Duke Energy 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

PART II

variable rate demand tax-exempt bonds that may be put to the Company at the

option of the holder. Borrowing sublimits for the Subsidiary Registrants are also

reduced for amounts outstanding under the money pool arrangement. The credit

facility contains a covenant requiring the debt-to-total capitalization ratio to not

exceed 65% for each borrower.

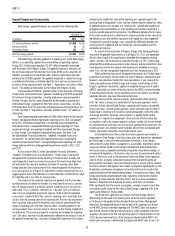

in millions

Duke Energy

(Parent)

Duke Energy

Carolinas

Progress Energy

Carolinas

Progress

Energy Florida

Duke Energy

Ohio

Duke Energy

Indiana Total

Facility Size(a) $1,750 $1,250 $750 $750 $ 750 $ 750 $6,000

Notes Payable and Commercial Paper(b) (195) (300) — — (104) (201) (800)

Outstanding Letters of Credit (50) (7) (2) (1) — — (60)

Tax Exempt Bonds — (75) — (84) (81) (240)

Available Capacity $1,505 $ 868 $748 $749 $ 562 $ 468 $4,900

(a) Represents the sublimit of each borrower at December 31, 2012. The Duke Energy Ohio sublimit includes $100 million for Duke Energy Kentucky.

(b) Duke Energy issued $450 million of Commercial Paper and loaned the proceeds through the money pool to Duke Energy Carolinas and Duke Energy Indiana. The balances are classifi ed as long-term borrowings within

Long-term Debt in Duke Energy Carolina’s and Duke Energy Indiana’s Consolidated Balance Sheets.

In January 2012, Duke Energy Indiana and Duke Energy Kentucky

collectively entered into a $156 million 2-year bilateral letter of credit

agreement, under which Duke Energy Indiana and Duke Energy Kentucky may

request the issuance of letters of credit up to $129 million and $27 million,

respectively, on their behalf to support various series of variable-rate demand

bonds. In addition, Duke Energy Indiana entered into a $78 million 2-year

bilateral letter of credit facility. These credit facilities may not be used for any

purpose other than to support the variable rate demand bonds issued by Duke

Energy Indiana and Duke Energy Kentucky. In February 2012, letters of credit

were issued corresponding to the amount of the facilities to support various

series of tax-exempt bonds at Duke Energy Indiana and Duke Energy Kentucky.

In February 2013, the letters of credit were amended to extend the expiration

date to January 2015.

Duke Energy’s debt and credit agreements contain various fi nancial

and other covenants. Failure to meet those covenants beyond applicable

grace periods could result in accelerated due dates and/or termination of the

agreements. As of December 31, 2012, Duke Energy was in compliance with

all covenants related to its signifi cant debt agreements. In addition, some

credit agreements may allow for acceleration of payments or termination of

the agreements due to nonpayment, or to the acceleration of other signifi cant

indebtedness of the borrower or some of its subsidiaries. None of the debt or

credit agreements contain material adverse change clauses.

Credit Ratings.

Duke Energy and certain subsidiaries each hold credit ratings by Fitch

Ratings (Fitch), Moody’s Investors Service (Moody’s) and Standard & Poor’s

(S&P). Duke Energy’s corporate credit rating and issuer credit rating from Fitch,

Moody’s and S&P, respectively, as of February 13, 2013 is BBB+, Baa2 and

BBB, respectively. As of February 13, 2013, the Duke Energy Registrants’ have

a stable outlook rating from Fitch and Moody’s, with the exception of Progress

Energy Florida, which has a negative outlook at Fitch. In addition, the Duke

Energy Registrants have a negative outlook rating from S&P.

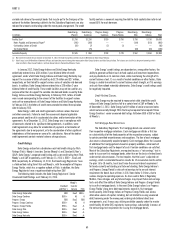

The following table includes the Duke Energy Registrants’ Senior

Unsecured Credit Ratings as of February 13, 2013.

Standard

and Poor’s

Moody’s

Investor

Service Fitch

Duke Energy Corporation BBB Baa2 BBB+

Duke Energy Carolinas BBB+ A3 A

Progress Energy BBB Baa2 BBB

Progress Energy Carolinas BBB+ A3 A

Progress Energy Florida BBB+ Baa1 A-

Duke Energy Ohio BBB+ Baa1 A-

Duke Energy Indiana BBB+ Baa1 A-

Duke Energy Kentucky BBB+ Baa1 A-

Duke Energy’s credit ratings are dependent on, among other factors, the

ability to generate suffi cient cash to fund capital and investment expenditures

and pay dividends on its common stock, while maintaining the strength of its

current balance sheet. If, as a result of market conditions or other factors, Duke

Energy is unable to maintain its current balance sheet strength, or if its earnings

and cash fl ow outlook materially deteriorates, Duke Energy’s credit ratings could

be negatively impacted.

Credit-Related Clauses.

Duke Energy may be required to repay certain debt should the credit

ratings at Duke Energy Carolinas fall to a certain level at S&P or Moody’s. As

of December 31, 2012, Duke Energy had $9 million of senior unsecured notes

which mature serially through 2016 that may be required to be repaid if Duke

Energy Carolinas’ senior unsecured debt ratings fall below BBB at S&P or Baa2

at Moody’s.

First Mortgage Bond Restrictions.

The Subsidiary Registrants’ fi rst mortgage bonds are secured under

their respective mortgage indentures. Each mortgage constitutes a fi rst lien

on substantially all of the fi xed properties of the respective company, subject

to certain permitted encumbrances and exceptions. The lien of each mortgage

also covers subsequently acquired property. Each mortgage allows the issuance

of additional fi rst mortgage bonds based on property additions, retirements of

fi rst mortgage bonds and the deposit of cash if certain conditions are satisfi ed.

Most of the Subsidiary Registrants are required to pass a “net earnings” test in

order to issue new fi rst mortgage bonds, other than on the basis of retired bonds

under certain circumstances. The test requires that the issuer’s adjusted net

earnings, which is calculated based on results for 12 consecutive months within

the prior 15 to 18 months, be at least twice the annual interest requirement

for bonds currently outstanding and to be outstanding. Duke Energy Indiana’s

and Progress Energy Florida’s ratios of net earnings to the annual interest

requirement for bonds have at times in 2012 been below 2.0 times, due to

various charges to operating expenses. As discussed in Note 4, Regulatory

Matters, these charges and any future charges may impact future net earnings

tests and affect the ability of Duke Energy Indiana and Progress Energy Florida

to issue fi rst mortgage bonds. In the event Duke Energy Indiana’s or Progress

Energy Florida’s long-term debt requirements exceed its fi rst mortgage

bond capacity, Duke Energy Indiana or Progress Energy Florida can access

alternative sources of capital, including, but not limited to issuing unsecured

debt, borrowing under the money pool, entering into bilateral direct loan

arrangements, and, if necessary, utilizing available capacity under the master

credit facility. All other DEC registrants have earnings substantially in excess of

the net earnings test requirement for issuing fi rst mortgage bonds.