MetLife 2012 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)

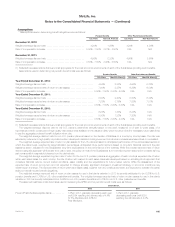

the manner prescribed by the NAIC (“TAC”) to its authorized control level RBC, calculated in the manner prescribed by the NAIC (“ACL RBC”).

Companies below specific trigger points or ratios are classified within certain levels, each of which requires specified corrective action. The minimum

level of TAC before corrective action commences is twice ACL RBC (“Company Action RBC”). While not required by or filed with insurance regulators,

the Company also calculates an internally defined combined RBC ratio (“Combined RBC Ratio”), which is determined by dividing the sum of TAC for

MetLife, Inc.’s principal U.S. insurance subsidiaries, excluding American Life, by the sum of Company Action RBC for such subsidiaries. The Company’s

Combined RBC Ratio was in excess of 400% for all periods presented. In addition, all non-exempted U.S. insurance subsidiaries individually exceeded

Company Action RBC for all periods presented.

MetLife, Inc.’s foreign operations are regulated by applicable authorities of the countries in which each entity operates and are subject to minimum

capital and solvency requirements in those countries before corrective action commences. At December 31, 2012 and 2011, the adjusted capital of

American Life’s insurance subsidiary in Japan, the Company’s largest foreign operation, was in excess of four times the 200% solvency margin ratio that

would require corrective action. Excluding Japan, the aggregate required capital and surplus of the Company’s other foreign insurance operations was

$2.3 billion and the aggregate actual regulatory capital and surplus of such operations was $7.8 billion as of the date of the most recent required capital

adequacy calculation for each jurisdiction. Each of those other foreign insurance operations exceeded minimum capital and solvency requirements of

their respective countries for all periods presented.

MetLife, Inc.’s insurance subsidiaries prepare statutory-basis financial statements in accordance with statutory accounting practices prescribed or

permitted by the insurance department of the state of domicile or applicable foreign jurisdiction. The NAIC has adopted the Codification of Statutory

Accounting Principles (“Statutory Codification”). Statutory Codification is intended to standardize regulatory accounting and reporting to state insurance

departments. However, statutory accounting principles continue to be established by individual state laws and permitted practices. Modifications by the

various state insurance departments may impact the effect of Statutory Codification on the statutory capital and surplus of MetLife, Inc.’s U.S. insurance

subsidiaries.

Statutory accounting principles differ from GAAP primarily by charging policy acquisition costs to expense as incurred, establishing future policy

benefit liabilities using different actuarial assumptions, reporting surplus notes as surplus instead of debt and valuing securities on a different basis.

In addition, certain assets are not admitted under statutory accounting principles and are charged directly to surplus. The most significant assets not

admitted by the Company are net deferred income tax assets resulting from temporary differences between statutory accounting principles basis and

tax basis not expected to reverse and become recoverable within three years. Further, statutory accounting principles do not give recognition to

purchase accounting adjustments.

MetLife, Inc.’s U.S. insurance subsidiaries have no material state prescribed accounting practices, except for American Life. American Life calculates

its policyholder reserves on insurance written in each foreign jurisdiction in accordance with the reserve standards required by such jurisdiction.

American Life is not required to quantify the impact to its statutory capital and surplus as a result of applying this prescribed practice to its branch

operations. Additionally, American Life’s insurance subsidiaries are valued based on each respective subsidiary’s underlying local statutory equity,

adjusted in a manner consistent with the reporting prescribed for its branch operations, which resulted in higher statutory capital and surplus of $413

million and $597 million for the years ended December 31, 2012 and 2011, respectively.

The tables below present amounts from MetLife, Inc.’s primary insurance subsidiaries, which are derived from the statutory–basis financial

statements as filed with the insurance regulators.

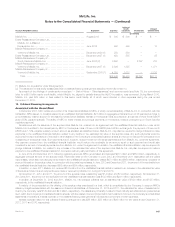

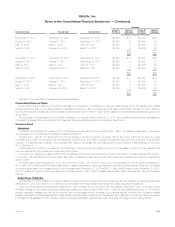

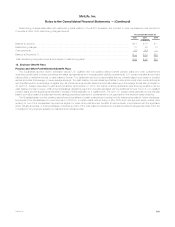

Statutory net income (loss) was as follows:

Years Ended December 31,

Company State of Domicile 2012 2011 2010

(In millions)

Metropolitan Life Insurance Company ........................................... NewYork $ 1,320 $ 1,970 $ 2,066

American Life Insurance Company ............................................. Delaware $ 317 $ 334 $ 803

MetLife Insurance Company of Connecticut ...................................... Connecticut $ 848 $ 46 $ 668

Metropolitan Property and Casualty Insurance Company ............................ Rhode Island $ 235 $ 41 $ 273

Metropolitan Tower Life Insurance Company ..................................... Delaware $ 61 $ 63 $ 151

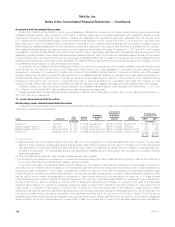

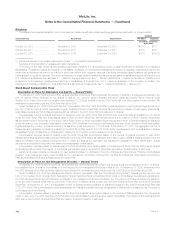

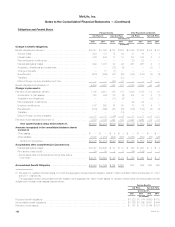

Statutory capital and surplus was as follows at:

December 31,

Company 2012 2011

(In millions)

Metropolitan Life Insurance Company ...................................................................... $ 14,295 $ 13,507

American Life Insurance Company ........................................................................ $ 3,044 $ 3,310

MetLife Insurance Company of Connecticut ................................................................. $ 5,331 $ 5,133

Metropolitan Property and Casualty Insurance Company ....................................................... $ 1,987 $ 1,857

Metropolitan Tower Life Insurance Company ................................................................ $ 781 $ 828

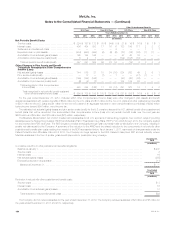

As derived from the most recent annual statutory basis financial statements filed with insurance regulators, the aggregate statutory net income and

aggregate statutory capital and surplus of the Company’s foreign insurance subsidiaries not owned directly or indirectly by the Company’s primary

insurance subsidiaries set forth in the table above was $679 million and $4.7 billion, respectively.

The Company’s domestic captive life reinsurance subsidiaries, which reinsure risks including the closed block, level premium term life and universal

life with secondary guarantees assumed from other Metlife subsidiaries, have no material state prescribed accounting practices, except for MetLife

Reinsurance Company of Vermont (“MRV”). MRV, with the explicit permission of the Commissioner of Insurance of the State of Vermont, has included,

as admitted assets, the value of letters of credit serving as collateral for reinsurance credit taken by various affiliated cedants, in connection with

reinsurance agreements entered into between MRV and the various affiliated cedants, which resulted in higher statutory capital and surplus of $5.1

176 MetLife, Inc.