MetLife 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

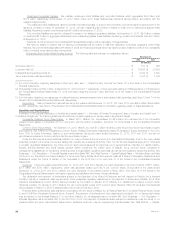

See “Risk Factors — Capital-Related Risks — We Have Been, and May Continue to be, Prevented from Repurchasing Our Stock and Paying

Dividends at the Level We Wish as a Result of Regulatory Restrictions and Restrictions Under the Terms of Certain of Our Securities” in the Form 10-K

and Note 16 of the Notes to the Consolidated Financial Statements for information regarding restrictions on payment of dividends and stock

repurchases.

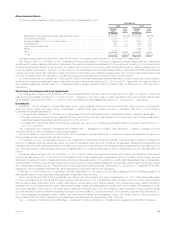

The Company

Liquidity

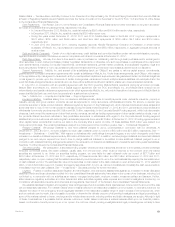

Liquidity refers to a company’s ability to generate adequate amounts of cash to meet its needs. We determine our liquidity needs based on a rolling

six-month forecast by portfolio of invested assets which we monitor daily. We adjust the asset mix and asset maturities based on this forecast. To

support this forecast, we conduct cash flow and stress testing, which include various scenarios of the potential risk of early contractholder and

policyholder withdrawal. We include provisions limiting withdrawal rights on many of our products, including general account pension products soldto

employee benefit plan sponsors. Certain of these provisions prevent the customer from making withdrawals prior to the maturity date of the product. In

the event of significant cash requirements beyond anticipated liquidity needs, we have various alternatives available depending on market conditions and

the amount and timing of the liquidity need. These options include cash flows from operations, the sale of liquid assets, global funding sources and

various credit facilities.

Under certain stressful market and economic conditions, our access to liquidity may deteriorate, or the cost to access liquidity may increase. If we

require significant amounts of cash on short notice in excess of anticipated cash requirements or if we are required to post or return cash collateral in

connection with derivatives or our securities lending program, we may have difficulty selling investment assets in a timely manner, be forced to sell them

for less than we otherwise would have been able to realize, or both. In addition, in the event of such forced sale, accounting guidance requires the

recognition of a loss for certain securities in an unrealized loss position and may require the impairment of other securities if there is a need to sell such

securities, which may negatively impact our financial condition. See “Risk Factors — Investment-Related Risks — Should the Need Arise, We May Have

Difficulty Selling Certain Holdings in Our Investment Portfolio or Our Securities Lending Program in a Timely Manner and Realizing Full Value Given Their

Illiquid Nature” in the 2012 Form 10-K.

In extreme circumstances, all general account assets within a particular legal entity — other than those which may have been pledged to a specific

purpose — are available to fund obligations of the general account of that legal entity.

Capital

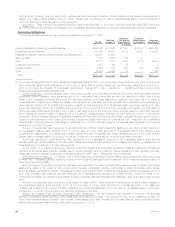

We manage our capital position to maintain our financial strength and credit ratings. Our capital position is supported by our ability to generate strong

cash flows within our operating companies and borrow funds at competitive rates, as well as by our demonstrated ability to raise additional capital to

meet operating and growth needs despite adverse market and economic conditions.

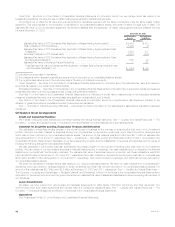

Rating Agencies. Rating agencies assign insurer financial strength ratings to MetLife, Inc.’s domestic life insurance subsidiaries and credit

ratings to MetLife, Inc. and certain of its subsidiaries. Financial strength ratings indicate the rating agency’s opinion regarding an insurance

company’s ability to meet contractholder and policyholder obligations. Credit ratings indicate the rating agency’s opinion regarding a debt issuer’s

ability to meet the terms of debt obligations in a timely manner. They are important factors in our overall funding profile and ability to access certain

types of liquidity. The level and composition of regulatory capital at the subsidiary level and our equity capital are among the many factors considered

in determining our insurer financial strength and credit ratings. Each agency has its own capital adequacy evaluation methodology, and assessments

are generally based on a combination of factors. In addition to heightening the level of scrutiny that they apply to insurance companies, rating

agencies have increased and may continue to increase the frequency and scope of their credit reviews, may request additional information from the

companies that they rate and may adjust upward the capital and other requirements employed in the rating agency models for maintenance of

certain ratings levels.

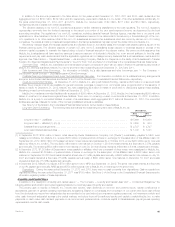

Downgrades in our financial strength ratings could have a material adverse effect on our financial condition and results of operations in many ways,

including:

‰reducing new sales of insurance products, annuities and other investment products;

‰adversely affecting our relationships with our sales force and independent sales intermediaries;

‰materially increasing the number or amount of policy surrenders and withdrawals by contractholders and policyholders;

‰requiring us to post additional collateral under certain of our financing transactions;

‰requiring us to reduce prices for many of our products and services to remain competitive; and

‰adversely affecting our ability to obtain reinsurance at reasonable prices or at all.

A downgrade in the credit or insurer financial strength ratings of MetLife, Inc. or its subsidiaries would likely (i) impact our ability to generate cash

flows from the sale of funding agreements and other capital market products offered by our Corporate Benefit Funding segment, (ii) impact the cost and

availability of financing for MetLife, Inc. and its subsidiaries and (iii) result in additional collateral requirements or other required payments under certain

agreements, which are eligible to be satisfied in cash or by posting securities held by the subsidiaries subject to the agreements. See “— Liquidity and

Capital Uses — Pledged Collateral.”

Statutory Capital and Dividends. Our insurance subsidiaries have statutory surplus well above levels to meet current regulatory requirements.

Except for American Life, risk-based capital (“RBC”) requirements are used as minimum capital requirements by the NAIC and the state insurance

departments to identify companies that merit regulatory action. RBC is based on a formula calculated by applying factors to various asset, premium and

statutory reserve items. The formula takes into account the risk characteristics of the insurer, including asset risk, insurance risk, interest rate risk and

business risk and is calculated on an annual basis. The formula is used as an early warning regulatory tool to identify possible inadequately capitalized

insurers for purposes of initiating regulatory action, and not as a means to rank insurers generally. These rules apply to each of our domestic insurance

subsidiaries. State insurance laws grant insurance regulators the authority to require various actions by, or take various actions against, insurers whose

total adjusted capital does not meet or exceed certain RBC levels. At the date of the most recent annual statutory financial statements filed with

insurance regulators, the total adjusted capital of each of these subsidiaries was in excess of each of those RBC levels.

MetLife, Inc. 55