MetLife 2012 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

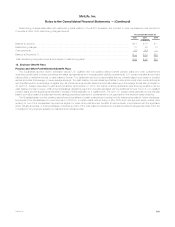

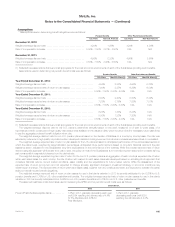

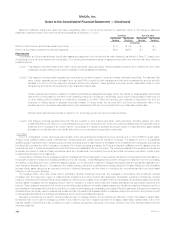

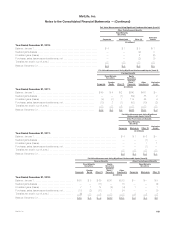

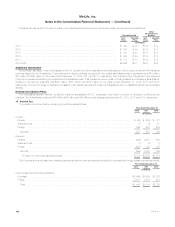

December 31, 2011

Pension Benefits Other Postretirement Benefits

Fair Value Hierarchy Fair Value Hierarchy

Level 1 Level 2 Level 3

Total

Estimated

Fair Value Level 1 Level 2 Level 3

Total

Estimated

Fair Value

(In millions)

Assets:

Fixed maturity securities:

Foreign bonds .......................................... $— $ 96 $— $ 96 $— $13 $— $13

Equity securities:

Common stock - foreign .................................. — 43 — 43 — — — —

Other investments ......................................... 19 — — 19 — — — —

Derivative assets .......................................... — — 13 13 — — — —

Real estate ............................................... — — 8 8 — — — —

Short-term investments ..................................... — 6 — 6 — — — —

Total assets ........................................

$19 $145 $21 $185

$—

$13

$—

$13

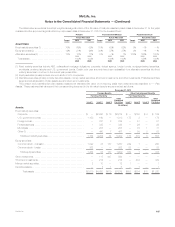

A rollforward of all pension benefit plan assets measured at estimated fair value on a recurring basis using significant unobservable (Level 3) inputs

was as follows:

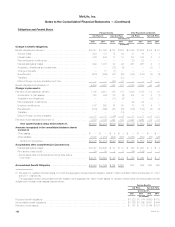

Fair Value Measurements Using Significant Unobservable Inputs (Level 3)

Pension Benefits

Years Ended December 31,

2012 2011 2010

Derivative

Assets Real

Estate Derivative

Assets Real

Estate Derivative

Assets (1) Real

Estate (1)

(In millions)

Balance, January 1, .................................................. $13 $ 8 $11 $ 8 $— $—

Realized gains (losses) ............................................... (1) (1) — — 3 —

Unrealized gains (losses) .............................................. 1 — 2 — (3) —

Purchases, sales, issuances, and settlements, net ......................... ———— (1)—

Transfers into and/or out of Level 3 ...................................... ————12 8

Balance, December 31, .............................................. $13 $ 7 $13 $ 8 $11 $ 8

(1) Derivative assets and real estate transfers into Level 3 are due to the ALICO Acquisition and are not related to the changes in Level 3 classificationat

the security level.

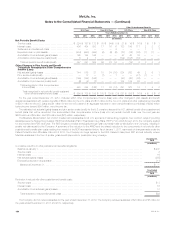

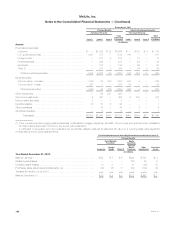

Expected Future Contributions and Benefit Payments

It is the Subsidiaries’ practice to make contributions to the U.S. qualified pension plan to comply with minimum funding requirements of ERISA. In

accordance with such practice, no contributions are required for 2013. The Subsidiaries expect to make discretionary contributions to the qualified

pension plan of $233 million in 2013. For information on employer contributions, see “— Obligations and Funded Status.”

Benefit payments due under the U.S. non-qualified pension plans are primarily funded from the Subsidiaries’ general assets as they become due

under the provision of the plans, therefore benefit payments equal employer contributions. The U.S. Subsidiaries expect to make contributions of $61

million to fund the benefit payments in 2013.

U.S. and non-U.S. postretirement benefits are either: (i) not vested under law; (ii) a non-funded obligation of the Subsidiaries; or (iii) both. Current

regulations do not require funding for these benefits. The Subsidiaries use their general assets, net of participant’s contributions, to pay postretirement

medical claims as they come due in lieu of utilizing any plan assets. The U.S. Subsidiaries expect to make contributions of $78 million towards benefit

obligations in 2013 to pay postretirement medical claims.

As noted previously, the Subsidiaries no longer expect to receive the RDS under the Medicare Modernization Act of 2003 to partially offset payment

of such benefits. Instead, the gross benefit payments that will be made under the PDP will already reflect subsidies.

MetLife, Inc. 191