MetLife 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

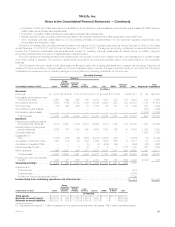

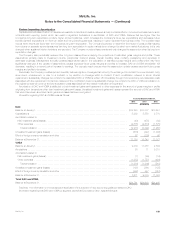

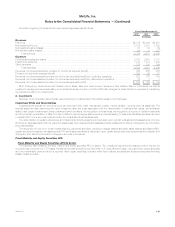

December 31,

2012 2011

(In millions)

FHLB of NY ................................................................................................. $736 $658

FHLB of Des Moines .......................................................................................... $ 83 $ 51

FHLB of Boston .............................................................................................. $ 67 $ 70

FHLB of Pittsburgh ........................................................................................... $ 14 N/A

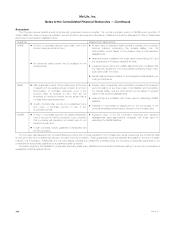

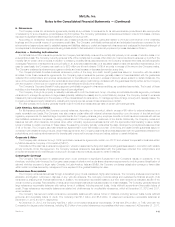

Such subsidiaries have also entered into funding agreements. The liability for funding agreements is included in PABs. Information related to the

funding agreements was as follows at:

Liability Collateral

December 31,

2012 2011 2012 2011

(In millions)

FHLB of NY(1) ...................................................................... $13,512 $11,655 $14,611 (2) $13,002 (2)

Farmer Mac(3) ...................................................................... $ 2,750 $ 2,750 $ 3,159 $ 3,157

FHLB of Des Moines(1) ............................................................... $ 1,405 $ 695 $ 1,902 (2) $ 953 (2)

FHLB of Boston(1) ................................................................... $ 450 $ 450 $ 537(2)$ 518(2)

FHLB of Pittsburgh ................................................................... $ — N/A $ 810(2) N/A

(1) Represents funding agreements issued to the FHLB in exchange for cash and for which the FHLB has been granted a lien on certain assets, some

of which are in the custody of the FHLB, including residential mortgage-backed securities (“RMBS”), to collateralize obligations under advances

evidenced by funding agreements. The Company is permitted to withdraw any portion of the collateral in the custody of the FHLB as long as there

is no event of default and the remaining qualified collateral is sufficient to satisfy the collateral maintenance level. Upon any event of default by the

Company, the FHLB’s recovery on the collateral is limited to the amount of the Company’s liability to the FHLB.

(2) Advances are collateralized by mortgage-backed securities. The amount of collateral presented is at estimated fair value.

(3) Represents funding agreements issued to certain SPEs that have issued debt securities for which payment of interest and principal is secured by

such funding agreements, and such debt securities are also guaranteed as to payment of interest and principal by the Federal Agricultural

Mortgage Corporation, a federally chartered instrumentality of the U.S. (“Farmer Mac”). The obligations under these funding agreements are

secured by a pledge of certain eligible agricultural real estate mortgage loans and may, under certain circumstances, be secured by other qualified

collateral. The amount of collateral presented is at carrying value.

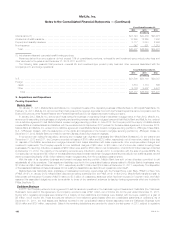

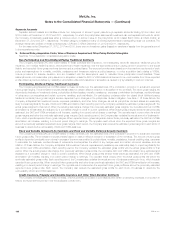

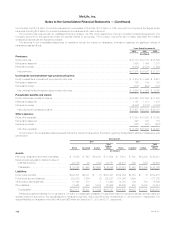

Liabilities for Unpaid Claims and Claim Expenses

Information regarding the liabilities for unpaid claims and claim expenses relating to property and casualty, group accident and non-medical health

policies and contracts, which are reported in future policy benefits and other policy-related balances, was as follows:

Years Ended December 31,

2012 2011 2010

(In millions)

Balance at January 1, ........................................................................... $10,117 $10,708 $ 8,219

Less: Reinsurance recoverables ................................................................. 1,436 2,198 547

Net balance at January 1, ....................................................................... 8,681 8,510 7,672

Acquisitions, net ............................................................................... — — 583

Incurred related to:

Current year ................................................................................ 8,399 9,028 6,482

Prior years .................................................................................. (69) (199) (75)

Total incurred ............................................................................. 8,330 8,829 6,407

Paid related to:

Current year ................................................................................ (5,689) (6,238) (4,050)

Prior years .................................................................................. (2,467) (2,420) (2,102)

Total paid ................................................................................ (8,156) (8,658) (6,152)

Net balance at December 31, .................................................................... 8,855 8,681 8,510

Add: Reinsurance recoverables ................................................................. 1,581 1,436 2,198

Balance at December 31, ....................................................................... $10,436 $10,117 $10,708

During 2012, 2011 and 2010, as a result of changes in estimates of insured events in the respective prior year, claims and claim adjustment

expenses associated with prior years decreased by $69 million, $199 million and $75 million, respectively, due to a reduction in prior year automobile

bodily injury and homeowners’ severity and improved loss ratio for non-medical health claim liabilities.

MetLife, Inc. 107