foreign branch and U.S. income tax returns, the Company revised the estimate of the

valuation allowance required for U.S. deferred tax assets relating to the ongoing restructuring of American Life’s non-U.S. branches. The net reduction in

the valuation allowance was primarily due to the following factors:

‰Additional U.S. deferred tax assets that more likely than not will not be realizable;

‰Additional tax basis in assets as a result of the gain recognized related to the branch restructuring that more likely than not will not be realizable;

and

‰A reduction in both the gross deferred tax asset and the valuation allowance related to the completion of the Company’s transfer of the Japan,

U.K. and Greek branch businesses to wholly-owned subsidiaries.

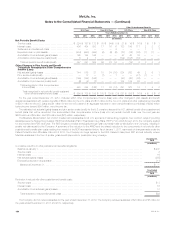

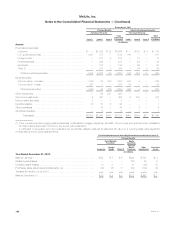

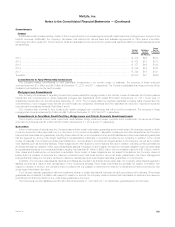

The following table provides a rollforward of the deferred tax asset valuation allowance associated with the branch restructuring:

Year Ended December 31, 2012

Japan U.K. Greece

Other

Non-U.S.

Branches Total

(In millions)

Balance, January 1, ...................................................... $566 $ 3 $128 $ 23 $ 720

Income tax expense (benefit) ............................................. (1) 55 (34) 12 32

Deferred income tax expense (benefit) related to unrealized investment gains

(losses) ............................................................ 320 (11) (50) (10) 249

Offsetting reduction in gross deferred tax asset related to the branch transfer to

subsidiary .......................................................... (885) (47) (44) — (976)

Balance, December 31, ................................................... $ — $— $ — $25 $ 25

During 2012, after conversion of the Japan branch to a subsidiary, MLKK recorded a deferred tax benefit along with a reduction in deferred tax

liabilities for investments in the amount of $324 million.

The Company also has recorded a valuation allowance increase related to tax expense of $8 million related to certain foreign capital loss

carryforwards, and decreases of $25 million related to certain state and foreign net operating loss carryforwards, and $3 million related to certain other

assets. The valuation allowance reflects management’s assessment, based on available information, that it is more likely than not that the deferred

income tax asset for certain foreign net operating and capital loss carryforwards, certain state net operating loss carryforwards, certain foreign unrealized

losses and certain foreign other assets will not be realized. The tax benefit will be recognized when management believes that it is more likely than not

that these deferred income tax assets are realizable. The aforementioned amounts related to capital loss carryforwards and net operating loss

carryforwards impact the consolidated statement of operations. If these losses continue to change thus increasing or decreasing deferred tax assets,

the associated valuation allowance will increase or decrease accordingly. The Company does not expect future amounts to be materially different.

The Company has not provided U.S. deferred taxes on cumulative earnings of certain non-U.S. affiliates and associated companies that have been

reinvested indefinitely. These earnings relate to ongoing operations and have been reinvested in active non-U.S. business operations. The Company

does not intend to repatriate these earnings to fund U.S. operations. Deferred taxes are provided for earnings of non-U.S. affiliates and associated

companies when the Company plans to remit those earnings. At December 31, 2012, the Company had not made a provision for U.S. taxes on

approximately $2.4 billion of the excess of the amount for financial reporting over the tax basis of investments in foreign subsidiaries that are essentially

permanent in duration. It is not practicable to estimate the amount of deferred tax liability related to investments in these foreign subsidiaries.

The Company files income tax returns with the U.S. federal government and various state and local jurisdictions, as well as foreign jurisdictions. The

Company is under continuous examination by the IRS and other tax authorities in jurisdictions in which the Company has significant business

operations. The income tax years under examination vary by jurisdiction and subsidiary. The Company is no longer subject to U.S. federal, state and

local, or foreign income tax examinations in major taxing jurisdictions for years prior to 2003, except for 2000 through 2002 where the IRS has

disallowed certain tax credits claimed and the Company continues to protest. The IRS audit cycle for the years 2003 through 2006, which began in April

2010, is expected to conclude in 2013.

The Company’s liability for unrecognized tax benefits may increase or decrease in the next 12 months. A reasonable estimate of the increase or

decrease cannot be made at this time. However, the Company continues to believe that the ultimate resolution of the pending issues will not result in a

194 MetLife, Inc.