Duke Energy 2012 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

205

PART II

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS

ENERGY CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

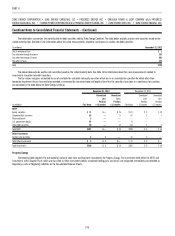

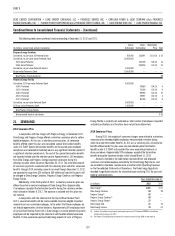

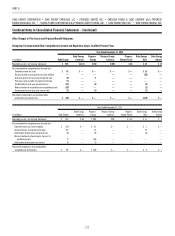

The following table shows the gross and net receivables sold:

Duke Energy Ohio Duke Energy Indiana

(percentages) 2012 2011 2012 2011

Anticipated credit loss ratio 0.7 0.8 0.3 0.4

Discount rate 1.2 2.6 1.2 2.6

Receivable turnover rate 12.7 12.7 10.2 10.2

Duke Energy Ohio Duke Energy Indiana

December 31, December 31,

(in millions) 2012 2011 2012 2011

Receivables sold $282 $302 $ 289 $279

Less: Retained interests 97 129 116 139

Net receivables sold $185 $173 $ 173 $140

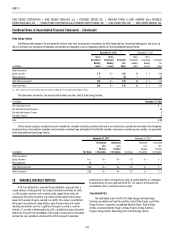

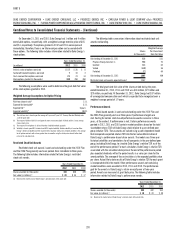

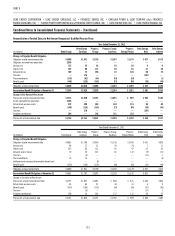

The following tables show the retained interests, sales, and cash fl ows

related to receivables sold:

(in millions) Duke Energy Ohio Duke Energy Indiana

Years Ended December 31, 2012

Sales

Receivables sold $2,154 $2,773

Loss recognized on sale 13 12

Cash Flows

Cash proceeds from receivables sold 2,172 2,784

Collection fees received 1 1

Return received on retained interests 5 7

(in millions) Duke Energy Ohio Duke Energy Indiana

Years Ended December 31, 2011

Sales

Receivables sold $ 2,390 $2,658

Loss recognized on sale 21 16

Cash Flows

Cash proceeds from receivables sold 2,474 2,674

Collection fees received 1 1

Return received on retained interests 12 13

(in millions) Duke Energy Ohio Duke Energy Indiana

Years Ended December 31, 2010

Sales

Receivables sold $ 2,858 $2,537

Loss recognized on sale 26 17

Cash Flows

Cash proceeds from receivables sold 2,809 2,474

Collection fees received 1 1

Return received on retained interests 15 13

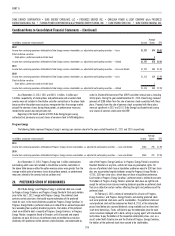

Cash fl ows from the sale of receivables are refl ected within Operating

Activities on Duke Energy Ohio’s and Duke Energy Indiana’s Consolidated

Statements of Cash Flows.

Collection fees received in connection with the servicing of transferred

accounts receivable are included in Operation, Maintenance and Other on

Duke Energy Ohio’s and Duke Energy Indiana’s Consolidated Statements of

Operations. The loss recognized on the sale of receivables is calculated monthly

by multiplying the receivables sold during the month by the required discount

which is derived monthly utilizing a three year weighted average formula that

considers charge-off history, late charge history, and turnover history on the

sold receivables, as well as a component for the time value of money. The

discount rate, or component for the time value of money, is calculated monthly

by summing the prior month-end LIBOR plus a fi xed rate of 1.00 percent as of

December 31, 2012, as compared to prior month-end LIBOR plus 2.39 percent

as of December 31, 2011.

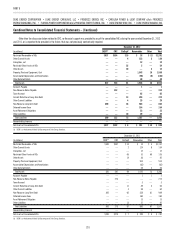

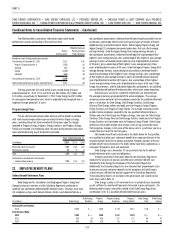

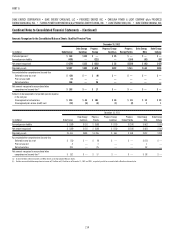

19. EARNINGS PER COMMON SHARE (EPS)

Basic Earnings Per Share (EPS) is computed by dividing net income

attributable to Duke Energy common shareholders, adjusted for distributed and

undistributed earnings allocated to participating securities, by the weighted-

average number of common shares outstanding during the period. Diluted

EPS is computed by dividing net income attributable to Duke Energy common

shareholders, as adjusted for distributed and undistributed earnings allocated

to participating securities, by the diluted weighted-average number of common

shares outstanding during the period. Diluted EPS refl ects the potential dilution

that could occur if securities or other agreements to issue common stock,

such as stock options, phantom shares and stock-based performance unit

awards were exercised or settled.

Duke Energy

On July 2, 2012, just prior to the close of the merger with Progress Energy,

Duke Energy executed a one-for-three reverse stock split. All earnings per share

amounts included in this 10-K are presented as if the one-for-three reverse

stock split had been effective January 1, 2010. The following table presents

Duke Energy’s basic and diluted EPS calculations and reconciles the weighted-

average number of common shares outstanding to the diluted weighted-average

number of common shares outstanding.