MetLife 2012 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

See “— Variable Interest Entities” for discussion of CSEs included in the table above.

Gains (losses) from foreign currency transactions included within net investment gains (losses) were ($112) million, $37 million and $230 million for

the years ended December 31, 2012, 2011 and 2010, respectively.

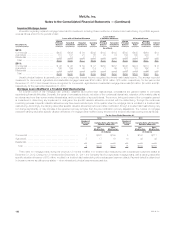

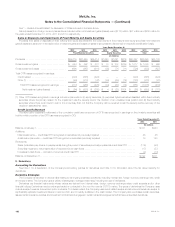

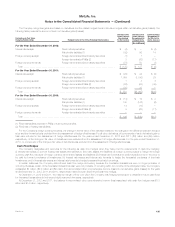

Sales or Disposals and Impairments of Fixed Maturity and Equity Securities

Proceeds from sales or disposals of fixed maturity and equity securities and the components of fixed maturity and equity securities net investment

gains (losses) are as shown in the table below. Investment gains and losses on sales of securities are determined on a specific identification basis.

Years Ended December 31,

2012 2011 2010 2012 2011 2010 2012 2011 2010

Fixed Maturity Securities Equity Securities Total

(In millions)

Proceeds ................................. $59,219 $67,449 $54,514 $1,648 $1,241 $616 $60,867 $68,690 $55,130

Gross investment gains ...................... $ 944 $ 892 $ 831 $ 73 $ 108 $129 $ 1,017 $ 1,000 $ 960

Gross investment losses ..................... (691) (867) (616) (35) (71) (11) (726) (938) (627)

Total OTTI losses recognized in earnings:

Credit-related ............................ (223) (645) (423) — — — (223) (645) (423)

Other (1) ................................ (94) (310) (47) (34) (60) (14) (128) (370) (61)

Total OTTI losses recognized in earnings ..... (317) (955) (470) (34) (60) (14) (351) (1,015) (484)

Net investment gains (losses) ............ $ (64) $ (930) $ (255) $ 4 $ (23) $104 $ (60) $ (953) $ (151)

(1) Other OTTI losses recognized in earnings include impairments on (i) equity securities, (ii) perpetual hybrid securities classified within fixed maturity

securities where the primary reason for the impairment was the severity and/or the duration of an unrealized loss position and (iii) fixed maturity

securities where there is an intent to sell or it is more likely than not that the Company will be required to sell the security before recovery of the

decline in estimated fair value.

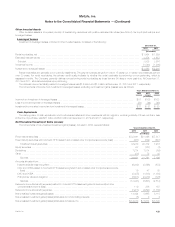

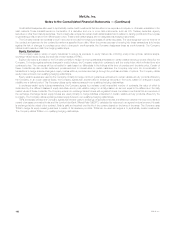

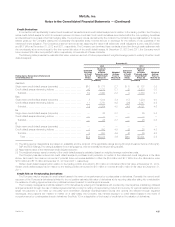

Credit Loss Rollforward

The table below presents a rollforward of the cumulative credit loss component of OTTI loss recognized in earnings on fixed maturity securities still

held for which a portion of the OTTI loss was recognized in OCI:

Years Ended December 31,

2012 2011

(In millions)

Balance, at January 1, ................................................................................. $471 $443

Additions:

Initial impairments — credit loss OTTI recognized on securities not previously impaired ............................. 46 45

Additional impairments — credit loss OTTI recognized on securities previously impaired ............................ 70 143

Reductions:

Sales (maturities, pay downs or prepayments) during the period of securities previously impaired as credit loss OTTI ...... (176) (90)

Securities impaired to net present value of expected future cash flows .......................................... (17) (57)

Increases in cash flows — accretion of previous credit loss OTTI .............................................. (2) (13)

Balance, at December 31, .............................................................................. $392 $471

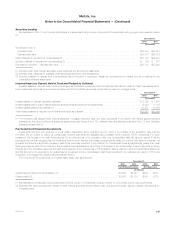

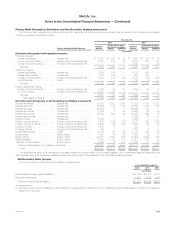

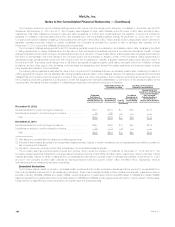

9. Derivatives

Accounting for Derivatives

See Note 1 for a description of the Company’s accounting policies for derivatives and Note 10 for information about the fair value hierarchy for

derivatives.

Derivative Strategies

The Company is exposed to various risks relating to its ongoing business operations, including interest rate, foreign currency exchange rate, credit

and equity market. The Company uses a variety of strategies to manage these risks, including the use of derivatives.

Derivatives are financial instruments whose values are derived from interest rates, foreign currency exchange rates, credit spreads and/or other

financial indices. Derivatives may be exchange-traded or contracted in the over-the-counter (“OTC”) market. The types of derivatives the Company uses

include swaps, forwards, futures and option contracts. To a lesser extent, the Company uses credit default swaps and structured interest rate swaps to

synthetically replicate investment risks and returns which are not readily available in the cash market. The Company also purchases certain securities,

issues certain insurance policies and investment contracts and engages in certain reinsurance agreements that have embedded derivatives.

130 MetLife, Inc.