Duke Energy 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

PART II

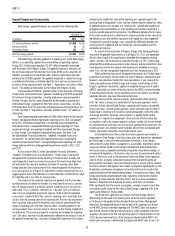

Income Tax Expense.

The variance in tax expense is primarily due to an increase in the effective

tax rate. The effective tax rate for the years ended December 31, 2012 and

2011 was 36.0% and 33.1%, respectively. The increase in the effective tax

rate is primarily due to a $10 million reduction of deferred tax liabilities as a

result of an election related to the transfer of certain gas-fi red generation assets

to its wholly owned subsidiary Duke Energy Commercial Asset Management,

LLC (DECAM) in the second quarter of 2011.

Matters Impacting Future Duke Energy Ohio Results

Duke Energy Ohio fi led electric and gas distribution rate cases in July

2012. These planned rate cases are needed to recover capital investments,

costs associated with MGP sites and operating costs. Duke Energy Ohio’s

earnings could be adversely impacted if these rate cases are denied or delayed

by the state regulatory commission.

The current low energy price projections, as well as recently issued and

proposed environmental regulations pertaining to coal and coal-fi red generating

facilities, could impact future cash fl ows and market valuations of Duke Energy

Ohio’s coal-fi red generation assets which could lead to impairment charges.

DUKE ENERGY INDIANA

INTRODUCTION

Management’s Discussion and Analysis should be read in conjunction

with the accompanying Consolidated Financial Statements and Notes for the

years ended December 31, 2012, 2011, and 2010.

BASIS OF PRESENTATION

The results of operations and variance discussion for Duke Energy

Indiana is presented in a reduced disclosure format in accordance with General

Instruction (I)(2)(a) of Form 10-K.

RESULTS OF OPERATIONS

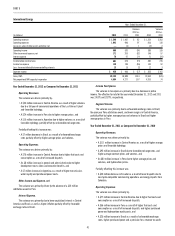

Years Ended December 31,

(in millions) 2012 2011 Variance

Operating revenues $2,717 $ 2,622 $ 95

Operating expenses 2,792 2,340 452

Operating (loss) income (75) 282 (357)

Other income and expense, net 90 97 (7)

Interest expense 138 137 1

(Loss) Income before income taxes (123) 242 (365)

Income tax (benefi t) expense (73) 74 (147)

Net (loss) income $ (50) $ 168 $(218)

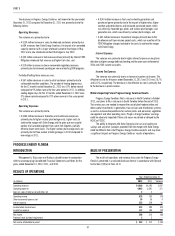

The following table shows the percent changes in GWh sales and average number of customers for Duke Energy Indiana. Except as otherwise noted, the below

percentages represent billed sales only for the periods presented and are not weather normalized.

Increase (decrease) over prior year 2012 2011

Residential sales(a) (4.8)% (3.0)%

General service sales(a) (0.5)% (1.5)%

Industrial sales(a) 1.7 % 1.5 %

Wholesale power sales 7.9 % (19.1)%

Total sales(b) 1.2 % (4.9)%

Average number of customers 0.6 % 0.1 %

(a) Major components of retail sales.

(b) Consists of all components of sales, including all billed and unbilled retail sales, and wholesale sales to incorporated municipalities and to public and private utilities and power marketers.

Duke Energy Indiana’s net loss for the year ended December 31, 2012

compared to net income for the year ended December 31, 2011 was primarily

due to the following factors:

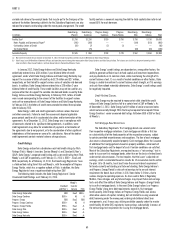

Operating Revenues.

The variance was primarily due to:

• A $102 million net increase in fuel revenues (including emission

allowances) primarily due to an increase in fuel rates as a result of

higher fuel and purchased power costs,

• A $17 million net increase in rate riders primarily related to higher recoveries

under the clean coal technology and energy effi ciency riders, and

• A $12 million increase in rate pricing due to the positive impact on

overall average prices of lower sales volumes.

Partially offsetting these increases were:

• A $31 million decrease in retail revenue due to a regulatory order to

refund revenues to customers related to the Edwardsport IGCC plant that

is currently under construction. See Note 4 to the Consolidated Financial

Statements “Regulatory Matters,” for additional information, and

• A $7 million decrease in retail revenues related to less favorable

weather conditions and weather-normal sales volumes in 2012

compared to 2011.