Duke Energy 2012 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2012 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

162

PART II

Combined Notes to Consolidated Financial Statements – (Continued)

DUKE ENERGY CORPORATION • DUKE ENERGY CAROLINAS, LLC • PROGRESS ENERGY, INC. • CAROLINA POWER & LIGHT COMPANY d/b/a PROGRESS ENERGY

CAROLINAS, INC. • FLORIDA POWER CORPORATION d/b/a PROGRESS ENERY FLORIDA, INC. • DUKE ENERGY OHIO, INC. • DUKE ENERGY INDIANA, INC.

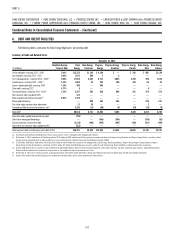

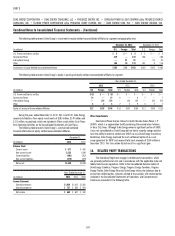

The Duke Energy Registrants’ regulated operations accrue costs of

removal for property that does not have an associated legal retirement

obligation based on regulatory orders from the various state commissions.

These costs of removal are recorded as a regulatory liability in accordance with

regulatory treatment. The Duke Energy Registrants do not accrue the estimated

cost of removal for any non regulated assets. See Note 4 for the estimated cost

of removal for assets without an associated legal retirement obligation, which

are included in Regulatory Liabilities on the Consolidated Balance Sheets as of

December 31, 2012 and 2011.

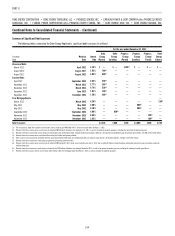

Nuclear Decommissioning Costs.

In 2010, the NCUC and PSCSC approved the retail portion of a

total $48 million annual amount for contributions and expense levels

for decommissioning for Duke Energy Carolinas. In each of the years

ended December 31, 2012, 2011 and 2010, Duke Energy Carolinas

expensed $48 million and contributed cash of $48 million to the NDTF for

decommissioning costs. In 2010, the NCUC and the PSCSC approved the retail

portion of a total $31 million annual amount for contributions and expense

levels for decommissioning for Progress Energy Carolinas. In each of the years

ended December 31, 2012, 2011 and 2010, Progress Energy Carolinas expensed

$31 million and contributed cash of $31 million to the NDTF for decommissioning

costs. These amounts are presented in the Consolidated Statements of Cash

Flows in Purchases of available-for-sale securities within Net Cash Used

in Investing Activities. The contributions for Duke Energy Carolinas were

to the funds reserved for contaminated costs as contributions to the funds

reserved for non-contaminated costs have been discontinued since the current

estimates indicate existing funds to be suffi cient to cover projected future costs.

The contributions for Progress Energy Carolinas were to funds reserved for

contaminated and non-contaminated costs. Both the NCUC and the PSCSC have

allowed Duke Energy Carolinas and Progress Energy Carolinas to recover estimated

decommissioning costs through retail rates over the expected remaining service

periods of their respective nuclear stations. Duke Energy Carolinas and Progress

Energy Carolinas believe that the decommissioning costs being recovered through

rates, when coupled with expected fund earnings, will be suffi cient to provide for

the cost of future decommissioning. As discussed below, Progress Energy Florida

has suspended its accrual for nuclear decommissioning.

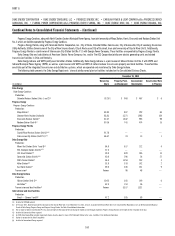

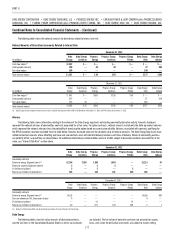

Use of the NDTF investments are restricted to nuclear decommissioning

activities and the NDTF investments are managed and invested in accordance

with applicable requirements of various regulatory bodies, including the NRC,

the FERC, the NCUC, the PSCSC and the Internal Revenue Service (IRS). The

fair value of assets that are legally restricted for purposes of settling asset

retirement obligations associated with nuclear decommissioning are $3,941

million and $2,053 million for Duke Energy and Duke Energy Carolinas for the

year ended December 31, 2012, respectively, and $1,797 million for Duke

Energy and Duke Energy Carolinas for the year ended December 31, 2011. The

NDTF balances presented on the Consolidated Balance Sheets for Progress

Energy, Progress Energy Carolinas and Progress Energy Florida represent the

fair value of assets legally restricted for purposes of settling asset retirement

obligations associated with nuclear decommissioning.

