Duke Energy 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

PART II

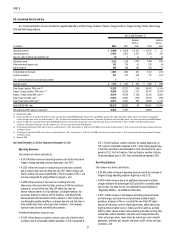

The following table shows the percent changes in GWh sales and average number of customers for Duke Energy Carolinas. Except as otherwise noted, the below

percentages represent billed sales only for the periods presented and are not weather normalized.

Increase (decrease) over prior year 2012 2011

Residential sales(a) (7.2)% (5.7)%

General service sales(a) (0.4)% (1.3)%

Industrial sales(a) 0.9% 0.8%

Wholesale power sales 4.0% 1.2%

Total sales(b) (0.9)% (3.9)%

Average number of customers 0.6% 0.3%

(a) Major components of retail sales.

(b) Consists of all components of sales, including all billed and unbilled retail sales, and wholesale sales to incorporated municipalities and to public and private utilities and power marketers.

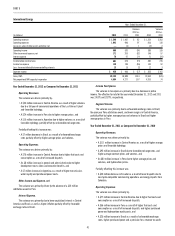

The increase in Duke Energy Carolinas’ net income for the year ended

December 31, 2012, compared to December 31, 2011, was primarily due to the

following factors:

Operating Revenues.

The variance was primarily due to:

• A $323 million increase in net retail pricing and rate riders primarily

due to revised retail base rates implemented in North Carolina and

South Carolina in the fi rst quarter of 2012, and revenues recognized for

the energy effi ciency programs, and

• A $40 million increase in weather adjusted sales volumes to customers

primarily due to higher weather-normal sales to retail customers and an

extra day of revenues due to 2012 being a leap year.

Partially offsetting these increases were:

• A $141 million (net of fuel) decrease in GWh sales to retail customers

due to overall unfavorable weather conditions. The weather statistics

for heating degree days in 2012 were unfavorable compared to the

same period in 2011, while weather statistics for cooling degree days

were less favorable in 2012 compared to the same period in 2011, and

• An $88 million decrease in fuel revenues driven primarily by decreased

demand from retail customers mainly due to overall unfavorable

weather conditions, partially offset by higher fuel rates in both North

Carolina and South Carolina. Fuel revenues represent sales to retail and

wholesale customers.

Operating Expenses.

The variance was primarily due to:

• A $107 million increase in depreciation and amortization primarily due

to increases in depreciation as a result of additional plant in service

and amortization of certain regulatory assets,

• A $75 million increase in operating and maintenance expenses primarily

due to Duke Energy Carolinas’ portion of the costs associated with the

Progress Energy merger including donations, severance, and certain other

costs, higher non-outage and outage costs at generation plants, increased

corporate costs, and required donations resulting from the most recent

North Carolina and South Carolina rate cases, partially offset by the

establishment of regulatory assets in the fi rst quarter of 2012, pursuant

to regulatory orders for future recovery of certain employee severance

costs related to the 2010 voluntary severance plan and other costs,

decreased storm costs, and lower governance costs, and

• A $25 million increase in general taxes primarily due to higher revenue

related taxes in 2012, higher North Carolina property tax expense,

capitalization of North Carolina property taxes in the prior year related

to future generation plants, a favorable prior year resolution of a

property tax issue related to pollution control equipment exemptions

and a sales and use tax refund in 2011 with no comparable refund in

2012, and

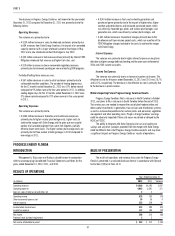

• A $19 million increase in impairment charges primarily related to

the merger with Progress Energy. These charges relate to planned

transmission project costs for which no recovery is expected, and

certain costs associated with mitigation sales pursuant to merger

settlement agreements with the Federal Energy Regulatory Commission

(FERC).

Partially offsetting these increases was:

• An $80 million decrease in fuel expense (including purchased power)

primarily related to lower volume of coal used in electric generation due

to lower demand from retail customers based on overall unfavorable

weather conditions and lower coal-fi red generation due to low natural

gas prices.

Interest Expense.

The variance is primarily due to lower debt return on deferred projects

and a lower debt component of allowance for funds used during construction

(AFUDC).

Income Tax Expense.

The variance in income tax expense is primarily due to prior year state

audit settlements. The effective tax rate for the years ended December 31, 2012

and 2011 was 34.3% and 36.1%, respectively.

Matters Impacting Future Duke Energy Carolinas Results

Duke Energy Carolinas fi led a rate case on February 4, 2013 in North

Carolina and plans to fi le a rate case in South Carolina in early 2013. These

planned rates cases are needed to recover investments in Duke Energy

Carolinas’ ongoing infrastructure modernization projects and operating costs.

Duke Energy Carolinas’ earnings could be adversely impacted if these rate cases

are denied or delayed by either of the state regulatory commissions.

The ability to integrate Progress Energy businesses and realize cost

savings and any other synergies expected from the merger with Progress Energy

could be different from what Duke Energy Carolinas expects and may have a

signifi cant impact on Duke Energy Carolinas’ results of operations.