Duke Energy 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

PART II

Energy Carolinas’ and Progress Energy Florida’s rates; therefore, fl uctuations

in equity prices do not affect their Consolidated Statements of Operations

as changes in the fair value of these investments are deferred as regulatory

assets or regulatory liabilities pursuant to an Order by the NCUC, PSCSC and

FPSC. Earnings or losses of the fund will ultimately impact the amount of

costs recovered through Duke Energy Carolinas’, Progress Energy Carolinas’

and Progress Energy Florida’s rates. See Note 9 to the Consolidated Financial

Statements, “Asset Retirement Obligations” for additional information regarding

nuclear decommissioning costs. See Note 17 to the Consolidated Financial

Statements, “Investments in Debt and Equity Securities” for additional

information regarding NTDF assets.

Foreign Currency Risk

Duke Energy is exposed to foreign currency risk from investments in

international businesses owned and operated in foreign countries and from

certain commodity-related transactions within domestic operations that are

denominated in foreign currencies. To mitigate risks associated with foreign

currency fl uctuations, contracts may be denominated in or indexed to the

U.S. Dollar/infl ation rates and/or local infl ation rates, or investments may be

naturally hedged through debt denominated or issued in the foreign currency.

Duke Energy may also use foreign currency derivatives, where possible, to

manage its risk related to foreign currency fl uctuations. To monitor its currency

exchange rate risks, Duke Energy uses sensitivity analysis, which measures the

impact of devaluation of the foreign currencies to which it has exposure.

In 2012, Duke Energy’s primary foreign currency rate exposure was to

the Brazilian Real. The table below summarizes the potential effect of foreign

currency devaluations on Duke Energy’s Consolidated Statement of Operations

and Consolidated Balance Sheets, based on a sensitivity analysis performed as

of December 31, 2012 and December 31, 2011.

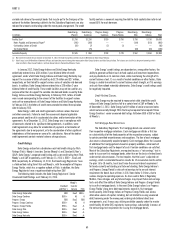

Summary of Sensitivity Analysis for Foreign Currency Risks

(in millions)

Assuming 10% devaluation in the currency

exchange rates in all exposure currencies

As of December 31,

2012

As of December 31,

2011

Income Statement impact(a) $ (20) $ (20)

Balance Sheet impact(b) $(150) $(160)

(a) Amounts represent the potential annual net pre-tax loss on the translation of local currency earnings to

the Consolidated Statement of Operations in 2012 and 2011, respectively.

(b) Amounts represent the potential impact to the currency translation through the cumulative translation

adjustment in Accumulated Other Comprehensive Income (AOCI) on the Consolidated Balance Sheets.

Other Issues

Fixed Charges Coverage Ratios

The Duke Energy Registrants’ fi xed charges coverage ratios, as calculated

using SEC guidelines, are included in the table below.

Years Ended December 31,

2012 2011 2010

Duke Energy 2.5

(a) 3.2 3.0

Duke Energy Carolinas 3.7 3.7 3.6

Progress Energy 1.6 2.1 2.6

Progress Energy Carolinas 2.2 4.2 5.1

Progress Energy Florida 2.3 2.8 3.4

Duke Energy Ohio 3.4 3.4 (b)

Duke Energy Indiana 0.1 2.2 3.6

(a) Includes the results of Progress Energy, Inc. beginning on July 2, 2012.

(b) Duke Energy Ohio’s earnings were insuffi cient to cover fi xed charges by $317 million in 2010 due

primarily to non-cash goodwill and other asset impairment charges of $677 million in 2010.

Global Climate Change

The EPA publishes an inventory of man-made U.S. greenhouse gas (GHG)

emissions annually. In 2010, the most recent year reported, carbon dioxide

(CO2), a byproduct of all sources of combustion, accounted for approximately

84 percent of total U.S. GHG emissions. The Duke Energy Registrants’ GHG

emissions consist primarily of CO2 and most come from its fl eet of coal-fi red

power plants in the U.S. In 2012, the Duke Energy Registrants’ U.S. power plants

emitted approximately 132 million tons of CO2. The CO2 emissions from Duke

Energy’s international electric operations were approximately 3 million tons. The

Duke Energy Registrants’ future CO2 emissions will be infl uenced by variables

including new regulations, economic conditions that affect electricity demand,

and the Duke Energy Registrants’ decisions regarding generation technologies

deployed to meet customer electricity needs.

The Duke Energy Registrants believe it is unlikely that legislation

mandating reductions in GHG emissions or establishing a carbon tax will be

passed by the 113th Congress which began on January 3, 2013. Beyond 2014

the prospects for enactment of any federal legislation mandating reductions

in GHG emissions or establishing a carbon tax is highly uncertain. Given the

high degree of uncertainty surrounding potential future federal GHG legislation,

management cannot predict if or when such legislation might be enacted, what

the requirements of any potential legislation might be, or the potential impact

it might have on the Duke Energy Registrants. Among the outcomes of the

18th Conference of the Parties of the United Nations Framework Convention

on Climate Change which concluded in December 2012 was an affi rmation by

the participating countries to complete negotiations on a new global agreement

by 2015 that would take effect in 2020. The international climate change

negotiating process is highly uncertain and management cannot predict what

the outcome might be or the potential impact it might have on the Duke Energy

Registrants.

The Duke Energy Registrants do not anticipate any of the states in which

it currently operates fossil-fueled electric generating units taking action absent

a federal requirement to mandate reductions in GHG emissions from these

facilities.

The Duke Energy Registrants are taking actions today that will result in

reduced GHG emissions over time. These actions will lower the Duke Energy

Registrants’ exposure to any future mandatory GHG emission reduction

requirements or carbon tax, whether a result of federal legislation or EPA

regulation. Under any future scenario involving mandatory GHG limitations, the

Duke Energy Registrants would plan to seek recovery of their compliance costs

through appropriate regulatory mechanisms.

The Duke Energy Registrants recognize that certain groups associate

severe weather events with climate change, and forecast the possibility

that these weather events could have a material impact on future results

of operations should they occur more frequently and with greater severity.

However, the uncertain nature of potential changes of extreme weather events

(such as increased frequency, duration, and severity), the long period of time

over which any potential changes might take place, and the inability to predict

these with any degree of accuracy, make estimating any potential future

fi nancial risk to the Duke Energy Registrants’ operations that may result from

the physical risks of potential changes in the frequency and/or severity of

extreme weather events, whatever the cause or causes might be, impossible.

Currently, the Duke Energy Registrants plan and prepare for extreme weather

events that it experiences from time to time, such as ice storms, tornados,

hurricanes, severe thunderstorms, high winds and droughts.

The Duke Energy Registrants’ past experiences preparing for and

responding to the impacts of these types of weather-related events would

reasonably be expected to help management plan and prepare for future severe

weather events to reduce, but not eliminate, the operational, economic and

fi nancial impacts of such events. For example, the Duke Energy Registrants

routinely take steps to reduce the potential impact of severe weather events

on its electric distribution systems. The Duke Energy Registrants’ electric

generating facilities are designed to withstand extreme weather events without

signifi cant damage. The Duke Energy Registrants maintain an inventory of coal

and oil on site to mitigate the effects of any potential short-term disruption in