MetLife 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

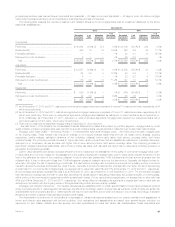

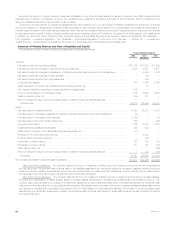

Credit Risk. See Note 9 of the Notes to Consolidated Financial Statements for information about how we manage credit risk related to its

freestanding derivatives, including the use of master netting agreements and collateral arrangements.

Our policy is not to offset the fair value amounts recognized for derivatives executed with the same counterparty under the same master netting

agreement. This policy applies to the recognition of derivatives in the consolidated balance sheets, and does not affect our legal right of offset. The

estimated fair value of our net derivative assets and net derivative liabilities after the application of master netting agreements and collateral were as

follows at December 31, 2012:

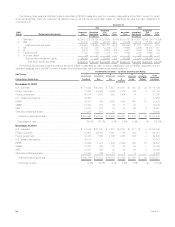

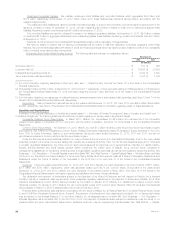

December 31, 2012

Net Derivative

Assets Net Derivative

Liabilities

(In millions)

Estimated Fair Value of OTC Derivatives After Application of Master Netting Agreements(1) ......... $9,486 $ 918

Cash collateral on OTC Derivatives .................................................... (5,960) (1)

Estimated Fair Value of OTC Derivatives After Application of Master Netting Agreements and Cash

Collateral(1) ..................................................................... 3,526 917

Securities Collateral on OTC Derivatives(2) .............................................. (3,687) (875)

Estimated Fair Value of OTC Derivatives After Application of Master Netting Agreements and Cash

and Securities Collateral(1) ......................................................... (161) 42

Estimated Fair Value of Exchange-Traded Derivatives ...................................... — 151

Total Estimated Fair Value of Derivatives After Application of Master Netting Agreements and Cash

and Securities Collateral(1), (3) ..................................................... $ (161) $193

(1) Includes income accruals on derivatives.

(2) The collateral is held in separate custodial accounts and is not recorded on our consolidated balance sheets.

(3) The negative asset value is due to the customary delay in the timing of collateral movements.

Credit Derivatives. See Note 9 of the Notes to Consolidated Financial Statements for information about the estimated fair value and maximum

amount at risk related to our written credit default swaps.

Embedded Derivatives. See Note 10 of the Notes to the Consolidated Financial Statements for information about embedded derivatives measured

at estimated fair value on a recurring basis and their corresponding fair value hierarchy.

See Note 10 of the Notes to the Consolidated Financial Statements for a rollforward of the fair value measurements for net embedded derivatives

measured at estimated fair value on a recurring basis using significant unobservable (Level 3) inputs.

See Note 9 of the Notes to the Consolidated Financial Statements for information about the nonperformance risk adjustment included in the

valuation of guaranteed minimum benefits accounted for as embedded derivatives.

See “— Summary of Critical Accounting Estimates — Derivatives” for further information on the estimates and assumptions that affect embedded

derivatives.

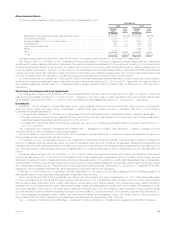

Off-Balance Sheet Arrangements

Credit and Committed Facilities

We maintain unsecured credit facilities and committed facilities with various financial institutions. See “— Liquidity and Capital Resources — The

Company — Liquidity and Capital Sources — Credit and Committed Facilities” for further descriptions of such arrangements.

Collateral for Securities Lending, Repurchase Program and Derivatives

We participate in a securities lending program in the normal course of business for the purpose of enhancing the total return on our investment

portfolio. We have non-cash collateral for securities lending from counterparties on deposit from customers, which cannot be sold or repledged, and

which has not been recorded on our consolidated balance sheets. The amount of this collateral was $104 million and $371 million at estimated fair

value at December 31, 2012 and 2011, respectively. See “— Investments — Securities Lending” and “Securities Lending” in Note 1 of the Notes to the

Consolidated Financial Statements for discussion of our securities lending program and the classification of revenues and expenses and the nature of

the secured financing arrangement and associated liability.

We also participate in a third-party custodian administered repurchase program for the purpose of enhancing the total return on our investment

portfolio. We loan certain of our fixed maturity securities to financial institutions and, in exchange, non-cash collateral is put on deposit by the financial

institutions on our behalf with the third-party custodian. The estimated fair value of securities loaned in connection with these transactions was $729

million and $506 million at December 31, 2012 and 2011, respectively. Non-cash collateral on deposit with the third-party custodian on our behalf was

$785 million and $551 million at December 31, 2012 and 2011, respectively, which cannot be sold or repledged, and which has not been recorded on

our consolidated balance sheets.

We enter into derivatives to manage various risks relating to our ongoing business operations. We have non-cash collateral from counterparties for

derivatives, which can be sold or repledged subject to certain constraints, and which has not been recorded on our consolidated balance sheets. The

amount of this collateral was $3.7 billion and $2.5 billion at December 31, 2012 and 2011, respectively. See “— Liquidity and Capital Resources —

The Company — Liquidity and Capital Uses — Pledged Collateral” and “Derivatives” in Note 9 of the Notes to the Consolidated Financial Statements for

information on the earned income on and the gross notional amount, estimated fair value of assets and liabilities and primary underlying risk exposureof

our derivatives.

Lease Commitments

As lessee, we have entered into various lease and sublease agreements for office space, information technology and other equipment. Our

commitments under such lease agreements are included within the contractual obligations table. See “— Liquidity and Capital Resources — The

Company — Contractual Obligations” and Note 21 of the Notes to the Consolidated Financial Statements.

Guarantees

See “Guarantees” in Note 21 of the Notes to the Consolidated Financial Statements.

48 MetLife, Inc.