Duke Energy 2012 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308

|

|

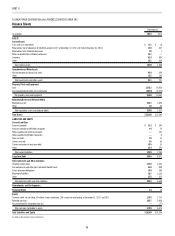

102

PART II

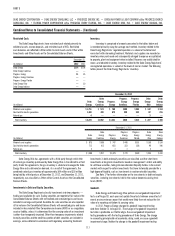

Years Ended December 31,

(in millions) 2012 2011 2010

CASH FLOWS FROM OPERATING ACTIVITIES

Net income (loss) $ 175 $ 194 $(441)

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Depreciation and amortization 342 338 403

Gains on sales of other assets and other, net (7) (5) (3)

Impairment charges 2 89 837

Deferred income taxes 61 190 17

Accrued pension and other post-retirement benefi t costs 11 14 12

Contributions to qualifi ed pension plans — (48) (45)

(Increase) decrease in

Net realized and unrealized mark-to-market and hedging transactions (5) (8) (18)

Receivables 29 10 191

Receivables from affi liated companies 61 98 (221)

Inventory 15 11 15

Other current assets (62) (24) 71

Increase (decrease) in

Accounts payable 5 (33) 87

Accounts payable to affi liated companies (22) 1 (108)

Taxes accrued (24) 8 25

Other current liabilities (21) (3) 6

Other assets — (61) 42

Other liabilities (116) 47 (15)

Net cash provided by operating activities 444 818 855

CASH FLOWS FROM INVESTING ACTIVITIES

Capital expenditures (514) (499) (446)

Net proceeds from the sales of other assets 82 ——

Notes receivable from affi liated companies 400 79 (296)

Change in restricted cash — (26) —

Other 6 (3) 2

Net cash used in investing activities (26) (449) (740)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from the issuance of long-term debt —— 34

Payments for the redemption of long-term debt (556) (9) (36)

Notes payable and commercial paper —— (12)

Notes payable to affi liated companies 245 ——

Dividends to parent (175) (485) —

Other — (4) —

Net cash used in fi nancing activities (486) (498) (14)

Net (decrease) increase in cash and cash equivalents (68) (129) 101

Cash and cash equivalents at beginning of period 99 228 127

Cash and cash equivalents at end of period $ 31 $ 99 $ 228

Supplemental Disclosures

Cash paid for interest, net of amount capitalized $ 93 $ 100 $ 108

Cash paid (received) for income taxes $ 18 $(102) $ 114

Signifi cant non-cash transactions:

Accrued capital expenditures $ 31 $ 43 $ 40

Transfer of Vermillion Generating Station to Duke Energy Indiana $ 28 $— $—

See Notes to Consolidated Financial Statements

DUKE ENERGY OHIO, INC.

Consolidated Statements of Cash Flows