The NCUC, PSCSC and the FPSC require updated cost estimates for

decommissioning nuclear plants every fi ve years.

Duke Energy Carolinas completed site-specifi c nuclear decommissioning

cost studies in January 2009 that showed total estimated nuclear

decommissioning costs, including the cost to decommission plant components

not subject to radioactive contamination, of $3 billion in 2008 dollars. This

estimate includes Duke Energy Carolinas’ ownership interest in its jointly owned

unit. Duke Energy Carolinas fi led these site-specifi c nuclear decommissioning

cost studies with the NCUC and the PSCSC in conjunction with various rate case

fi lings. In addition to the decommissioning cost studies, a new funding study was

completed and indicates the current annual funding requirement of $48 million

is suffi cient to cover the estimated decommissioning costs.

Progress Energy Carolinas completed site-specifi c nuclear

decommissioning cost studies in December 2009, which were fi led with the

NCUC on March 16, 2010. Progress Energy Carolinas estimate is based on

prompt dismantlement decommissioning, which refl ects the cost of removal

of all radioactive and other structures currently at the site, with such removal

occurring after operating license expiration. These decommissioning cost

estimates also include interim spent fuel storage costs associated with

maintaining spent nuclear fuel on site until such time that it can be transferred

to a DOE facility. See Note 5 for information related to spent nuclear fuel

litigation. These estimates, in 2009 dollars, were $3.0 billion. The estimates

are subject to change based on a variety of factors including, but not limited to,

cost escalation, changes in technology applicable to nuclear decommissioning

and changes in federal, state or local regulations. This estimate includes

Progress Energy Carolinas ownership interest in jointly owned units. In addition

to the decommissioning cost studies, a new funding study was completed and

indicates the current annual funding requirement of $31 million is suffi cient to

cover the estimated decommissioning costs.

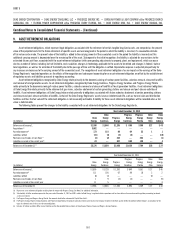

Progress Energy Florida completed a site-specifi c nuclear

decommissioning cost study in October 2008, which was fi led with the FPSC in

2009 as part of Progress Energy Florida’s base rate fi ling. However, the FPSC

deferred review of Progress Energy Florida’s nuclear decommissioning study

from the rate case to be addressed in 2010 in order for FPSC staff to assess

Progress Energy Florida’s study in combination with other utilities anticipated

to submit nuclear decommissioning studies in 2010. Progress Energy Florida

was not required to prepare a new site-specifi c nuclear decommissioning study

in 2010; however, Progress Energy Florida was required to update the 2008

study with the most currently available escalation rates in 2010, which was

fi led with the FPSC in December 2010. The FPSC approved Progress Energy

Florida’s nuclear decommissioning cost study on April 30, 2012. Progress

Energy Florida’s estimate is based on prompt dismantlement decommissioning

and includes interim spent fuel storage costs associated with maintaining

spent nuclear fuel on site until such time that it can be transferred to a DOE

facility. See Note 5 for information related to spent nuclear fuel litigation. The

estimate, in 2008 dollars, is $751 million and is subject to change based on

a variety of factors including, but not limited to, cost escalation, changes in

technology applicable to nuclear decommissioning and changes in federal,

state or local regulations. This estimate includes Progress Energy Florida’s

ownership interest in jointly owned stations. Based on the 2008 estimate,

assumed operating license renewal and updated escalation factors in 2010,

Progress Energy Florida decreased its asset retirement cost and its asset

retirement obligation by approximately $37 million in 2010. With the retirement

of Crystal River Unit 3 it is anticipated that a delayed dismantlement approach

to decommissioning referred to as SAFSTOR, will be submitted to the NRC for

approval. This decommissioning approach is currently utilized at a number of

retired domestic nuclear power plants and is one of three generally accepted

approaches to decommissioning required by the NRC. Once an updated site

specifi c decommissioning study is completed it will be fi led with the FPSC.

As part of the evaluation of repairing Crystal River Unit 3, initial estimates of

the cost to decommission the plant under the SAFSTOR option were developed.

The estimate in 2011 dollars is $989 million. Based on the 2011 SAFSTOR