MetLife 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

Effective January 1, 2010, the Company adopted guidance related to financial instrument transfers and consolidation of VIEs. The financial

instrument transfer guidance eliminates the concept of a qualified special purpose entity (“QSPE”), eliminates the guaranteed mortgage securitization

exception, changes the criteria for achieving sale accounting when transferring a financial asset and changes the initial recognition of retained beneficial

interests. The revised consolidation guidance changed the definition of the primary beneficiary, as well as the method of determining whether an entity is

a primary beneficiary of a VIE from a quantitative model to a qualitative model. Under the qualitative VIE consolidation model, the entity that has both the

ability to direct the most significant activities of the VIE and the obligation to absorb losses or receive benefits that could potentially be significant to the

VIE is considered to be the primary beneficiary. The guidance requires a continuous reassessment, as well as enhanced disclosures, including the

effects of a company’s involvement with VIEs on its financial statements.

As a result of the adoption of the amended VIE consolidation guidance, the Company consolidated certain former QSPEs that were previously

accounted for as fixed maturity commercial mortgage-backed securities (“CMBS”) and equity security collateralized debt obligations. The Company also

elected FVO for all of the consolidated assets and liabilities of these entities. Upon consolidation, the Company recorded $278 million of securities

classified as FVO and trading securities, $6.8 billion of commercial mortgage loans and $6.8 billion of long-term debt based on estimated fair values at

January 1, 2010 and de-recognized $179 million in fixed maturity securities and less than $1 million in equity securities. The consolidation also resulted

in a decrease in retained earnings of $12 million, net of income tax, and an increase in AOCI of $42 million, net of income tax, at January 1, 2010. For

the year ended December 31, 2010, the Company recorded $426 million of net investment income on the consolidated assets, $411 million of interest

expense in other expenses on the related long-term debt, and $6 million in net investment gains (losses) to remeasure the assets and liabilities at their

estimated fair values.

Future Adoption of New Accounting Pronouncements

In January 2013, the FASB issued new guidance regarding comprehensive income (Accounting Standards Update (“ASU”) 2013-02,

Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income), effective prospectively for

fiscal years beginning after December 15, 2012. The amendments require an entity to provide information about the amounts reclassified out of AOCI

by component. In addition, an entity is required to present, either on the face of the statement where net income is presented or in the notes, significant

amounts reclassified out of AOCI by the respective line items of net income but only if the amount reclassified is required under GAAP to be reclassified

to net income in its entirety in the same reporting period. For other amounts that are not required under GAAP to be reclassified in their entirety to net

income, an entity is required to cross-reference to other disclosures required under GAAP that provide additional detail about those amounts. The

Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In January 2013, the FASB issued new guidance regarding balance sheet offsetting disclosures (ASU 2013-01, Balance Sheet (Topic 210):

Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities (“ASU 2013-01”)), effective for fiscal years and interim periods within those

years beginning on or after January 1, 2013. The amendments in ASU 2013-01 clarify that the scope of ASU 2011-11 (as defined below), applies to

derivatives, including bifurcated embedded derivatives, repurchase and reverse repurchase agreements, and securities borrowing and lending

transactions. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In December 2011, the FASB issued new guidance regarding balance sheet offsetting disclosures (ASU 2011-11, Balance Sheet (Topic 210):

Disclosures about Offsetting Assets and Liabilities (“ASU 2011-11”)),effective for annual reporting periods beginning on or after January 1, 2013, and

interim periods within those annual periods. The guidance will be applied retrospectively for all comparative periods presented. The guidance requires an

entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effects of those

arrangements on its financial position. Entities are required to disclose both gross information and net information about both instruments and

transactions eligible for offset in the statement of financial position and instruments and transactions subject to an agreement similar to a master netting

arrangement. The objective of the guidance is to facilitate comparison between those entities that prepare their financial statements on the basis of

GAAP and those entities that prepare their financial statements on the basis of International Financial Reporting Standards. The Company is currently

evaluating the impact of this guidance on its consolidated financial statements and related disclosures.

In July 2011, the FASB issued new guidance on other expenses (ASU 2011-06, Other Expenses (Topic 720): Fees Paid to the Federal Government

by Health Insurers), effective for calendar years beginning after December 31, 2013. The objective of this standard is to address how health insurers

should recognize and classify in their income statements fees mandated by the Patient Protection and Affordable Care Act, as amended by the Health

Care and Education Reconciliation Act. The amendments in this standard specify that the liability for the fee should be estimated and recorded in full

once the entity provides qualifying health insurance in the applicable calendar year in which the fee is payable with a corresponding deferred cost that is

amortized to expense using the straight-line method of allocation unless another method better allocates the fee over the calendar year that it is payable.

The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

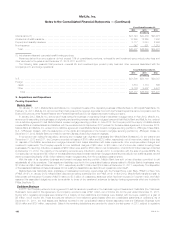

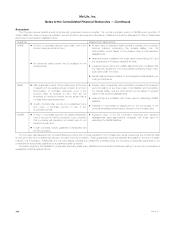

2. Segment Information

MetLife is organized into six segments, reflecting three broad geographic regions: Retail; Group, Voluntary & Worksite Benefits; Corporate Benefit

Funding; and Latin America (collectively, the “Americas”); Asia; and EMEA.

Americas

The Americas consists of the following segments:

Retail

The Retail segment offers a broad range of protection products and services and a variety of annuities to individuals and employees of corporations

and other institutions, and is organized into two businesses: Life & Other and Annuities. Life & Other insurance products and services include variable

life, universal life, term life and whole life products. Additionally, through broker-dealer affiliates, the Company offers a full range of mutual funds and other

securities products. Life & Other products and services also include individual disability income products and personal lines property & casualty

insurance, including private passenger automobile, homeowners and personal excess liability insurance. Annuities include a variety of variable and fixed

annuities which provide for both asset accumulation and asset distribution needs.

MetLife, Inc. 95